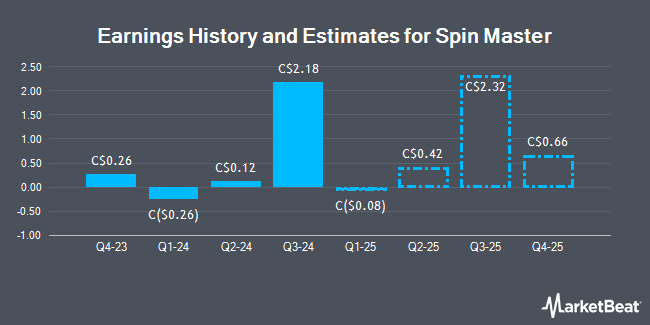

Spin Master Corp. (TSE:TOY - Free Report) - Equities research analysts at Stifel Canada increased their Q1 2025 earnings estimates for Spin Master in a report issued on Tuesday, February 25th. Stifel Canada analyst M. Landry now anticipates that the company will earn ($0.18) per share for the quarter, up from their prior estimate of ($0.25). The consensus estimate for Spin Master's current full-year earnings is $3.14 per share. Stifel Canada also issued estimates for Spin Master's Q2 2025 earnings at $0.26 EPS, Q2 2025 earnings at $0.26 EPS, Q4 2025 earnings at $0.61 EPS, Q4 2025 earnings at $0.61 EPS, FY2025 earnings at $3.15 EPS and FY2025 earnings at $3.15 EPS.

A number of other analysts have also recently commented on the company. Royal Bank of Canada reduced their price target on Spin Master from C$43.00 to C$41.00 and set an "outperform" rating for the company in a research report on Wednesday, February 26th. TD Securities reduced their target price on shares of Spin Master from C$46.00 to C$37.00 and set a "buy" rating for the company in a report on Wednesday, February 26th. Canaccord Genuity Group decreased their target price on shares of Spin Master from C$44.00 to C$35.00 and set a "buy" rating on the stock in a research note on Wednesday, February 26th. Stifel Nicolaus dropped their price target on shares of Spin Master from C$45.00 to C$40.00 and set a "buy" rating for the company in a research report on Wednesday, February 26th. Finally, National Bankshares decreased their price objective on shares of Spin Master from C$35.00 to C$32.00 and set a "sector perform" rating on the stock in a research report on Wednesday, February 26th. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Spin Master currently has an average rating of "Moderate Buy" and an average price target of C$37.75.

Read Our Latest Stock Analysis on Spin Master

Spin Master Stock Performance

Spin Master stock traded down C$0.81 during trading on Friday, reaching C$26.45. The company had a trading volume of 165,084 shares, compared to its average volume of 78,248. The firm has a market capitalization of C$1.94 billion, a price-to-earnings ratio of 62.60, a price-to-earnings-growth ratio of 0.57 and a beta of 1.86. The company has a current ratio of 1.14, a quick ratio of 2.06 and a debt-to-equity ratio of 39.61. The firm's 50-day simple moving average is C$31.32 and its 200 day simple moving average is C$31.61. Spin Master has a 52 week low of C$25.76 and a 52 week high of C$35.44.

Spin Master Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, January 10th. Shareholders of record on Friday, January 10th were issued a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 1.81%. The ex-dividend date was Friday, December 27th. Spin Master's dividend payout ratio (DPR) is presently 113.60%.

About Spin Master

(

Get Free Report)

Spin Master Corp., a children's entertainment company, engages in the creation, design, manufacture, licensing, and marketing of various toys, entertainment products, and digital games in North America, Europe, and internationally. The Toys segment's product categories include activities, games and puzzles, and plush; wheels and action; outdoor; and preschool, dolls, and interactive products.

See Also

Before you consider Spin Master, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spin Master wasn't on the list.

While Spin Master currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.