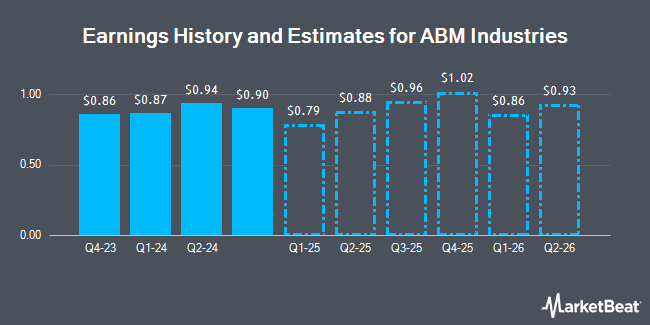

ABM Industries Incorporated (NYSE:ABM - Free Report) - Equities research analysts at William Blair lifted their Q2 2025 earnings per share estimates for ABM Industries in a research note issued on Wednesday, December 18th. William Blair analyst T. Mulrooney now forecasts that the business services provider will post earnings of $0.93 per share for the quarter, up from their prior forecast of $0.91. The consensus estimate for ABM Industries' current full-year earnings is $3.53 per share.

A number of other analysts have also issued reports on ABM. UBS Group lifted their target price on ABM Industries from $55.00 to $56.00 and gave the stock a "neutral" rating in a research report on Thursday. Truist Financial lifted their price objective on ABM Industries from $49.00 to $55.00 and gave the stock a "hold" rating in a report on Monday, September 9th. Finally, Robert W. Baird increased their target price on ABM Industries from $49.00 to $56.00 and gave the company a "neutral" rating in a research note on Monday, September 9th.

View Our Latest Stock Report on ABM

ABM Industries Stock Up 0.0 %

Shares of NYSE ABM traded up $0.01 during trading on Monday, reaching $50.35. 385,509 shares of the stock were exchanged, compared to its average volume of 534,479. The company has a quick ratio of 1.38, a current ratio of 1.38 and a debt-to-equity ratio of 0.71. The business's 50-day moving average price is $55.23 and its 200 day moving average price is $53.43. The company has a market capitalization of $3.13 billion, a price-to-earnings ratio of 20.81 and a beta of 1.14. ABM Industries has a twelve month low of $39.64 and a twelve month high of $59.78.

ABM Industries (NYSE:ABM - Get Free Report) last released its quarterly earnings results on Wednesday, December 18th. The business services provider reported $0.90 EPS for the quarter, topping the consensus estimate of $0.87 by $0.03. ABM Industries had a return on equity of 12.93% and a net margin of 1.89%. The firm had revenue of $2.18 billion for the quarter, compared to analyst estimates of $2.08 billion. During the same period in the previous year, the company posted $1.01 EPS. ABM Industries's revenue for the quarter was up 4.0% on a year-over-year basis.

ABM Industries Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, February 3rd. Investors of record on Thursday, January 2nd will be paid a $0.265 dividend. This represents a $1.06 dividend on an annualized basis and a yield of 2.11%. This is an increase from ABM Industries's previous quarterly dividend of $0.23. The ex-dividend date of this dividend is Thursday, January 2nd. ABM Industries's dividend payout ratio (DPR) is 83.46%.

Insider Activity at ABM Industries

In related news, CFO Earl Ray Ellis sold 40,000 shares of the firm's stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $53.96, for a total value of $2,158,400.00. Following the sale, the chief financial officer now owns 45,260 shares of the company's stock, valued at approximately $2,442,229.60. This trade represents a 46.92 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 1.04% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On ABM Industries

Several large investors have recently added to or reduced their stakes in the stock. Pacer Advisors Inc. acquired a new stake in shares of ABM Industries in the second quarter valued at approximately $125,118,000. Pzena Investment Management LLC bought a new stake in ABM Industries during the 2nd quarter valued at $21,032,000. LSV Asset Management raised its stake in ABM Industries by 92.3% during the 2nd quarter. LSV Asset Management now owns 760,321 shares of the business services provider's stock valued at $38,449,000 after acquiring an additional 364,879 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its position in ABM Industries by 652,535.3% during the 2nd quarter. Allspring Global Investments Holdings LLC now owns 110,948 shares of the business services provider's stock worth $5,611,000 after acquiring an additional 110,931 shares during the period. Finally, Barclays PLC grew its stake in shares of ABM Industries by 238.7% in the third quarter. Barclays PLC now owns 113,850 shares of the business services provider's stock worth $6,004,000 after purchasing an additional 80,238 shares in the last quarter. 91.62% of the stock is owned by institutional investors and hedge funds.

About ABM Industries

(

Get Free Report)

ABM Industries Incorporated, through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally. It operates through Business & Industry, Manufacturing & Distribution, Education, Aviation, and Technical Solutions segments.

See Also

Before you consider ABM Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ABM Industries wasn't on the list.

While ABM Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.