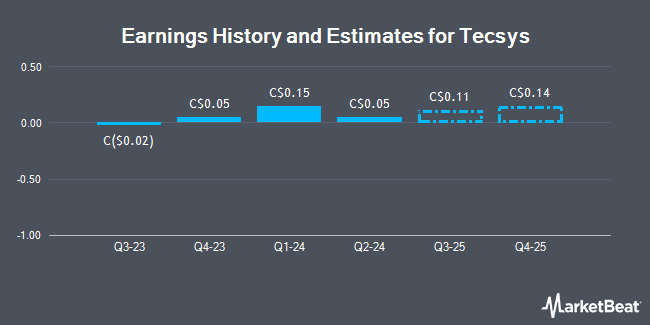

Tecsys Inc. (TSE:TCS - Free Report) - Analysts at Ventum Cap Mkts dropped their Q3 2025 earnings per share estimates for shares of Tecsys in a research note issued to investors on Thursday, December 5th. Ventum Cap Mkts analyst A. Ezzat now forecasts that the company will post earnings per share of $0.12 for the quarter, down from their prior estimate of $0.15. The consensus estimate for Tecsys' current full-year earnings is $0.46 per share. Ventum Cap Mkts also issued estimates for Tecsys' Q4 2025 earnings at $0.15 EPS, FY2025 earnings at $0.38 EPS and FY2026 earnings at $0.66 EPS.

Tecsys (TSE:TCS - Get Free Report) last posted its quarterly earnings results on Thursday, September 5th. The company reported C$0.05 earnings per share for the quarter, missing analysts' consensus estimates of C$0.09 by C($0.04). Tecsys had a return on equity of 2.08% and a net margin of 0.86%. The company had revenue of C$42.28 million for the quarter, compared to analysts' expectations of C$44.89 million.

Other analysts have also issued research reports about the stock. Cormark lowered shares of Tecsys from a "moderate buy" rating to a "hold" rating in a research note on Monday, September 9th. Ventum Financial lifted their target price on Tecsys from C$45.00 to C$52.00 in a research report on Friday.

Read Our Latest Research Report on TCS

Tecsys Trading Up 2.9 %

TSE:TCS traded up C$1.23 on Monday, hitting C$44.33. 9,738 shares of the stock were exchanged, compared to its average volume of 8,917. The company has a current ratio of 1.38, a quick ratio of 1.40 and a debt-to-equity ratio of 2.87. Tecsys has a fifty-two week low of C$29.20 and a fifty-two week high of C$45.35. The stock has a market cap of C$655.64 million, a PE ratio of 443.30 and a beta of 0.65. The stock has a fifty day moving average of C$42.21 and a 200-day moving average of C$39.89.

Insider Transactions at Tecsys

In other news, Director David Brereton sold 1,500 shares of the firm's stock in a transaction on Friday, December 6th. The stock was sold at an average price of C$43.96, for a total value of C$65,940.00. Corporate insiders own 17.05% of the company's stock.

About Tecsys

(

Get Free Report)

Tecsys Inc engages in the development, marketing, and sale of enterprise-wide supply chain management software and related services in Canada, the United States, Europe, and internationally. The company offers warehouse management, distribution and transportation management, supply management at point-of-use and order management and fulfillment, as well as financial management and analytics solutions.

Featured Stories

Before you consider Tecsys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tecsys wasn't on the list.

While Tecsys currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.