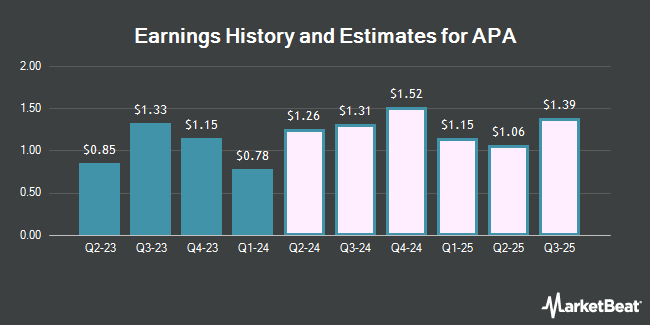

APA Co. (NASDAQ:APA - Free Report) - Investment analysts at Capital One Financial increased their Q4 2024 earnings per share (EPS) estimates for shares of APA in a note issued to investors on Wednesday, November 13th. Capital One Financial analyst B. Velie now expects that the company will earn $1.10 per share for the quarter, up from their prior forecast of $0.80. The consensus estimate for APA's current full-year earnings is $3.97 per share. Capital One Financial also issued estimates for APA's Q1 2025 earnings at $0.31 EPS, Q2 2025 earnings at $0.29 EPS, Q3 2025 earnings at $0.30 EPS, Q4 2025 earnings at $0.31 EPS and FY2025 earnings at $1.20 EPS.

APA has been the subject of a number of other reports. Citigroup cut their target price on APA from $32.00 to $29.00 in a research report on Friday, October 18th. Bernstein Bank cut their price objective on APA from $30.00 to $28.00 in a research report on Friday, October 18th. Truist Financial reduced their target price on APA from $36.00 to $33.00 and set a "buy" rating for the company in a report on Friday, November 8th. Piper Sandler reduced their target price on APA from $28.00 to $26.00 and set a "neutral" rating for the company in a report on Monday. Finally, Evercore ISI reduced their target price on APA from $39.00 to $33.00 and set an "in-line" rating for the company in a report on Monday, September 30th. Four equities research analysts have rated the stock with a sell rating, eleven have given a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, APA presently has a consensus rating of "Hold" and an average price target of $32.81.

Get Our Latest Analysis on APA

APA Stock Performance

APA stock traded up $0.04 on Monday, reaching $22.42. The company's stock had a trading volume of 3,624,561 shares, compared to its average volume of 6,258,105. APA has a 52 week low of $21.15 and a 52 week high of $37.82. The company has a market capitalization of $8.29 billion, a P/E ratio of 3.19 and a beta of 3.24. The firm has a fifty day moving average of $24.51 and a two-hundred day moving average of $27.65. The company has a debt-to-equity ratio of 1.03, a current ratio of 1.24 and a quick ratio of 1.24.

APA Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, November 22nd. Investors of record on Tuesday, October 22nd will be given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 4.46%. The ex-dividend date of this dividend is Tuesday, October 22nd. APA's payout ratio is currently 14.12%.

Institutional Trading of APA

A number of large investors have recently added to or reduced their stakes in APA. Covestor Ltd increased its stake in shares of APA by 75.4% in the first quarter. Covestor Ltd now owns 1,093 shares of the company's stock worth $38,000 after purchasing an additional 470 shares in the last quarter. Whittier Trust Co. of Nevada Inc. lifted its holdings in shares of APA by 386.7% during the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 1,358 shares of the company's stock worth $40,000 after acquiring an additional 1,079 shares during the last quarter. Rothschild Investment LLC purchased a new stake in APA during the second quarter valued at about $42,000. GPS Wealth Strategies Group LLC grew its position in APA by 1,325.0% during the 2nd quarter. GPS Wealth Strategies Group LLC now owns 1,710 shares of the company's stock worth $50,000 after acquiring an additional 1,590 shares during the last quarter. Finally, Huntington National Bank increased its stake in APA by 48.8% in the 3rd quarter. Huntington National Bank now owns 1,710 shares of the company's stock worth $42,000 after purchasing an additional 561 shares during the period. Hedge funds and other institutional investors own 83.01% of the company's stock.

About APA

(

Get Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Featured Articles

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.