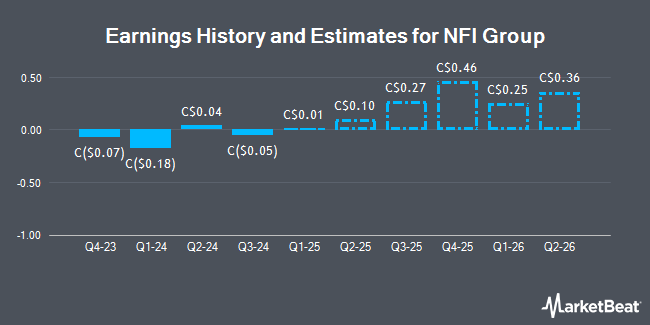

NFI Group Inc. (TSE:NFI - Free Report) - Equities researchers at Atb Cap Markets boosted their Q1 2026 earnings per share estimates for NFI Group in a research report issued to clients and investors on Sunday, March 16th. Atb Cap Markets analyst C. Murray now forecasts that the company will earn $0.24 per share for the quarter, up from their prior estimate of $0.21. The consensus estimate for NFI Group's current full-year earnings is $1.28 per share. Atb Cap Markets also issued estimates for NFI Group's Q2 2026 earnings at $0.40 EPS and FY2026 earnings at $1.97 EPS.

A number of other equities research analysts also recently issued reports on NFI. BMO Capital Markets decreased their price objective on NFI Group from C$14.00 to C$13.00 in a research report on Friday, March 14th. Cibc World Mkts upgraded NFI Group from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, December 4th. CIBC upped their price objective on NFI Group from C$19.00 to C$20.00 and gave the company an "outperform" rating in a research report on Monday, March 17th. Finally, ATB Capital upped their price objective on NFI Group from C$24.00 to C$26.00 and gave the company an "outperform" rating in a research report on Monday, March 17th. One equities research analyst has rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, NFI Group currently has a consensus rating of "Buy" and a consensus target price of C$20.80.

View Our Latest Research Report on NFI

NFI Group Trading Down 1.4 %

NFI stock traded down C$0.18 during midday trading on Tuesday, reaching C$12.55. 208,430 shares of the company traded hands, compared to its average volume of 374,720. NFI Group has a 52-week low of C$9.91 and a 52-week high of C$19.55. The company has a debt-to-equity ratio of 171.59, a quick ratio of 0.55 and a current ratio of 1.71. The business has a 50 day moving average of C$11.92 and a 200-day moving average of C$14.66. The firm has a market capitalization of C$1.04 billion, a price-to-earnings ratio of -42.99, a P/E/G ratio of -0.07 and a beta of 1.41.

About NFI Group

(

Get Free Report)

NFI Group Inc is a Canadian automobile manufacturer. The company organizes itself into two segments: Manufacturing operations, and Aftermarket operations. Manufacturing operations, which represents more than half of the company's revenue, includes the manufacture of transit buses for public transportation, and motor coaches.

Read More

Before you consider NFI Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NFI Group wasn't on the list.

While NFI Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.