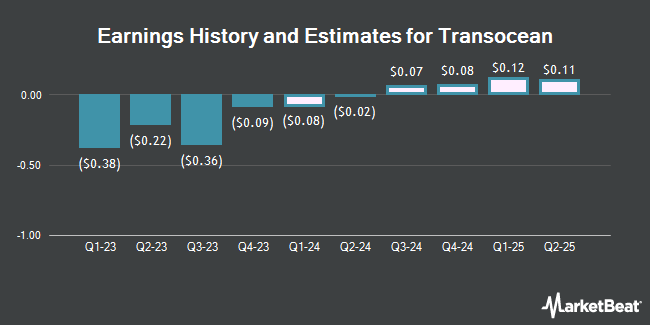

Transocean Ltd. (NYSE:RIG - Free Report) - Research analysts at Zacks Research lowered their Q2 2025 earnings estimates for shares of Transocean in a research report issued to clients and investors on Monday, March 10th. Zacks Research analyst N. Choudhury now expects that the offshore drilling services provider will earn $0.01 per share for the quarter, down from their previous forecast of $0.02. The consensus estimate for Transocean's current full-year earnings is $0.14 per share. Zacks Research also issued estimates for Transocean's Q3 2025 earnings at $0.03 EPS, Q1 2026 earnings at $0.04 EPS and FY2027 earnings at $0.18 EPS.

Transocean (NYSE:RIG - Get Free Report) last announced its quarterly earnings results on Monday, February 17th. The offshore drilling services provider reported ($0.09) EPS for the quarter, missing the consensus estimate of $0.02 by ($0.11). Transocean had a negative return on equity of 0.52% and a negative net margin of 14.53%. The business had revenue of $952.00 million for the quarter, compared to analyst estimates of $962.28 million.

Several other equities analysts have also recently commented on RIG. SEB Equity Research set a $2.80 price target on Transocean in a report on Wednesday, March 5th. JPMorgan Chase & Co. raised Transocean from an "underweight" rating to a "neutral" rating and set a $5.00 price target for the company in a report on Friday, December 6th. Evercore ISI cut Transocean from an "outperform" rating to an "in-line" rating and dropped their target price for the stock from $6.00 to $5.00 in a report on Wednesday, January 15th. Benchmark reissued a "hold" rating on shares of Transocean in a report on Tuesday, December 3rd. Finally, TD Cowen dropped their target price on Transocean from $6.50 to $5.50 and set a "hold" rating for the company in a report on Wednesday, January 8th. Two research analysts have rated the stock with a sell rating, six have assigned a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average target price of $5.42.

Get Our Latest Stock Analysis on Transocean

Transocean Price Performance

NYSE RIG opened at $2.95 on Wednesday. Transocean has a 1 year low of $2.55 and a 1 year high of $6.88. The company has a market cap of $2.59 billion, a P/E ratio of -4.03, a P/E/G ratio of 0.86 and a beta of 2.72. The company has a fifty day simple moving average of $3.63 and a 200 day simple moving average of $4.02. The company has a current ratio of 1.47, a quick ratio of 1.34 and a debt-to-equity ratio of 0.60.

Insider Transactions at Transocean

In related news, EVP Roderick James Mackenzie sold 22,000 shares of the firm's stock in a transaction on Tuesday, February 11th. The stock was sold at an average price of $3.85, for a total transaction of $84,700.00. Following the sale, the executive vice president now owns 313,072 shares of the company's stock, valued at approximately $1,205,327.20. This trade represents a 6.57 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. 13.16% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Transocean

A number of large investors have recently bought and sold shares of the company. Twin Tree Management LP bought a new stake in Transocean in the 4th quarter valued at $27,000. Optiver Holding B.V. increased its position in Transocean by 53.6% during the 4th quarter. Optiver Holding B.V. now owns 8,400 shares of the offshore drilling services provider's stock worth $32,000 after buying an additional 2,933 shares during the period. Blue Trust Inc. grew its holdings in shares of Transocean by 96.2% during the 4th quarter. Blue Trust Inc. now owns 9,841 shares of the offshore drilling services provider's stock worth $37,000 after purchasing an additional 4,826 shares in the last quarter. Adero Partners LLC acquired a new stake in shares of Transocean during the 4th quarter worth $38,000. Finally, Stratos Wealth Partners LTD. acquired a new stake in shares of Transocean during the 4th quarter worth $40,000. Institutional investors and hedge funds own 67.73% of the company's stock.

About Transocean

(

Get Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.