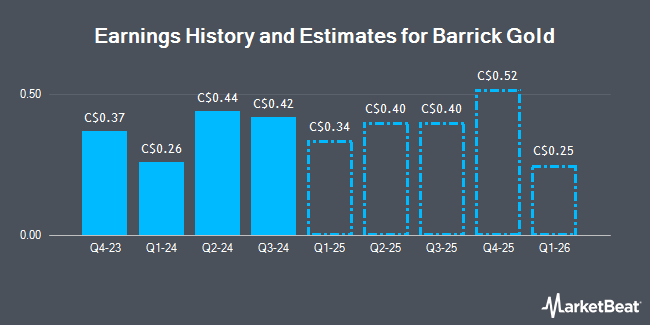

Barrick Gold Co. (TSE:ABX - Free Report) NYSE: ABX - Research analysts at Raymond James dropped their Q4 2024 earnings estimates for shares of Barrick Gold in a report issued on Thursday, January 9th. Raymond James analyst B. Macarthur now anticipates that the basic materials company will post earnings per share of $0.56 for the quarter, down from their prior forecast of $0.57. The consensus estimate for Barrick Gold's current full-year earnings is $2.24 per share. Raymond James also issued estimates for Barrick Gold's Q1 2025 earnings at $0.47 EPS, Q2 2025 earnings at $0.43 EPS, Q3 2025 earnings at $0.50 EPS, Q4 2025 earnings at $0.53 EPS and FY2025 earnings at $2.00 EPS.

Other equities analysts have also recently issued reports about the company. TD Securities reiterated a "buy" rating and set a C$34.00 price target on shares of Barrick Gold in a report on Wednesday, October 16th. UBS Group lowered shares of Barrick Gold from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, October 30th. Cibc World Mkts downgraded shares of Barrick Gold from a "strong-buy" rating to a "hold" rating in a research note on Monday, November 25th. Royal Bank of Canada upped their price objective on shares of Barrick Gold to C$21.00 and gave the stock a "buy" rating in a report on Friday, December 20th. Finally, Sanford C. Bernstein dropped their target price on shares of Barrick Gold from C$37.00 to C$36.00 in a report on Tuesday, November 5th. Three investment analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, Barrick Gold presently has a consensus rating of "Moderate Buy" and an average price target of C$30.17.

Check Out Our Latest Stock Report on ABX

Barrick Gold Trading Down 1.9 %

Shares of Barrick Gold stock opened at C$22.70 on Monday. Barrick Gold has a fifty-two week low of C$18.65 and a fifty-two week high of C$29.50. The company has a debt-to-equity ratio of 14.54, a quick ratio of 2.62 and a current ratio of 3.01. The firm has a market capitalization of C$39.73 billion, a price-to-earnings ratio of 19.08, a PEG ratio of 2.34 and a beta of 0.48. The stock has a 50 day moving average of C$23.81 and a 200 day moving average of C$25.23.

Insider Activity

In other news, Director Dennis Mark Bristow acquired 85,296 shares of the company's stock in a transaction on Thursday, November 21st. The shares were bought at an average cost of C$25.03 per share, with a total value of C$2,135,291.53. Also, Senior Officer Poupak Bahamin sold 2,500 shares of Barrick Gold stock in a transaction on Friday, November 29th. The stock was sold at an average price of C$24.49, for a total transaction of C$61,215.00. Insiders own 0.60% of the company's stock.

Barrick Gold Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, December 16th. Stockholders of record on Friday, November 29th were given a dividend of $0.135 per share. This represents a $0.54 dividend on an annualized basis and a dividend yield of 2.38%. The ex-dividend date was Friday, November 29th. Barrick Gold's dividend payout ratio is currently 45.38%.

About Barrick Gold

(

Get Free Report)

Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties in Canada and internationally. The company also explores and sells silver and energy materials. It has ownership interests in producing gold mines located in Argentina, Canada, Côte d'Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

Featured Articles

Before you consider Barrick Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrick Gold wasn't on the list.

While Barrick Gold currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.