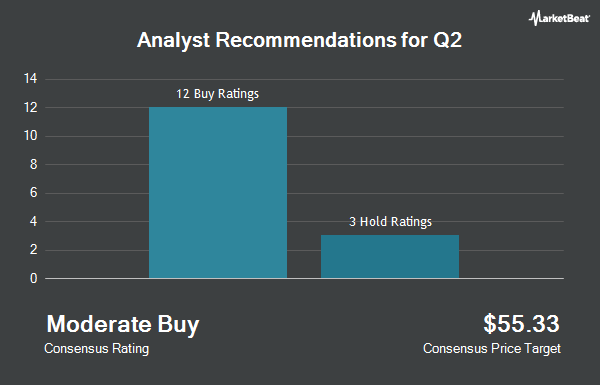

Shares of Q2 Holdings, Inc. (NYSE:QTWO - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the fourteen research firms that are covering the firm, Marketbeat Ratings reports. Five investment analysts have rated the stock with a hold recommendation and nine have given a buy recommendation to the company. The average 1-year price objective among brokerages that have covered the stock in the last year is $90.79.

Several brokerages recently issued reports on QTWO. Stephens increased their target price on shares of Q2 from $75.00 to $100.00 and gave the stock an "overweight" rating in a research note on Thursday. DA Davidson reissued a "neutral" rating and set a $76.00 price objective on shares of Q2 in a research report on Monday, September 30th. Citigroup downgraded Q2 from a "buy" rating to a "neutral" rating and raised their target price for the company from $72.00 to $90.00 in a research note on Friday, October 18th. Needham & Company LLC upped their price target on Q2 from $90.00 to $120.00 and gave the stock a "buy" rating in a research note on Thursday. Finally, Morgan Stanley raised their price objective on Q2 from $65.00 to $90.00 and gave the company an "equal weight" rating in a research note on Thursday.

Read Our Latest Stock Report on QTWO

Q2 Trading Up 12.9 %

Shares of QTWO stock traded up $11.67 during mid-day trading on Thursday, hitting $102.17. The company's stock had a trading volume of 2,222,992 shares, compared to its average volume of 592,589. The company has a market cap of $6.16 billion, a PE ratio of -88.08 and a beta of 1.58. The company has a debt-to-equity ratio of 1.02, a quick ratio of 2.44 and a current ratio of 2.44. The company's fifty day simple moving average is $79.80 and its 200-day simple moving average is $69.08. Q2 has a 52 week low of $32.97 and a 52 week high of $105.00.

Q2 (NYSE:QTWO - Get Free Report) last issued its earnings results on Wednesday, November 6th. The technology company reported ($0.03) earnings per share for the quarter, topping analysts' consensus estimates of ($0.04) by $0.01. The business had revenue of $175.02 million during the quarter, compared to the consensus estimate of $173.31 million. Q2 had a negative return on equity of 3.95% and a negative net margin of 10.40%. As a group, equities research analysts expect that Q2 will post -0.02 earnings per share for the current fiscal year.

Insider Activity

In other news, EVP Jonathan Price sold 11,000 shares of the business's stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $71.64, for a total value of $788,040.00. Following the transaction, the executive vice president now owns 215,079 shares in the company, valued at $15,408,259.56. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, Director Jeffrey T. Diehl sold 28,005 shares of the firm's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $75.25, for a total transaction of $2,107,376.25. Following the completion of the sale, the director now owns 397,702 shares in the company, valued at approximately $29,927,075.50. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, EVP Jonathan Price sold 11,000 shares of the business's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $71.64, for a total transaction of $788,040.00. Following the completion of the transaction, the executive vice president now owns 215,079 shares in the company, valued at approximately $15,408,259.56. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 41,963 shares of company stock worth $3,109,699 over the last quarter. Insiders own 3.00% of the company's stock.

Institutional Investors Weigh In On Q2

Several large investors have recently modified their holdings of QTWO. Brown Capital Management LLC lifted its holdings in Q2 by 0.4% during the first quarter. Brown Capital Management LLC now owns 2,565,647 shares of the technology company's stock valued at $134,850,000 after purchasing an additional 11,000 shares during the last quarter. Conestoga Capital Advisors LLC lifted its stake in shares of Q2 by 1.5% during the 3rd quarter. Conestoga Capital Advisors LLC now owns 2,308,194 shares of the technology company's stock valued at $184,125,000 after buying an additional 34,300 shares in the last quarter. Hood River Capital Management LLC boosted its holdings in Q2 by 5.7% in the 2nd quarter. Hood River Capital Management LLC now owns 1,261,924 shares of the technology company's stock worth $76,132,000 after buying an additional 67,757 shares during the period. American Century Companies Inc. grew its stake in Q2 by 5,990.6% in the 2nd quarter. American Century Companies Inc. now owns 1,210,143 shares of the technology company's stock valued at $73,008,000 after buying an additional 1,190,274 shares in the last quarter. Finally, Perpetual Ltd bought a new stake in Q2 during the 3rd quarter valued at $80,788,000.

Q2 Company Profile

(

Get Free ReportQ2 Holdings, Inc provides cloud-based digital solutions to regional and community financial institutions in the United States. The company offers Digital Banking Platform, an end-to-end digital banking platform supports its financial institution customers in their delivery of unified digital banking services across digital channels.

Featured Articles

Before you consider Q2, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Q2 wasn't on the list.

While Q2 currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.