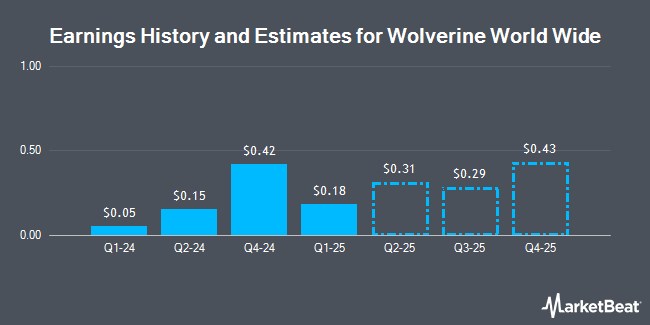

Wolverine World Wide, Inc. (NYSE:WWW - Free Report) - Analysts at Seaport Res Ptn upped their Q3 2024 earnings per share estimates for Wolverine World Wide in a report released on Monday, November 4th. Seaport Res Ptn analyst M. Kummetz now expects that the textile maker will earn $0.22 per share for the quarter, up from their prior forecast of $0.20. The consensus estimate for Wolverine World Wide's current full-year earnings is $0.85 per share. Seaport Res Ptn also issued estimates for Wolverine World Wide's Q4 2024 earnings at $0.43 EPS.

Wolverine World Wide (NYSE:WWW - Get Free Report) last released its earnings results on Wednesday, August 7th. The textile maker reported $0.15 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.10 by $0.05. Wolverine World Wide had a negative net margin of 4.42% and a negative return on equity of 0.34%. The business had revenue of $425.40 million for the quarter, compared to analyst estimates of $411.20 million. During the same quarter in the previous year, the business earned $0.19 earnings per share. Wolverine World Wide's revenue for the quarter was down 27.8% on a year-over-year basis.

A number of other equities research analysts also recently weighed in on the company. UBS Group upgraded Wolverine World Wide from a "neutral" rating to a "buy" rating and lifted their target price for the stock from $13.00 to $20.00 in a report on Friday, July 19th. Argus upgraded shares of Wolverine World Wide to a "hold" rating in a research report on Friday, August 16th. BNP Paribas raised shares of Wolverine World Wide from a "neutral" rating to an "outperform" rating and set a $22.00 target price on the stock in a research note on Thursday, October 3rd. Robert W. Baird lifted their price target on shares of Wolverine World Wide from $13.00 to $15.00 and gave the company a "neutral" rating in a research note on Thursday, August 8th. Finally, Telsey Advisory Group reiterated a "market perform" rating and set a $15.00 price objective on shares of Wolverine World Wide in a report on Thursday, October 31st. Three investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $18.00.

View Our Latest Research Report on WWW

Wolverine World Wide Trading Up 3.7 %

Shares of NYSE:WWW traded up $0.57 during midday trading on Wednesday, reaching $16.06. The company's stock had a trading volume of 2,452,519 shares, compared to its average volume of 1,092,331. Wolverine World Wide has a fifty-two week low of $7.58 and a fifty-two week high of $18.51. The company has a debt-to-equity ratio of 2.14, a quick ratio of 0.74 and a current ratio of 1.19. The firm has a 50 day moving average price of $15.65 and a two-hundred day moving average price of $13.93. The firm has a market capitalization of $1.28 billion, a price-to-earnings ratio of -15.15 and a beta of 1.78.

Wolverine World Wide Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, February 3rd. Investors of record on Thursday, January 2nd will be issued a $0.10 dividend. The ex-dividend date is Thursday, January 2nd. This represents a $0.40 dividend on an annualized basis and a dividend yield of 2.49%. Wolverine World Wide's dividend payout ratio is presently -37.74%.

Insider Activity at Wolverine World Wide

In related news, insider David A. Latchana sold 7,706 shares of Wolverine World Wide stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $17.02, for a total transaction of $131,156.12. Following the transaction, the insider now owns 13,889 shares of the company's stock, valued at $236,390.78. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 2.28% of the stock is owned by insiders.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in WWW. Future Financial Wealth Managment LLC purchased a new stake in Wolverine World Wide in the 3rd quarter valued at about $35,000. Canada Pension Plan Investment Board purchased a new stake in shares of Wolverine World Wide during the second quarter valued at approximately $68,000. Cedar Mountain Advisors LLC bought a new stake in Wolverine World Wide during the third quarter worth $70,000. GAMMA Investing LLC boosted its position in Wolverine World Wide by 15.9% in the third quarter. GAMMA Investing LLC now owns 4,494 shares of the textile maker's stock worth $78,000 after purchasing an additional 616 shares during the last quarter. Finally, Central Pacific Bank Trust Division bought a new position in Wolverine World Wide in the 1st quarter valued at $81,000. 90.25% of the stock is owned by institutional investors.

Wolverine World Wide Company Profile

(

Get Free Report)

Wolverine World Wide, Inc designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America. It operates through Active Group and Work Group segments. The company offers casual footwear and apparel; performance outdoor and athletic footwear and apparel; kids' footwear; industrial work boots and apparel; and uniform shoes and boots.

Recommended Stories

Before you consider Wolverine World Wide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wolverine World Wide wasn't on the list.

While Wolverine World Wide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.