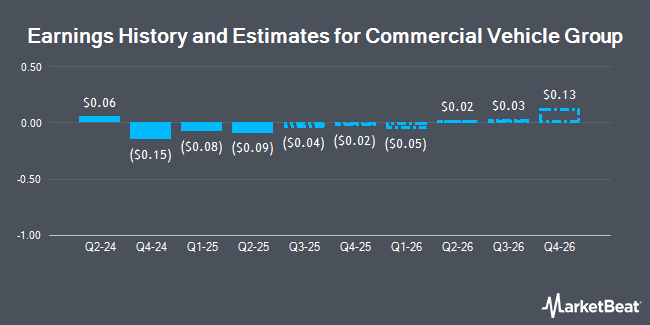

Commercial Vehicle Group, Inc. (NASDAQ:CVGI - Free Report) - Stock analysts at Noble Financial issued their Q1 2025 EPS estimates for Commercial Vehicle Group in a report released on Wednesday, March 12th. Noble Financial analyst J. Gomes anticipates that the company will earn ($0.21) per share for the quarter. The consensus estimate for Commercial Vehicle Group's current full-year earnings is $0.11 per share. Noble Financial also issued estimates for Commercial Vehicle Group's Q2 2025 earnings at ($0.06) EPS, Q3 2025 earnings at $0.03 EPS, Q4 2025 earnings at $0.07 EPS, FY2025 earnings at ($0.17) EPS and FY2026 earnings at $0.13 EPS.

Commercial Vehicle Group (NASDAQ:CVGI - Get Free Report) last issued its quarterly earnings data on Monday, March 10th. The company reported ($0.15) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.07) by ($0.08). Commercial Vehicle Group had a return on equity of 5.17% and a net margin of 3.98%. The firm had revenue of $163.29 million during the quarter, compared to the consensus estimate of $158.37 million.

Commercial Vehicle Group Stock Performance

Shares of CVGI stock traded down $0.04 during trading hours on Friday, hitting $1.52. 534,292 shares of the company were exchanged, compared to its average volume of 221,267. The firm has a fifty day simple moving average of $2.04 and a 200 day simple moving average of $2.54. The company has a current ratio of 2.31, a quick ratio of 1.43 and a debt-to-equity ratio of 0.70. Commercial Vehicle Group has a 52-week low of $1.49 and a 52-week high of $6.64. The stock has a market capitalization of $52.44 million, a price-to-earnings ratio of 1.49, a P/E/G ratio of 0.43 and a beta of 2.39.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the business. Wealthedge Investment Advisors LLC purchased a new position in shares of Commercial Vehicle Group during the 4th quarter valued at $151,000. Squarepoint Ops LLC purchased a new position in shares of Commercial Vehicle Group in the fourth quarter valued at about $47,000. Two Sigma Investments LP increased its position in shares of Commercial Vehicle Group by 68.7% during the fourth quarter. Two Sigma Investments LP now owns 225,648 shares of the company's stock valued at $560,000 after buying an additional 91,908 shares during the period. Occudo Quantitative Strategies LP purchased a new position in shares of Commercial Vehicle Group during the fourth quarter valued at about $79,000. Finally, Millennium Management LLC purchased a new position in shares of Commercial Vehicle Group during the fourth quarter valued at about $297,000. 72.32% of the stock is currently owned by hedge funds and other institutional investors.

Commercial Vehicle Group Company Profile

(

Get Free Report)

Commercial Vehicle Group, Inc, together with its subsidiaries, designs, manufactures, assembles, and sells systems, assemblies, and components to commercial and electric vehicle, and industrial automation markets in North America, Europe, and the Asia-Pacific regions. The company operates in four segments: Vehicle Solutions, Electrical Systems, Aftermarket & Accessories, and Industrial Automation.

Recommended Stories

Before you consider Commercial Vehicle Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Commercial Vehicle Group wasn't on the list.

While Commercial Vehicle Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.