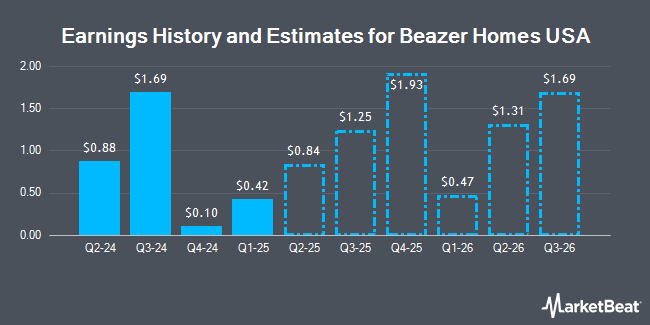

Beazer Homes USA, Inc. (NYSE:BZH - Free Report) - Analysts at Wedbush issued their Q1 2026 EPS estimates for Beazer Homes USA in a note issued to investors on Wednesday, November 13th. Wedbush analyst J. Mccanless anticipates that the construction company will post earnings of $0.49 per share for the quarter. Wedbush currently has a "Outperform" rating and a $45.00 target price on the stock. The consensus estimate for Beazer Homes USA's current full-year earnings is $4.72 per share. Wedbush also issued estimates for Beazer Homes USA's Q2 2026 earnings at $1.31 EPS, Q3 2026 earnings at $1.69 EPS and Q4 2026 earnings at $2.36 EPS.

Several other analysts have also recently commented on the stock. B. Riley decreased their price objective on shares of Beazer Homes USA from $38.00 to $37.00 and set a "buy" rating for the company in a research note on Friday, August 2nd. Zelman & Associates reaffirmed an "underperform" rating on shares of Beazer Homes USA in a report on Tuesday, September 17th. Finally, StockNews.com lowered Beazer Homes USA from a "hold" rating to a "sell" rating in a research note on Monday, August 5th. Two equities research analysts have rated the stock with a sell rating and three have issued a buy rating to the company. According to data from MarketBeat.com, Beazer Homes USA presently has a consensus rating of "Hold" and an average price target of $39.67.

Check Out Our Latest Analysis on BZH

Beazer Homes USA Stock Performance

BZH traded down $1.33 on Friday, reaching $33.30. 462,645 shares of the stock were exchanged, compared to its average volume of 362,598. The company has a debt-to-equity ratio of 0.91, a current ratio of 12.42 and a quick ratio of 0.92. The company's 50-day moving average price is $32.48 and its 200 day moving average price is $30.28. The firm has a market capitalization of $1.03 billion, a PE ratio of 7.42, a PEG ratio of 1.35 and a beta of 2.18. Beazer Homes USA has a fifty-two week low of $25.48 and a fifty-two week high of $38.22.

Insider Buying and Selling

In other Beazer Homes USA news, CFO David I. Goldberg sold 6,057 shares of the stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $32.06, for a total transaction of $194,187.42. Following the transaction, the chief financial officer now owns 131,004 shares in the company, valued at approximately $4,199,988.24. This represents a 4.42 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 6.99% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in BZH. Innealta Capital LLC acquired a new position in shares of Beazer Homes USA during the 2nd quarter worth about $88,000. Point72 Asset Management L.P. purchased a new stake in Beazer Homes USA during the 3rd quarter worth approximately $125,000. Systematic Financial Management LP acquired a new position in shares of Beazer Homes USA during the third quarter valued at approximately $182,000. Metis Global Partners LLC purchased a new position in shares of Beazer Homes USA in the third quarter valued at approximately $201,000. Finally, Quadrature Capital Ltd acquired a new stake in shares of Beazer Homes USA in the third quarter worth approximately $262,000. 85.65% of the stock is owned by institutional investors and hedge funds.

About Beazer Homes USA

(

Get Free Report)

Beazer Homes USA, Inc operates as a homebuilder in the United States. It designs, constructs, and sells single-family and multi-family homes under the Beazer Homes, Gatherings, and Choice Plans names. The company also sells its homes through commissioned new home sales counselors and independent brokers in Arizona, California, Nevada, Texas, Indiana, Delaware, Maryland, Tennessee, Virginia, Florida, Georgia, North Carolina, and South Carolina.

Featured Articles

Before you consider Beazer Homes USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beazer Homes USA wasn't on the list.

While Beazer Homes USA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.