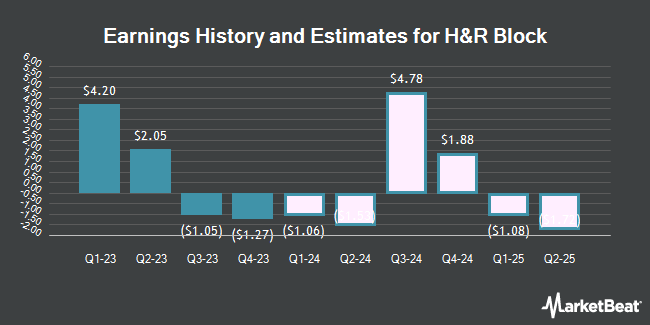

H&R Block, Inc. (NYSE:HRB - Free Report) - Zacks Research reduced their Q3 2026 earnings per share (EPS) estimates for shares of H&R Block in a research note issued on Wednesday, November 27th. Zacks Research analyst R. Department now anticipates that the company will post earnings of $5.44 per share for the quarter, down from their previous estimate of $5.54. The consensus estimate for H&R Block's current full-year earnings is $5.28 per share. Zacks Research also issued estimates for H&R Block's Q4 2026 earnings at $2.52 EPS and FY2026 earnings at $5.06 EPS.

A number of other research analysts also recently weighed in on HRB. The Goldman Sachs Group raised their price target on H&R Block from $39.00 to $44.00 and gave the company a "sell" rating in a research note on Friday, August 16th. StockNews.com cut H&R Block from a "buy" rating to a "hold" rating in a research report on Friday, August 16th. Finally, Barrington Research reissued an "outperform" rating and set a $70.00 target price on shares of H&R Block in a report on Friday, November 8th.

Read Our Latest Research Report on HRB

H&R Block Stock Down 0.3 %

Shares of HRB stock traded down $0.17 during trading hours on Monday, hitting $59.11. 1,191,612 shares of the company were exchanged, compared to its average volume of 1,202,152. The company has a market capitalization of $8.10 billion, a PE ratio of 14.37, a PEG ratio of 0.90 and a beta of 0.67. The business has a 50 day moving average of $60.76 and a two-hundred day moving average of $58.06. The company has a current ratio of 0.77, a quick ratio of 0.77 and a debt-to-equity ratio of 16.46. H&R Block has a 52 week low of $42.28 and a 52 week high of $68.45.

H&R Block (NYSE:HRB - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The company reported ($1.17) earnings per share for the quarter, missing analysts' consensus estimates of ($1.13) by ($0.04). H&R Block had a net margin of 16.19% and a negative return on equity of 212.45%. The firm had revenue of $193.81 million during the quarter, compared to analyst estimates of $188.78 million. During the same quarter in the prior year, the business earned ($1.05) earnings per share.

H&R Block Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, January 6th. Shareholders of record on Thursday, December 5th will be issued a $0.375 dividend. The ex-dividend date is Thursday, December 5th. This represents a $1.50 annualized dividend and a yield of 2.54%. H&R Block's dividend payout ratio is currently 36.59%.

H&R Block declared that its board has approved a share repurchase program on Thursday, August 15th that allows the company to buyback $1.50 billion in shares. This buyback authorization allows the company to buy up to 16.7% of its shares through open market purchases. Shares buyback programs are generally a sign that the company's board believes its shares are undervalued.

Insiders Place Their Bets

In other H&R Block news, CEO Jeffrey J. Jones II sold 9,722 shares of the stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $63.07, for a total transaction of $613,166.54. Following the transaction, the chief executive officer now owns 893,169 shares in the company, valued at $56,332,168.83. This represents a 1.08 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, VP Kellie J. Logerwell sold 8,000 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $64.41, for a total transaction of $515,280.00. Following the transaction, the vice president now directly owns 18,474 shares in the company, valued at $1,189,910.34. This represents a 30.22 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.30% of the company's stock.

Institutional Investors Weigh In On H&R Block

A number of large investors have recently added to or reduced their stakes in the stock. Pacer Advisors Inc. increased its holdings in H&R Block by 52.2% in the 2nd quarter. Pacer Advisors Inc. now owns 2,738,190 shares of the company's stock valued at $148,492,000 after buying an additional 939,270 shares during the period. Wedge Capital Management L L P NC boosted its position in shares of H&R Block by 1,630.9% during the 3rd quarter. Wedge Capital Management L L P NC now owns 777,264 shares of the company's stock worth $49,395,000 after acquiring an additional 732,359 shares in the last quarter. AQR Capital Management LLC increased its stake in H&R Block by 39.7% in the second quarter. AQR Capital Management LLC now owns 2,131,451 shares of the company's stock valued at $115,418,000 after acquiring an additional 606,250 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in H&R Block by 5.5% during the third quarter. Charles Schwab Investment Management Inc. now owns 4,936,829 shares of the company's stock valued at $313,735,000 after purchasing an additional 255,354 shares in the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in H&R Block by 29.0% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 698,101 shares of the company's stock worth $44,364,000 after purchasing an additional 156,856 shares during the last quarter. Institutional investors and hedge funds own 90.14% of the company's stock.

H&R Block Company Profile

(

Get Free Report)

H&R Block, Inc, through its subsidiaries, provides assisted income tax return preparation and do-it-yourself (DIY) tax return preparation services and products to the general public primarily in the United States, Canada, and Australia. It offers assisted income tax return preparation and related services through a system of retail offices operated directly by the company or its franchisees.

Featured Stories

Before you consider H&R Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&R Block wasn't on the list.

While H&R Block currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.