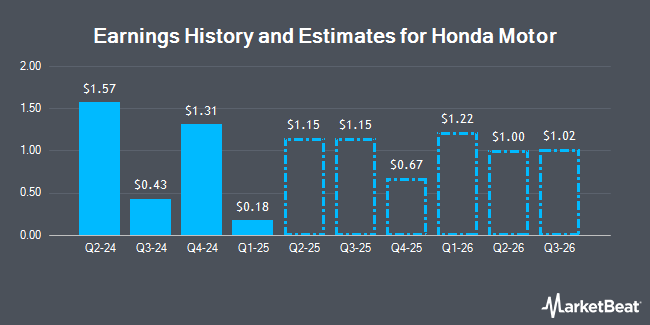

Honda Motor Co., Ltd. (NYSE:HMC - Free Report) - Zacks Research lowered their Q1 2026 earnings estimates for shares of Honda Motor in a report issued on Wednesday, December 4th. Zacks Research analyst R. Department now anticipates that the company will earn $1.39 per share for the quarter, down from their prior forecast of $1.41. The consensus estimate for Honda Motor's current full-year earnings is $4.09 per share. Zacks Research also issued estimates for Honda Motor's FY2026 earnings at $4.38 EPS, Q1 2027 earnings at $1.15 EPS and FY2027 earnings at $4.09 EPS.

Separately, StockNews.com downgraded shares of Honda Motor from a "strong-buy" rating to a "buy" rating in a research report on Saturday, November 2nd.

Read Our Latest Stock Analysis on HMC

Honda Motor Trading Up 0.3 %

Honda Motor stock traded up $0.08 during trading hours on Monday, reaching $26.12. 1,588,096 shares of the company's stock traded hands, compared to its average volume of 923,993. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.12 and a current ratio of 1.43. Honda Motor has a fifty-two week low of $25.56 and a fifty-two week high of $37.90. The firm's 50 day moving average is $28.81 and its 200-day moving average is $30.85.

Honda Motor (NYSE:HMC - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $0.43 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.86 by ($0.43). Honda Motor had a net margin of 4.53% and a return on equity of 7.53%. The business had revenue of $36.24 billion for the quarter, compared to analyst estimates of $35.60 billion.

Institutional Trading of Honda Motor

A number of hedge funds have recently modified their holdings of the company. Rothschild Investment LLC acquired a new position in shares of Honda Motor in the second quarter valued at approximately $28,000. LRI Investments LLC boosted its holdings in shares of Honda Motor by 1,263.6% in the second quarter. LRI Investments LLC now owns 900 shares of the company's stock valued at $29,000 after buying an additional 834 shares during the period. Family Firm Inc. acquired a new position in shares of Honda Motor in the second quarter valued at approximately $35,000. Wilmington Savings Fund Society FSB acquired a new position in shares of Honda Motor in the third quarter valued at approximately $36,000. Finally, Addison Advisors LLC boosted its holdings in shares of Honda Motor by 391.2% in the third quarter. Addison Advisors LLC now owns 1,282 shares of the company's stock valued at $41,000 after buying an additional 1,021 shares during the period. 5.32% of the stock is currently owned by institutional investors and hedge funds.

About Honda Motor

(

Get Free Report)

Honda Motor Co, Ltd. develops, manufactures, and distributes motorcycles, automobiles, power, and other products in Japan, North America, Europe, Asia, and internationally. It operates through four segments: Motorcycle Business, Automobile Business, Financial Services Business, and Power Product and Other Businesses.

Recommended Stories

Before you consider Honda Motor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honda Motor wasn't on the list.

While Honda Motor currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.