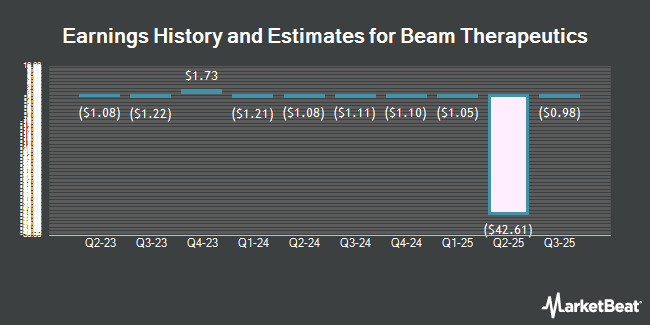

Beam Therapeutics Inc. (NASDAQ:BEAM - Free Report) - Equities researchers at Wedbush boosted their Q1 2025 EPS estimates for shares of Beam Therapeutics in a research note issued to investors on Monday, March 10th. Wedbush analyst D. Nierengarten now forecasts that the company will post earnings of ($1.00) per share for the quarter, up from their prior forecast of ($1.21). Wedbush currently has a "Outperform" rating and a $57.00 price target on the stock. The consensus estimate for Beam Therapeutics' current full-year earnings is ($4.57) per share. Wedbush also issued estimates for Beam Therapeutics' Q2 2025 earnings at ($0.97) EPS, Q3 2025 earnings at ($1.00) EPS, Q4 2025 earnings at ($1.05) EPS, FY2025 earnings at ($4.02) EPS, FY2026 earnings at ($4.89) EPS, FY2027 earnings at ($5.07) EPS, FY2028 earnings at ($4.02) EPS and FY2029 earnings at $0.57 EPS.

Beam Therapeutics (NASDAQ:BEAM - Get Free Report) last posted its earnings results on Tuesday, February 25th. The company reported ($1.09) earnings per share (EPS) for the quarter, topping the consensus estimate of ($1.25) by $0.16. The firm had revenue of $30.00 million during the quarter, compared to analyst estimates of $16.47 million. Beam Therapeutics had a negative net margin of 41.07% and a negative return on equity of 16.22%. The business's revenue was down 90.5% compared to the same quarter last year. During the same quarter in the prior year, the business posted $1.73 EPS.

A number of other equities research analysts also recently issued reports on BEAM. Sanford C. Bernstein raised shares of Beam Therapeutics from a "hold" rating to a "strong-buy" rating in a report on Tuesday, January 7th. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Beam Therapeutics in a research note on Wednesday. Royal Bank of Canada raised their target price on shares of Beam Therapeutics from $24.00 to $26.00 and gave the company a "sector perform" rating in a research note on Wednesday, February 26th. Scotiabank raised shares of Beam Therapeutics from a "sector perform" rating to a "sector outperform" rating and set a $40.00 price target on the stock in a research note on Monday. Finally, Guggenheim reissued a "buy" rating and set a $78.00 price target on shares of Beam Therapeutics in a research note on Thursday, February 27th. Two research analysts have rated the stock with a hold rating, ten have given a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, Beam Therapeutics has an average rating of "Buy" and an average price target of $50.82.

Read Our Latest Report on BEAM

Beam Therapeutics Stock Up 3.8 %

Shares of NASDAQ:BEAM opened at $27.42 on Thursday. The firm has a market capitalization of $2.29 billion, a PE ratio of -15.58 and a beta of 1.91. Beam Therapeutics has a twelve month low of $20.84 and a twelve month high of $37.49. The company has a 50-day moving average price of $27.10 and a two-hundred day moving average price of $26.04.

Hedge Funds Weigh In On Beam Therapeutics

Several institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Horizon Kinetics Asset Management LLC grew its stake in Beam Therapeutics by 4.4% in the fourth quarter. Horizon Kinetics Asset Management LLC now owns 9,597 shares of the company's stock valued at $238,000 after purchasing an additional 403 shares during the last quarter. Summit Investment Advisors Inc. grew its stake in Beam Therapeutics by 6.6% in the fourth quarter. Summit Investment Advisors Inc. now owns 7,999 shares of the company's stock valued at $198,000 after purchasing an additional 496 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank grew its stake in Beam Therapeutics by 2.5% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 21,396 shares of the company's stock valued at $524,000 after purchasing an additional 516 shares during the last quarter. Martingale Asset Management L P grew its stake in Beam Therapeutics by 8.6% in the fourth quarter. Martingale Asset Management L P now owns 11,438 shares of the company's stock valued at $284,000 after purchasing an additional 909 shares during the last quarter. Finally, Swiss National Bank grew its stake in Beam Therapeutics by 0.8% in the fourth quarter. Swiss National Bank now owns 137,800 shares of the company's stock valued at $3,417,000 after purchasing an additional 1,100 shares during the last quarter. Hedge funds and other institutional investors own 99.68% of the company's stock.

Insider Transactions at Beam Therapeutics

In other news, insider Christine Bellon sold 1,241 shares of the firm's stock in a transaction on Thursday, January 2nd. The stock was sold at an average price of $24.68, for a total transaction of $30,627.88. Following the transaction, the insider now owns 102,968 shares in the company, valued at approximately $2,541,250.24. This trade represents a 1.19 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO John M. Evans sold 30,000 shares of the firm's stock in a transaction on Thursday, January 30th. The shares were sold at an average price of $26.75, for a total value of $802,500.00. Following the transaction, the chief executive officer now owns 908,659 shares in the company, valued at approximately $24,306,628.25. This represents a 3.20 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 4.20% of the company's stock.

About Beam Therapeutics

(

Get Free Report)

Beam Therapeutics Inc, a biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States. It develops BEAM-101 for the treatment of sickle cell disease or beta-thalassemia; and BEAM-302, a liver-targeting LNP formulation to treat severe alpha-1 antitrypsin deficiency; BEAM-201, an anti-CD7 CAR-T product candidate, which is in Phase 1/2 clinical trials for the treatment of refractory T-cell acute lymphoblastic leukemia/T cell lymphoblastic lymphoma; and BEAM-301, a liver-targeting LNP formulation for the treatment of glycogen storage disease 1a.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Beam Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beam Therapeutics wasn't on the list.

While Beam Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.