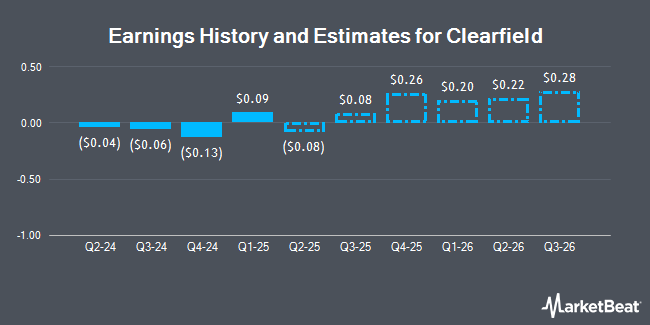

Clearfield, Inc. (NASDAQ:CLFD - Free Report) - Investment analysts at Roth Capital decreased their Q4 2025 earnings per share (EPS) estimates for shares of Clearfield in a report issued on Sunday, December 8th. Roth Capital analyst S. Searle now expects that the communications equipment provider will earn $0.33 per share for the quarter, down from their prior forecast of $0.44. The consensus estimate for Clearfield's current full-year earnings is ($0.05) per share. Roth Capital also issued estimates for Clearfield's Q1 2026 earnings at $0.20 EPS, Q2 2026 earnings at $0.22 EPS, Q3 2026 earnings at $0.34 EPS, Q4 2026 earnings at $0.48 EPS and FY2026 earnings at $1.24 EPS.

Clearfield (NASDAQ:CLFD - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The communications equipment provider reported ($0.06) EPS for the quarter, beating the consensus estimate of ($0.19) by $0.13. The business had revenue of $46.80 million during the quarter, compared to analysts' expectations of $41.95 million. Clearfield had a negative return on equity of 4.41% and a negative net margin of 7.47%. The firm's quarterly revenue was down 5.8% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.17 EPS.

Several other equities research analysts have also recently commented on CLFD. StockNews.com raised Clearfield from a "sell" rating to a "hold" rating in a research note on Friday. Needham & Company LLC reissued a "buy" rating and issued a $50.00 price target on shares of Clearfield in a research note on Friday, November 8th. One analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $46.75.

View Our Latest Analysis on Clearfield

Clearfield Stock Up 0.5 %

Shares of NASDAQ CLFD traded up $0.17 during trading hours on Tuesday, hitting $32.49. The stock had a trading volume of 113,344 shares, compared to its average volume of 155,982. The company has a market capitalization of $464.28 million, a P/E ratio of -38.22 and a beta of 1.28. The firm's 50-day moving average price is $34.13 and its two-hundred day moving average price is $37.13. Clearfield has a 52 week low of $24.78 and a 52 week high of $44.83. The company has a debt-to-equity ratio of 0.01, a quick ratio of 6.69 and a current ratio of 9.43.

Insiders Place Their Bets

In other Clearfield news, Chairman Ronald G. Roth acquired 5,000 shares of Clearfield stock in a transaction dated Thursday, December 5th. The stock was bought at an average cost of $31.00 per share, with a total value of $155,000.00. Following the completion of the transaction, the chairman now owns 1,266,796 shares of the company's stock, valued at $39,270,676. The trade was a 0.40 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 16.00% of the company's stock.

Institutional Investors Weigh In On Clearfield

Hedge funds have recently modified their holdings of the business. Concurrent Investment Advisors LLC bought a new stake in shares of Clearfield in the second quarter valued at approximately $835,000. Creative Planning boosted its position in shares of Clearfield by 2.5% in the second quarter. Creative Planning now owns 98,088 shares of the communications equipment provider's stock valued at $3,782,000 after acquiring an additional 2,426 shares during the period. Dimensional Fund Advisors LP boosted its position in shares of Clearfield by 83.2% in the second quarter. Dimensional Fund Advisors LP now owns 228,173 shares of the communications equipment provider's stock valued at $8,798,000 after acquiring an additional 103,648 shares during the period. Segall Bryant & Hamill LLC boosted its position in shares of Clearfield by 12.2% in the third quarter. Segall Bryant & Hamill LLC now owns 249,087 shares of the communications equipment provider's stock valued at $9,704,000 after acquiring an additional 27,178 shares during the period. Finally, Select Equity Group L.P. bought a new stake in shares of Clearfield in the second quarter valued at approximately $453,000. 88.73% of the stock is owned by institutional investors.

About Clearfield

(

Get Free Report)

Clearfield, Inc manufactures and sells various fiber connectivity products in the United States and internationally. The company offers FieldSmart, a series of panels, cabinets, wall boxes, and other enclosures; WaveSmart, an optical components integrated for signal coupling, splitting, termination, multiplexing, demultiplexing, and attenuation for integration within its fiber management platform; and active cabinet products.

Read More

Before you consider Clearfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearfield wasn't on the list.

While Clearfield currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.