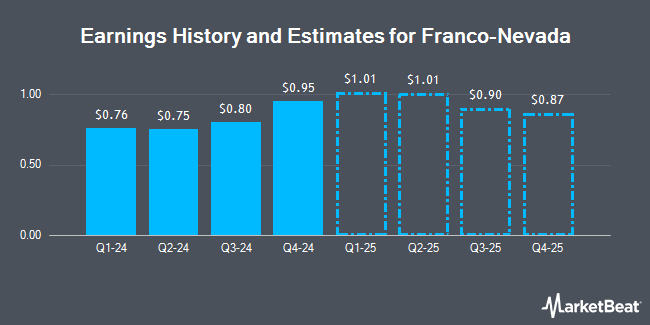

Franco-Nevada Co. (NYSE:FNV - Free Report) TSE: FNV - Research analysts at Raymond James decreased their Q4 2024 earnings estimates for Franco-Nevada in a research note issued on Thursday, November 7th. Raymond James analyst B. Macarthur now forecasts that the basic materials company will earn $0.81 per share for the quarter, down from their previous forecast of $0.92. The consensus estimate for Franco-Nevada's current full-year earnings is $3.25 per share. Raymond James also issued estimates for Franco-Nevada's Q2 2025 earnings at $0.88 EPS, Q3 2025 earnings at $0.96 EPS and FY2025 earnings at $3.68 EPS.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last posted its quarterly earnings data on Wednesday, November 6th. The basic materials company reported $0.80 EPS for the quarter, missing analysts' consensus estimates of $0.83 by ($0.03). The company had revenue of $275.70 million for the quarter, compared to analysts' expectations of $279.11 million. Franco-Nevada had a positive return on equity of 10.63% and a negative net margin of 55.28%. The company's revenue for the quarter was down 10.9% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.91 EPS.

Other analysts have also issued research reports about the stock. StockNews.com upgraded shares of Franco-Nevada from a "sell" rating to a "hold" rating in a research report on Thursday, August 22nd. HC Wainwright lifted their price objective on Franco-Nevada from $185.00 to $200.00 and gave the company a "buy" rating in a research report on Friday. TD Cowen upgraded Franco-Nevada from a "hold" rating to a "buy" rating in a research note on Thursday, August 15th. Scotiabank decreased their price target on Franco-Nevada from $142.00 to $141.00 and set a "sector perform" rating on the stock in a research note on Friday. Finally, TD Securities upgraded Franco-Nevada from a "hold" rating to a "buy" rating in a report on Thursday, August 15th. Four equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $156.57.

Check Out Our Latest Research Report on FNV

Franco-Nevada Trading Down 3.8 %

Shares of Franco-Nevada stock traded down $4.61 during mid-day trading on Monday, hitting $117.83. 1,274,610 shares of the stock were exchanged, compared to its average volume of 658,750. The company has a 50-day simple moving average of $126.57 and a 200 day simple moving average of $124.18. The stock has a market capitalization of $22.68 billion, a price-to-earnings ratio of -37.29, a price-to-earnings-growth ratio of 20.59 and a beta of 0.75. Franco-Nevada has a twelve month low of $102.29 and a twelve month high of $137.60.

Franco-Nevada Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Investors of record on Thursday, December 5th will be given a dividend of $0.36 per share. This represents a $1.44 dividend on an annualized basis and a yield of 1.22%. The ex-dividend date is Thursday, December 5th. Franco-Nevada's dividend payout ratio (DPR) is presently -45.57%.

Institutional Trading of Franco-Nevada

Several large investors have recently added to or reduced their stakes in the stock. Graham Capital Wealth Management LLC boosted its holdings in Franco-Nevada by 0.4% in the 2nd quarter. Graham Capital Wealth Management LLC now owns 21,183 shares of the basic materials company's stock worth $2,511,000 after acquiring an additional 86 shares during the period. Meixler Investment Management Ltd. boosted its stake in shares of Franco-Nevada by 0.5% in the second quarter. Meixler Investment Management Ltd. now owns 21,460 shares of the basic materials company's stock valued at $2,543,000 after purchasing an additional 101 shares during the period. Natixis Advisors LLC grew its holdings in Franco-Nevada by 0.5% during the 2nd quarter. Natixis Advisors LLC now owns 19,167 shares of the basic materials company's stock valued at $2,272,000 after purchasing an additional 101 shares in the last quarter. Huntington National Bank increased its stake in Franco-Nevada by 7.4% during the 3rd quarter. Huntington National Bank now owns 1,486 shares of the basic materials company's stock worth $185,000 after buying an additional 102 shares during the period. Finally, Hillsdale Investment Management Inc. increased its stake in Franco-Nevada by 33.3% during the 1st quarter. Hillsdale Investment Management Inc. now owns 440 shares of the basic materials company's stock worth $52,000 after buying an additional 110 shares during the period. 77.06% of the stock is currently owned by institutional investors and hedge funds.

Franco-Nevada Company Profile

(

Get Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Read More

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.