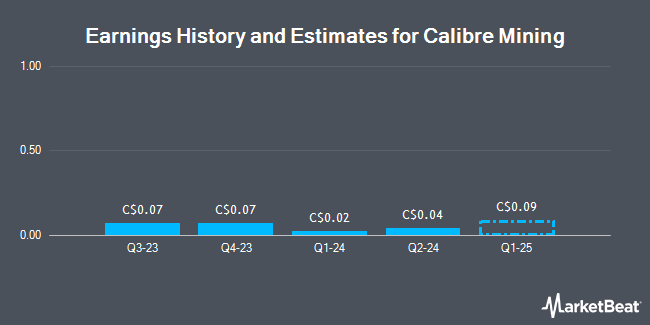

Calibre Mining Corp. (TSE:CXB - Free Report) - Cormark issued their Q4 2024 earnings per share estimates for Calibre Mining in a research note issued on Thursday, January 9th. Cormark analyst N. Dion expects that the company will post earnings of $0.09 per share for the quarter. The consensus estimate for Calibre Mining's current full-year earnings is $0.39 per share. Cormark also issued estimates for Calibre Mining's FY2025 earnings at $0.30 EPS and FY2026 earnings at $0.37 EPS.

A number of other equities analysts have also weighed in on CXB. National Bank Financial upgraded Calibre Mining from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, October 9th. Jefferies Financial Group boosted their price target on Calibre Mining from C$2.75 to C$3.50 in a report on Friday, October 4th. National Bankshares dropped their price objective on shares of Calibre Mining from C$3.60 to C$3.40 and set an "outperform" rating on the stock in a research note on Thursday. TD Securities cut their target price on shares of Calibre Mining from C$3.50 to C$3.25 in a report on Wednesday, November 6th. Finally, Stifel Nicolaus lowered their price target on shares of Calibre Mining from C$5.00 to C$4.40 in a report on Monday, October 21st. Five research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Calibre Mining has an average rating of "Buy" and an average target price of C$3.41.

Check Out Our Latest Research Report on CXB

Calibre Mining Price Performance

Shares of TSE:CXB opened at C$2.37 on Monday. The company has a current ratio of 2.33, a quick ratio of 0.97 and a debt-to-equity ratio of 39.77. Calibre Mining has a twelve month low of C$1.18 and a twelve month high of C$2.90. The company's 50 day moving average is C$2.30 and its 200 day moving average is C$2.31. The company has a market cap of C$1.87 billion, a PE ratio of 16.93 and a beta of 2.08.

Calibre Mining Company Profile

(

Get Free Report)

Calibre Mining Corp., together with its subsidiaries, engages in the exploration, development, and mining of gold properties in Nicaragua, the United States, and Canada. It primarily explores gold, silver, and copper deposits. The company was formerly known as TLC Ventures Corp. and changed its name to Calibre Mining Corp.

Featured Articles

Before you consider Calibre Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calibre Mining wasn't on the list.

While Calibre Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.