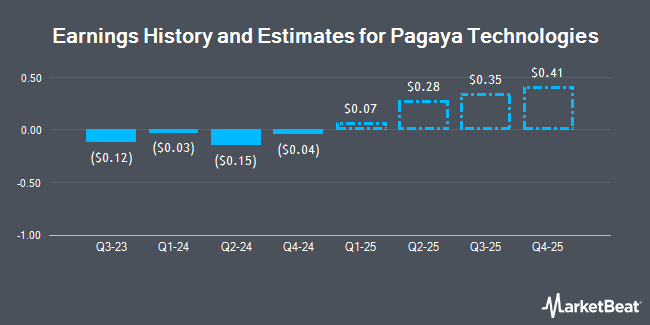

Pagaya Technologies Ltd. (NASDAQ:PGY - Free Report) - Investment analysts at Wedbush increased their Q4 2024 EPS estimates for shares of Pagaya Technologies in a report issued on Monday, November 25th. Wedbush analyst D. Chiaverini now anticipates that the company will earn $0.03 per share for the quarter, up from their previous forecast of $0.02. Wedbush currently has a "Neutral" rating and a $13.00 target price on the stock. The consensus estimate for Pagaya Technologies' current full-year earnings is $0.08 per share. Wedbush also issued estimates for Pagaya Technologies' Q2 2025 earnings at $0.28 EPS and FY2026 earnings at $1.22 EPS.

A number of other analysts have also recently issued reports on PGY. Oppenheimer started coverage on Pagaya Technologies in a report on Tuesday, October 1st. They set an "outperform" rating and a $12.00 target price for the company. Canaccord Genuity Group cut their target price on shares of Pagaya Technologies from $32.00 to $25.00 and set a "buy" rating on the stock in a research note on Wednesday, November 13th. B. Riley decreased their target price on Pagaya Technologies from $48.00 to $36.00 and set a "buy" rating for the company in a research report on Monday, September 30th. JMP Securities restated a "market outperform" rating and issued a $25.00 target price on shares of Pagaya Technologies in a research note on Tuesday, September 3rd. Finally, Benchmark reiterated a "buy" rating and issued a $21.00 price target on shares of Pagaya Technologies in a research note on Wednesday, October 16th. Two research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to MarketBeat, Pagaya Technologies has a consensus rating of "Moderate Buy" and a consensus price target of $22.11.

View Our Latest Stock Analysis on Pagaya Technologies

Pagaya Technologies Trading Up 3.4 %

NASDAQ:PGY traded up $0.35 on Wednesday, hitting $10.71. 1,591,733 shares of the stock were exchanged, compared to its average volume of 1,414,173. The stock has a fifty day moving average of $11.04 and a 200-day moving average of $12.24. The stock has a market cap of $788.90 million, a PE ratio of -4.22 and a beta of 6.33. The company has a current ratio of 1.17, a quick ratio of 1.17 and a debt-to-equity ratio of 0.82. Pagaya Technologies has a fifty-two week low of $8.20 and a fifty-two week high of $20.50.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in PGY. nVerses Capital LLC acquired a new position in shares of Pagaya Technologies in the second quarter valued at about $74,000. SG Americas Securities LLC acquired a new position in Pagaya Technologies in the second quarter valued at approximately $101,000. BNP Paribas Financial Markets boosted its position in shares of Pagaya Technologies by 48.4% during the 3rd quarter. BNP Paribas Financial Markets now owns 9,757 shares of the company's stock worth $103,000 after purchasing an additional 3,181 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank bought a new stake in Pagaya Technologies during the 2nd quarter valued at $166,000. Finally, The Manufacturers Life Insurance Company lifted its holdings in shares of Pagaya Technologies by 13.2% in the third quarter. The Manufacturers Life Insurance Company now owns 16,614 shares of the company's stock valued at $176,000 after purchasing an additional 1,937 shares in the last quarter. Institutional investors and hedge funds own 57.14% of the company's stock.

Insider Activity at Pagaya Technologies

In other Pagaya Technologies news, insider Yahav Yulzari sold 150,000 shares of the firm's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $15.50, for a total transaction of $2,325,000.00. Following the transaction, the insider now owns 161,637 shares in the company, valued at approximately $2,505,373.50. This trade represents a 48.13 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, President Sanjiv Das sold 10,683 shares of the company's stock in a transaction dated Thursday, October 17th. The shares were sold at an average price of $11.77, for a total value of $125,738.91. Following the completion of the sale, the president now directly owns 64,794 shares of the company's stock, valued at approximately $762,625.38. This trade represents a 14.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 186,045 shares of company stock worth $2,755,982 in the last ninety days. 49.56% of the stock is currently owned by insiders.

About Pagaya Technologies

(

Get Free Report)

Pagaya Technologies Ltd., a product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial institutions and investors in the United States, Israel, the Cayman Islands, and internationally. The company develops and implements proprietary artificial intelligence technology and related software solutions to assist partners to originate loans and other assets.

See Also

Before you consider Pagaya Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pagaya Technologies wasn't on the list.

While Pagaya Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.