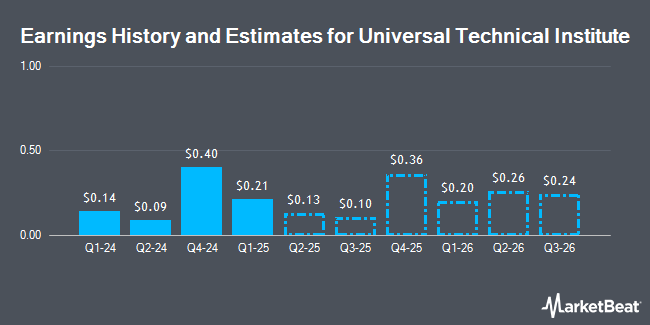

Universal Technical Institute, Inc. (NYSE:UTI - Free Report) - Equities research analysts at Barrington Research issued their Q1 2025 earnings estimates for Universal Technical Institute in a research note issued to investors on Thursday, November 21st. Barrington Research analyst A. Paris expects that the company will post earnings of $0.20 per share for the quarter. Barrington Research currently has a "Outperform" rating and a $25.00 target price on the stock. The consensus estimate for Universal Technical Institute's current full-year earnings is $0.97 per share. Barrington Research also issued estimates for Universal Technical Institute's Q2 2025 earnings at $0.18 EPS, Q3 2025 earnings at $0.15 EPS, FY2025 earnings at $0.97 EPS and FY2026 earnings at $1.15 EPS.

UTI has been the subject of several other research reports. Truist Financial increased their price objective on Universal Technical Institute from $22.00 to $26.00 and gave the stock a "buy" rating in a research report on Thursday. Rosenblatt Securities reissued a "buy" rating and issued a $22.00 price objective on shares of Universal Technical Institute in a research note on Wednesday, September 11th. B. Riley lifted their target price on shares of Universal Technical Institute from $22.00 to $25.00 and gave the stock a "buy" rating in a research report on Thursday, November 7th. Northland Securities raised their price objective on shares of Universal Technical Institute from $20.00 to $24.00 and gave the stock an "outperform" rating in a research note on Thursday. Finally, Lake Street Capital raised their price target on Universal Technical Institute from $19.00 to $22.00 and gave the stock a "buy" rating in a research report on Thursday. Seven investment analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company has an average rating of "Buy" and an average target price of $24.00.

Get Our Latest Research Report on UTI

Universal Technical Institute Stock Performance

NYSE UTI traded up $0.55 on Monday, hitting $25.93. 938,128 shares of the company's stock were exchanged, compared to its average volume of 529,527. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.08 and a quick ratio of 1.02. The firm's 50-day moving average price is $17.56 and its two-hundred day moving average price is $16.75. The firm has a market cap of $1.40 billion, a price-to-earnings ratio of 35.04, a P/E/G ratio of 1.75 and a beta of 1.34. Universal Technical Institute has a fifty-two week low of $10.46 and a fifty-two week high of $26.13.

Institutional Trading of Universal Technical Institute

Several large investors have recently bought and sold shares of UTI. Vanguard Group Inc. increased its position in shares of Universal Technical Institute by 55.0% during the first quarter. Vanguard Group Inc. now owns 2,375,929 shares of the company's stock worth $37,872,000 after acquiring an additional 842,765 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in Universal Technical Institute by 1.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,004,788 shares of the company's stock valued at $31,533,000 after purchasing an additional 36,135 shares in the last quarter. Geode Capital Management LLC increased its holdings in Universal Technical Institute by 9.8% during the 3rd quarter. Geode Capital Management LLC now owns 952,799 shares of the company's stock worth $15,496,000 after purchasing an additional 85,417 shares during the last quarter. FMR LLC raised its position in shares of Universal Technical Institute by 73,048.1% in the 3rd quarter. FMR LLC now owns 879,240 shares of the company's stock valued at $14,296,000 after purchasing an additional 878,038 shares in the last quarter. Finally, State Street Corp boosted its stake in shares of Universal Technical Institute by 3.6% during the 3rd quarter. State Street Corp now owns 856,091 shares of the company's stock valued at $13,920,000 after buying an additional 29,461 shares during the last quarter. Institutional investors and hedge funds own 75.67% of the company's stock.

Universal Technical Institute Company Profile

(

Get Free Report)

Universal Technical Institute, Inc provides transportation, skilled trades, and healthcare education programs in the United States. The company operates in two segments, UTI and Concorde. It offers certificate, diploma, or degree programs under various brands, such as Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology.

Further Reading

Before you consider Universal Technical Institute, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Technical Institute wasn't on the list.

While Universal Technical Institute currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.