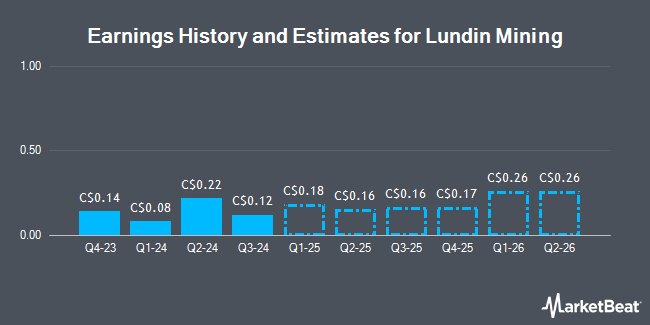

Lundin Mining Co. (TSE:LUN - Free Report) - Investment analysts at Ventum Cap Mkts cut their Q1 2025 EPS estimates for shares of Lundin Mining in a research report issued on Tuesday, February 11th. Ventum Cap Mkts analyst C. Mackay now anticipates that the mining company will earn $0.14 per share for the quarter, down from their prior estimate of $0.17.

A number of other analysts have also recently commented on LUN. UBS Group dropped their price target on shares of Lundin Mining from C$17.00 to C$15.50 in a research note on Tuesday, January 7th. Scotiabank cut shares of Lundin Mining from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, January 15th. Jefferies Financial Group lowered their target price on shares of Lundin Mining from C$20.00 to C$16.00 in a research note on Monday, January 6th. Raymond James lowered their target price on shares of Lundin Mining from C$15.00 to C$14.00 and set a "market perform" rating on the stock in a research note on Thursday, January 16th. Finally, Stifel Nicolaus lowered their target price on shares of Lundin Mining from C$17.50 to C$16.00 and set a "buy" rating on the stock in a research note on Thursday, January 30th. Seven equities research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of C$17.19.

Check Out Our Latest Stock Report on LUN

Lundin Mining Stock Performance

Shares of LUN stock traded up C$0.09 during trading on Friday, reaching C$12.42. 1,886,823 shares of the company's stock traded hands, compared to its average volume of 2,416,933. The company has a market capitalization of C$7.59 billion, a P/E ratio of 24.65, a PEG ratio of -0.26 and a beta of 1.66. The company has a current ratio of 1.40, a quick ratio of 0.90 and a debt-to-equity ratio of 41.58. The firm's 50-day moving average is C$12.31 and its 200 day moving average is C$13.14. Lundin Mining has a 1 year low of C$10.56 and a 1 year high of C$17.97.

About Lundin Mining

(

Get Free Report)

Lundin Mining Corp is a diversified Canadian base metals mining company with operations in Brazil Chile Portugal Sweden and the United States of America producing copper zinc gold and nickel. Its material mineral properties include Candelaria Chapada Eagle and Neves-Corvo.

Featured Stories

Before you consider Lundin Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lundin Mining wasn't on the list.

While Lundin Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.