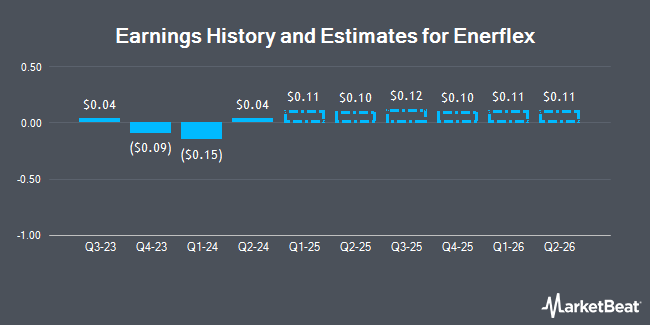

Enerflex Ltd. (NYSE:EFXT - Free Report) - Research analysts at Atb Cap Markets dropped their Q4 2024 earnings per share (EPS) estimates for shares of Enerflex in a research note issued to investors on Tuesday, December 10th. Atb Cap Markets analyst T. Monachello now expects that the company will post earnings of $0.07 per share for the quarter, down from their prior forecast of $0.08. The consensus estimate for Enerflex's current full-year earnings is $0.26 per share. Atb Cap Markets also issued estimates for Enerflex's Q3 2025 earnings at $0.16 EPS, Q1 2026 earnings at $0.10 EPS, Q2 2026 earnings at $0.10 EPS and Q3 2026 earnings at $0.09 EPS.

Separately, Royal Bank of Canada upped their target price on Enerflex from $9.00 to $12.00 and gave the stock an "outperform" rating in a research report on Friday, November 15th.

View Our Latest Report on EFXT

Enerflex Stock Down 1.6 %

NYSE:EFXT traded down $0.15 on Thursday, hitting $9.49. The stock had a trading volume of 160,542 shares, compared to its average volume of 202,202. The company has a quick ratio of 0.88, a current ratio of 1.19 and a debt-to-equity ratio of 0.79. Enerflex has a 52 week low of $4.23 and a 52 week high of $9.82. The business's fifty day moving average is $7.75 and its 200 day moving average is $6.27. The company has a market cap of $1.18 billion, a PE ratio of -15.06 and a beta of 2.20.

Institutional Trading of Enerflex

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Clearbridge Investments LLC lifted its holdings in shares of Enerflex by 16.3% in the second quarter. Clearbridge Investments LLC now owns 567,366 shares of the company's stock valued at $3,064,000 after purchasing an additional 79,419 shares in the last quarter. International Assets Investment Management LLC purchased a new stake in Enerflex in the 3rd quarter valued at $730,000. Marshall Wace LLP lifted its stake in Enerflex by 183.4% during the 2nd quarter. Marshall Wace LLP now owns 218,505 shares of the company's stock valued at $1,180,000 after acquiring an additional 141,393 shares in the last quarter. The Manufacturers Life Insurance Company boosted its holdings in Enerflex by 4.5% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 179,088 shares of the company's stock worth $965,000 after acquiring an additional 7,700 shares during the last quarter. Finally, 1832 Asset Management L.P. grew its stake in shares of Enerflex by 16.1% in the 2nd quarter. 1832 Asset Management L.P. now owns 10,336,900 shares of the company's stock worth $55,819,000 after acquiring an additional 1,435,900 shares in the last quarter. 46.47% of the stock is owned by institutional investors.

Enerflex Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, January 16th. Shareholders of record on Tuesday, November 26th will be paid a dividend of $0.0268 per share. The ex-dividend date is Tuesday, November 26th. This represents a $0.11 dividend on an annualized basis and a yield of 1.13%. This is an increase from Enerflex's previous quarterly dividend of $0.02. Enerflex's payout ratio is -17.46%.

About Enerflex

(

Get Free Report)

Enerflex Ltd. offers energy infrastructure and energy transition solutions to natural gas markets in North America, Latin America, and the Eastern Hemisphere. The company provides natural gas compression infrastructure, processing, and treated water infrastructure under contract to oil and natural gas customers; power generation rental solutions; custom and standard compression packages for reciprocating and screw compressor applications; re-engineering, re-configuration, and re-packaging of compressors for various field applications; integrated turnkey power generation, gas compression, processing facilities, natural gas compression, processing, and electric power solutions; after-market mechanical services and parts distribution, as well as maintenance solutions to the oil and natural gas industry, operations, and overhaul services; and equipment supply, parts supply, and general asset management.

Recommended Stories

Before you consider Enerflex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enerflex wasn't on the list.

While Enerflex currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.