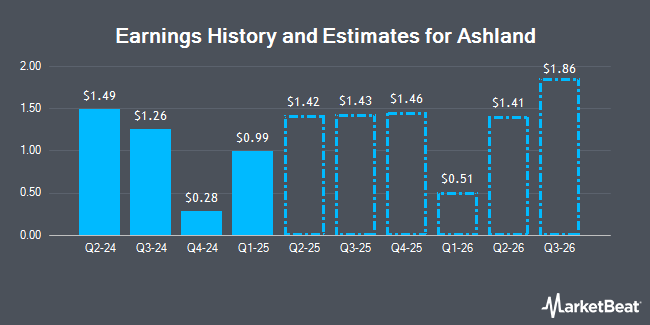

Ashland Inc. (NYSE:ASH - Free Report) - Investment analysts at Seaport Res Ptn cut their Q1 2025 earnings per share (EPS) estimates for Ashland in a research note issued on Wednesday, December 11th. Seaport Res Ptn analyst M. Harrison now forecasts that the basic materials company will post earnings per share of $0.23 for the quarter, down from their prior forecast of $0.67. The consensus estimate for Ashland's current full-year earnings is $4.52 per share. Seaport Res Ptn also issued estimates for Ashland's Q2 2025 earnings at $1.26 EPS, Q3 2025 earnings at $1.47 EPS, Q4 2025 earnings at $1.51 EPS, Q1 2026 earnings at $0.78 EPS, Q3 2026 earnings at $1.78 EPS and Q4 2026 earnings at $1.78 EPS.

Several other equities analysts have also issued reports on ASH. Wells Fargo & Company cut their target price on Ashland from $95.00 to $90.00 and set an "overweight" rating on the stock in a research note on Wednesday, December 11th. BMO Capital Markets lifted their target price on Ashland from $83.00 to $84.00 and gave the company a "market perform" rating in a research note on Wednesday, December 11th. Finally, StockNews.com downgraded Ashland from a "buy" rating to a "hold" rating in a report on Thursday. Three analysts have rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $102.00.

Read Our Latest Report on ASH

Ashland Stock Down 1.4 %

Shares of Ashland stock traded down $1.03 during trading on Monday, hitting $73.75. 485,337 shares of the stock traded hands, compared to its average volume of 422,115. The firm has a market cap of $3.47 billion, a P/E ratio of 22.01, a price-to-earnings-growth ratio of 1.15 and a beta of 0.86. The company has a current ratio of 2.44, a quick ratio of 1.33 and a debt-to-equity ratio of 0.47. Ashland has a 52-week low of $72.83 and a 52-week high of $102.50. The stock's fifty day simple moving average is $81.15 and its 200 day simple moving average is $87.69.

Ashland (NYSE:ASH - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The basic materials company reported $1.26 EPS for the quarter, missing the consensus estimate of $1.28 by ($0.02). The firm had revenue of $522.00 million for the quarter, compared to analysts' expectations of $524.07 million. Ashland had a net margin of 7.95% and a return on equity of 7.43%. The business's quarterly revenue was up .8% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.41 EPS.

Ashland Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Sunday, December 15th. Stockholders of record on Sunday, December 1st were given a $0.405 dividend. This represents a $1.62 dividend on an annualized basis and a dividend yield of 2.20%. The ex-dividend date of this dividend was Friday, November 29th. Ashland's dividend payout ratio (DPR) is presently 48.36%.

Insider Activity

In related news, SVP Robin E. Lampkin sold 868 shares of the business's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $77.90, for a total transaction of $67,617.20. Following the completion of the sale, the senior vice president now directly owns 2,883 shares in the company, valued at approximately $224,585.70. The trade was a 23.14 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, VP Eric N. Boni sold 451 shares of the business's stock in a transaction on Thursday, December 5th. The stock was sold at an average price of $78.07, for a total value of $35,209.57. Following the transaction, the vice president now directly owns 14,182 shares in the company, valued at $1,107,188.74. This trade represents a 3.08 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 0.69% of the company's stock.

Hedge Funds Weigh In On Ashland

Several large investors have recently modified their holdings of the business. Dimensional Fund Advisors LP lifted its stake in Ashland by 3.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,773,170 shares of the basic materials company's stock worth $262,037,000 after acquiring an additional 86,977 shares in the last quarter. Massachusetts Financial Services Co. MA lifted its stake in Ashland by 12.3% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 2,598,602 shares of the basic materials company's stock worth $226,000,000 after acquiring an additional 284,215 shares in the last quarter. Allspring Global Investments Holdings LLC lifted its stake in Ashland by 6.3% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,737,738 shares of the basic materials company's stock worth $151,131,000 after acquiring an additional 103,517 shares in the last quarter. Pacer Advisors Inc. lifted its stake in Ashland by 6,127.2% during the 3rd quarter. Pacer Advisors Inc. now owns 880,459 shares of the basic materials company's stock worth $76,574,000 after acquiring an additional 866,320 shares in the last quarter. Finally, Geode Capital Management LLC lifted its stake in Ashland by 0.3% during the 3rd quarter. Geode Capital Management LLC now owns 827,642 shares of the basic materials company's stock worth $72,000,000 after acquiring an additional 2,316 shares in the last quarter. Institutional investors and hedge funds own 93.95% of the company's stock.

About Ashland

(

Get Free Report)

Ashland Inc provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally. It operates through Life Sciences, Personal Care, Specialty Additives, and Intermediates segments. The Life Sciences segment offers pharmaceutical solutions, including controlled release polymers, disintegrants, tablet coatings, thickeners, solubilizers, and tablet binders; nutrition solutions, such as thickeners, stabilizers, emulsifiers, and additives; and nutraceutical solutions comprising products for weight management, joint comfort, stomach and intestinal health, sports nutrition, and general wellness, as well as custom formulation, toll processing, and particle engineering solutions.

See Also

Before you consider Ashland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ashland wasn't on the list.

While Ashland currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report