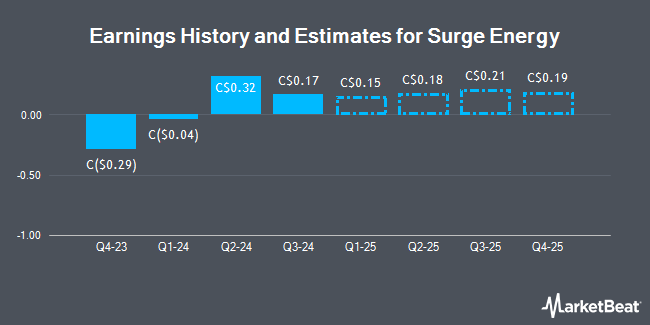

Surge Energy Inc. (TSE:SGY - Free Report) - Atb Cap Markets increased their Q3 2025 earnings estimates for shares of Surge Energy in a report released on Thursday, March 6th. Atb Cap Markets analyst A. Arif now anticipates that the company will post earnings of $0.21 per share for the quarter, up from their previous estimate of $0.18. Atb Cap Markets also issued estimates for Surge Energy's Q4 2025 earnings at $0.19 EPS, FY2026 earnings at $0.52 EPS and FY2027 earnings at $0.21 EPS.

Separately, BMO Capital Markets lowered their price objective on shares of Surge Energy from C$11.00 to C$9.00 in a research report on Friday, December 13th.

View Our Latest Stock Report on SGY

Surge Energy Stock Down 1.4 %

Shares of SGY traded down C$0.08 during midday trading on Monday, reaching C$5.45. 352,859 shares of the company were exchanged, compared to its average volume of 606,064. The company has a current ratio of 0.66, a quick ratio of 0.40 and a debt-to-equity ratio of 31.48. Surge Energy has a 1-year low of C$4.80 and a 1-year high of C$8.16. The company has a market cap of C$548.07 million, a price-to-earnings ratio of -6.83, a P/E/G ratio of 0.59 and a beta of 2.54. The stock has a 50-day moving average price of C$5.65 and a 200-day moving average price of C$5.82.

Insider Activity at Surge Energy

In other Surge Energy news, Director James Murray Pasieka sold 11,213 shares of the business's stock in a transaction on Monday, December 23rd. The shares were sold at an average price of C$5.23, for a total transaction of C$58,643.99. 1.97% of the stock is owned by corporate insiders.

Surge Energy Dividend Announcement

The company also recently declared a monthly dividend, which will be paid on Monday, March 17th. Investors of record on Monday, March 17th will be paid a $0.0433 dividend. The ex-dividend date is Friday, February 28th. This represents a $0.52 dividend on an annualized basis and a yield of 9.53%. Surge Energy's dividend payout ratio (DPR) is -65.21%.

Surge Energy Company Profile

(

Get Free Report)

Surge Energy Inc explores, develops, and produces oil and gas in western Canada. Its principal properties are located in the areas of Sparky, Southeast Saskatchewan, Carbonates, Valhalla, and Shaunavon in Alberta and Saskatchewan. The company was formerly known as Zapata Energy Corporation and changed its name to Surge Energy Inc in June 2010.

Read More

Before you consider Surge Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Surge Energy wasn't on the list.

While Surge Energy currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.