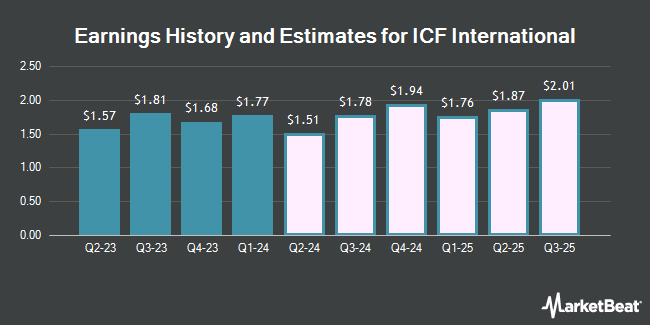

ICF International, Inc. (NASDAQ:ICFI - Free Report) - Zacks Research upped their Q2 2025 earnings per share estimates for shares of ICF International in a report issued on Wednesday, November 20th. Zacks Research analyst A. Bose now anticipates that the business services provider will earn $1.90 per share for the quarter, up from their prior forecast of $1.86. The consensus estimate for ICF International's current full-year earnings is $7.44 per share. Zacks Research also issued estimates for ICF International's Q4 2025 earnings at $2.03 EPS and Q1 2026 earnings at $2.24 EPS.

Several other equities analysts have also commented on ICFI. StockNews.com upgraded ICF International from a "buy" rating to a "strong-buy" rating in a research report on Tuesday, November 12th. Sidoti raised shares of ICF International from a "neutral" rating to a "buy" rating and set a $185.00 target price on the stock in a report on Tuesday, November 19th. Barrington Research reissued an "outperform" rating and issued a $174.00 price target on shares of ICF International in a research note on Friday, September 20th. Finally, Truist Financial reduced their price objective on ICF International from $180.00 to $140.00 and set a "hold" rating on the stock in a research note on Friday. One equities research analyst has rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and an average price target of $167.25.

Read Our Latest Analysis on ICFI

ICF International Price Performance

NASDAQ:ICFI traded up $1.23 during midday trading on Monday, hitting $135.52. The company had a trading volume of 270,867 shares, compared to its average volume of 109,876. The stock's fifty day moving average price is $163.71 and its 200-day moving average price is $153.82. ICF International has a 52-week low of $128.28 and a 52-week high of $179.67. The company has a quick ratio of 1.21, a current ratio of 1.21 and a debt-to-equity ratio of 0.43. The company has a market capitalization of $2.54 billion, a PE ratio of 23.82 and a beta of 0.61.

ICF International (NASDAQ:ICFI - Get Free Report) last announced its earnings results on Friday, November 1st. The business services provider reported $2.13 earnings per share for the quarter, beating analysts' consensus estimates of $1.77 by $0.36. ICF International had a net margin of 5.38% and a return on equity of 14.68%. The business had revenue of $517.00 million for the quarter, compared to the consensus estimate of $528.02 million. During the same period last year, the firm posted $1.81 earnings per share. ICF International's quarterly revenue was up 3.1% on a year-over-year basis.

ICF International Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, January 10th. Shareholders of record on Friday, December 6th will be given a dividend of $0.14 per share. This represents a $0.56 dividend on an annualized basis and a yield of 0.41%. The ex-dividend date is Friday, December 6th. ICF International's payout ratio is 9.84%.

Insiders Place Their Bets

In other ICF International news, CEO John Wasson sold 1,417 shares of ICF International stock in a transaction that occurred on Thursday, August 29th. The stock was sold at an average price of $165.14, for a total transaction of $234,003.38. Following the sale, the chief executive officer now directly owns 52,605 shares of the company's stock, valued at approximately $8,687,189.70. The trade was a 2.62 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, COO James C. M. Morgan sold 2,500 shares of the stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $175.07, for a total value of $437,675.00. Following the completion of the transaction, the chief operating officer now directly owns 37,663 shares of the company's stock, valued at $6,593,661.41. This represents a 6.22 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 6,823 shares of company stock worth $1,165,078. 1.39% of the stock is currently owned by company insiders.

Institutional Trading of ICF International

A number of hedge funds have recently made changes to their positions in the stock. Congress Asset Management Co. increased its stake in ICF International by 10.7% during the 3rd quarter. Congress Asset Management Co. now owns 353,824 shares of the business services provider's stock valued at $59,014,000 after purchasing an additional 34,299 shares in the last quarter. Tilia Fiduciary Partners Inc. bought a new stake in shares of ICF International during the third quarter valued at approximately $2,364,000. Argent Capital Management LLC raised its holdings in ICF International by 10.2% in the 2nd quarter. Argent Capital Management LLC now owns 27,418 shares of the business services provider's stock worth $4,070,000 after acquiring an additional 2,542 shares during the last quarter. Marshall Wace LLP bought a new position in ICF International in the 2nd quarter valued at approximately $301,000. Finally, SG Americas Securities LLC lifted its position in ICF International by 730.3% in the 2nd quarter. SG Americas Securities LLC now owns 9,225 shares of the business services provider's stock valued at $1,370,000 after acquiring an additional 8,114 shares in the last quarter. 94.12% of the stock is owned by institutional investors.

ICF International Company Profile

(

Get Free Report)

ICF International, Inc provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally. The company researches critical policy, industry, stakeholder issues, trends, and behaviors; measures and evaluates results and their impact; and provides strategic planning and advisory services to its clients on how to navigate societal, business, market, business, communication, and technology challenges.

See Also

Before you consider ICF International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICF International wasn't on the list.

While ICF International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.