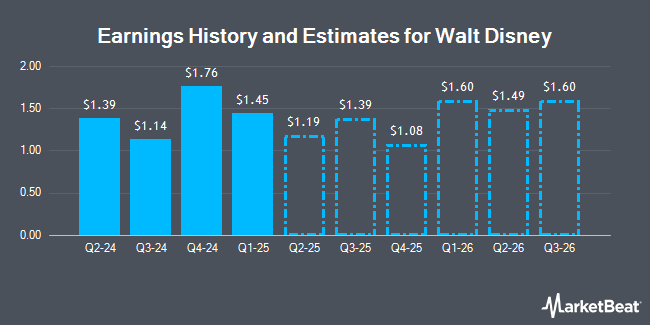

The Walt Disney Company (NYSE:DIS - Free Report) - Equities researchers at Seaport Res Ptn lifted their Q1 2025 earnings per share (EPS) estimates for shares of Walt Disney in a research report issued to clients and investors on Monday, November 18th. Seaport Res Ptn analyst D. Joyce now forecasts that the entertainment giant will post earnings per share of $1.54 for the quarter, up from their prior forecast of $1.37. Seaport Res Ptn currently has a "Strong-Buy" rating on the stock. The consensus estimate for Walt Disney's current full-year earnings is $5.14 per share. Seaport Res Ptn also issued estimates for Walt Disney's Q2 2025 earnings at $1.27 EPS, Q3 2025 earnings at $1.45 EPS, Q4 2025 earnings at $1.23 EPS, FY2025 earnings at $5.49 EPS and FY2026 earnings at $6.73 EPS.

DIS has been the topic of several other research reports. Raymond James restated a "market perform" rating on shares of Walt Disney in a research note on Tuesday, October 1st. Deutsche Bank Aktiengesellschaft raised their target price on Walt Disney from $115.00 to $131.00 and gave the company a "buy" rating in a report on Friday. Barclays decreased their price target on Walt Disney from $130.00 to $105.00 and set an "overweight" rating for the company in a research note on Thursday, August 8th. JPMorgan Chase & Co. lowered their price objective on Walt Disney from $135.00 to $125.00 and set an "overweight" rating on the stock in a report on Thursday, August 8th. Finally, Sanford C. Bernstein boosted their target price on Walt Disney from $115.00 to $120.00 and gave the stock an "outperform" rating in a report on Friday. Five equities research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $123.83.

Check Out Our Latest Research Report on DIS

Walt Disney Stock Down 1.0 %

NYSE:DIS traded down $1.12 during mid-day trading on Tuesday, reaching $112.42. The stock had a trading volume of 12,155,338 shares, compared to its average volume of 11,024,916. The stock has a market cap of $203.59 billion, a P/E ratio of 41.48, a PEG ratio of 1.85 and a beta of 1.40. The business's 50 day moving average is $96.55 and its 200 day moving average is $96.60. The company has a debt-to-equity ratio of 0.37, a current ratio of 0.73 and a quick ratio of 0.67. Walt Disney has a fifty-two week low of $83.91 and a fifty-two week high of $123.74.

Institutional Trading of Walt Disney

Several institutional investors have recently made changes to their positions in DIS. Concurrent Investment Advisors LLC grew its stake in shares of Walt Disney by 8.4% in the 3rd quarter. Concurrent Investment Advisors LLC now owns 66,744 shares of the entertainment giant's stock valued at $6,420,000 after purchasing an additional 5,184 shares during the period. Summit Global Investments grew its holdings in shares of Walt Disney by 476.0% in the 3rd quarter. Summit Global Investments now owns 12,379 shares of the entertainment giant's stock worth $1,191,000 after purchasing an additional 10,230 shares during the last quarter. Lmcg Investments LLC lifted its holdings in Walt Disney by 18.6% during the 3rd quarter. Lmcg Investments LLC now owns 147,353 shares of the entertainment giant's stock valued at $14,174,000 after purchasing an additional 23,116 shares during the last quarter. American Assets Inc. acquired a new position in Walt Disney in the third quarter valued at about $962,000. Finally, ICICI Prudential Asset Management Co Ltd grew its position in Walt Disney by 92.0% during the 3rd quarter. ICICI Prudential Asset Management Co Ltd now owns 92,938 shares of the entertainment giant's stock worth $8,940,000 after acquiring an additional 44,535 shares during the last quarter. 65.71% of the stock is currently owned by institutional investors and hedge funds.

Walt Disney Company Profile

(

Get Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Further Reading

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.