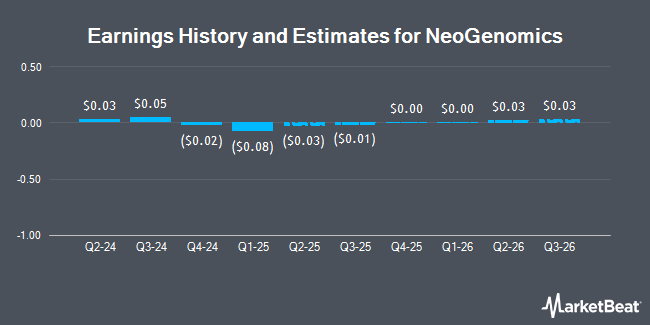

NeoGenomics, Inc. (NASDAQ:NEO - Free Report) - Equities research analysts at William Blair issued their Q1 2026 earnings per share (EPS) estimates for shares of NeoGenomics in a research note issued on Tuesday, February 18th. William Blair analyst A. Brackmann expects that the medical research company will post earnings of $0.00 per share for the quarter. The consensus estimate for NeoGenomics' current full-year earnings is ($0.20) per share. William Blair also issued estimates for NeoGenomics' Q2 2026 earnings at $0.01 EPS, Q3 2026 earnings at $0.02 EPS, Q4 2026 earnings at $0.02 EPS and FY2026 earnings at $0.03 EPS.

NeoGenomics (NASDAQ:NEO - Get Free Report) last released its quarterly earnings data on Tuesday, February 18th. The medical research company reported ($0.02) EPS for the quarter, missing analysts' consensus estimates of $0.03 by ($0.05). The firm had revenue of $172.00 million during the quarter, compared to the consensus estimate of $173.40 million. NeoGenomics had a negative net margin of 11.92% and a negative return on equity of 2.10%.

Other equities analysts have also recently issued reports about the company. Jefferies Financial Group started coverage on NeoGenomics in a research report on Tuesday, December 10th. They set a "buy" rating and a $22.00 target price for the company. Benchmark cut shares of NeoGenomics from a "buy" rating to a "hold" rating in a research report on Monday, January 13th. The Goldman Sachs Group dropped their target price on shares of NeoGenomics from $20.00 to $18.00 and set a "buy" rating for the company in a research report on Tuesday, January 28th. Needham & Company LLC cut their price target on shares of NeoGenomics from $19.00 to $18.00 and set a "buy" rating for the company in a research note on Wednesday, February 19th. Finally, Bank of America lowered their price objective on shares of NeoGenomics from $19.00 to $16.00 and set a "neutral" rating on the stock in a research report on Wednesday, February 19th. Two equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $19.80.

Get Our Latest Analysis on NEO

NeoGenomics Price Performance

Shares of NEO traded down $0.29 during mid-day trading on Friday, reaching $10.88. 1,299,972 shares of the stock traded hands, compared to its average volume of 1,192,398. The company has a market cap of $1.40 billion, a price-to-earnings ratio of -17.55 and a beta of 1.23. NeoGenomics has a 1 year low of $10.62 and a 1 year high of $19.11. The firm has a fifty day moving average price of $15.01 and a 200 day moving average price of $15.41. The company has a current ratio of 1.98, a quick ratio of 1.91 and a debt-to-equity ratio of 0.38.

Institutional Investors Weigh In On NeoGenomics

Hedge funds have recently made changes to their positions in the business. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in NeoGenomics by 7.1% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 646,111 shares of the medical research company's stock worth $10,648,000 after purchasing an additional 42,895 shares during the period. Sovereign s Capital Management LLC purchased a new position in shares of NeoGenomics in the fourth quarter worth about $490,000. Squarepoint Ops LLC bought a new stake in shares of NeoGenomics in the 4th quarter valued at about $276,000. Sherbrooke Park Advisers LLC bought a new stake in shares of NeoGenomics in the 4th quarter valued at about $183,000. Finally, ProShare Advisors LLC boosted its holdings in NeoGenomics by 44.5% during the 4th quarter. ProShare Advisors LLC now owns 38,445 shares of the medical research company's stock valued at $634,000 after acquiring an additional 11,831 shares during the period. 98.50% of the stock is currently owned by institutional investors.

About NeoGenomics

(

Get Free Report)

NeoGenomics, Inc operates a network of cancer-focused testing laboratories in the United States and the United Kingdom. It operates through Clinical Services and Advanced Diagnostics segments. The company offers testing services to hospitals, academic centers, pathologists, oncologists, clinicians, pharmaceutical companies, and clinical laboratories.

See Also

Before you consider NeoGenomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NeoGenomics wasn't on the list.

While NeoGenomics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.