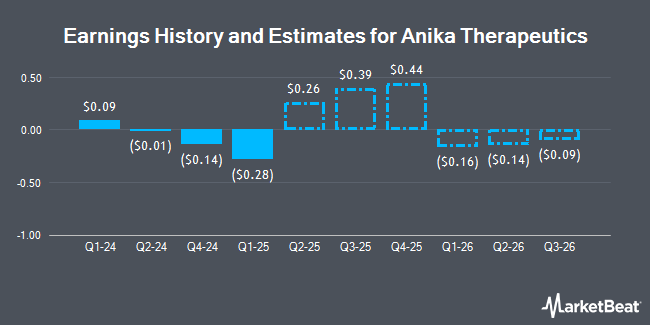

Anika Therapeutics, Inc. (NASDAQ:ANIK - Free Report) - Barrington Research issued their Q1 2026 earnings per share estimates for Anika Therapeutics in a research note issued to investors on Thursday, March 13th. Barrington Research analyst M. Petusky anticipates that the biotechnology company will post earnings per share of ($0.16) for the quarter. Barrington Research has a "Outperform" rating and a $20.00 price target on the stock. The consensus estimate for Anika Therapeutics' current full-year earnings is ($0.84) per share. Barrington Research also issued estimates for Anika Therapeutics' Q2 2026 earnings at ($0.14) EPS, Q3 2026 earnings at ($0.09) EPS, Q4 2026 earnings at ($0.09) EPS and FY2027 earnings at ($0.45) EPS.

Separately, StockNews.com raised Anika Therapeutics from a "hold" rating to a "buy" rating in a report on Thursday, March 13th.

Get Our Latest Stock Report on ANIK

Anika Therapeutics Price Performance

NASDAQ ANIK traded down $0.36 during trading on Monday, hitting $15.60. The company's stock had a trading volume of 39,153 shares, compared to its average volume of 67,652. The company has a market cap of $228.40 million, a PE ratio of -2.33 and a beta of 0.95. The business's 50 day simple moving average is $16.91 and its 200-day simple moving average is $19.31. Anika Therapeutics has a fifty-two week low of $14.95 and a fifty-two week high of $29.12.

Anika Therapeutics (NASDAQ:ANIK - Get Free Report) last issued its quarterly earnings results on Wednesday, March 12th. The biotechnology company reported ($0.14) earnings per share for the quarter, missing the consensus estimate of ($0.01) by ($0.13). The business had revenue of $30.60 million during the quarter, compared to analyst estimates of $29.00 million. Anika Therapeutics had a negative return on equity of 2.22% and a negative net margin of 59.40%.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of ANIK. R Squared Ltd purchased a new position in shares of Anika Therapeutics in the fourth quarter worth about $27,000. Aquatic Capital Management LLC purchased a new position in shares of Anika Therapeutics in the fourth quarter worth about $42,000. Tower Research Capital LLC TRC raised its stake in shares of Anika Therapeutics by 412.4% in the fourth quarter. Tower Research Capital LLC TRC now owns 2,890 shares of the biotechnology company's stock worth $48,000 after purchasing an additional 2,326 shares during the last quarter. Wells Fargo & Company MN raised its stake in shares of Anika Therapeutics by 31.1% in the fourth quarter. Wells Fargo & Company MN now owns 7,421 shares of the biotechnology company's stock worth $122,000 after purchasing an additional 1,759 shares during the last quarter. Finally, Public Employees Retirement System of Ohio purchased a new position in shares of Anika Therapeutics in the fourth quarter worth about $137,000. 91.53% of the stock is currently owned by hedge funds and other institutional investors.

About Anika Therapeutics

(

Get Free Report)

Anika Therapeutics, Inc, a joint preservation company, creates and delivers advancements in early intervention orthopedic care in the areas of osteoarthritis (OA) pain management, regenerative solutions, sports medicine, and arthrosurface joint solutions in the United States, Europe, and internationally.

Featured Articles

Before you consider Anika Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anika Therapeutics wasn't on the list.

While Anika Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.