QRG Capital Management Inc. trimmed its stake in shares of Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report) by 39.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 22,700 shares of the basic materials company's stock after selling 14,959 shares during the period. QRG Capital Management Inc.'s holdings in Cal-Maine Foods were worth $1,699,000 as of its most recent SEC filing.

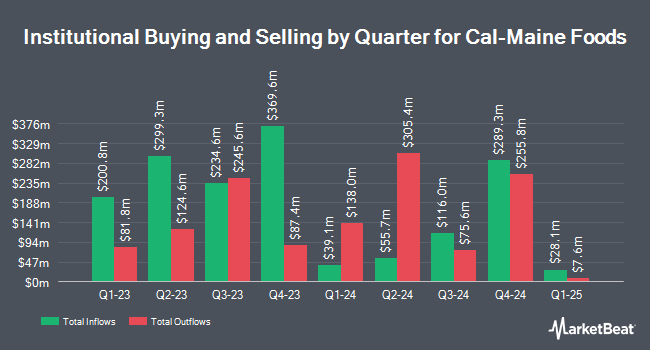

A number of other hedge funds and other institutional investors have also modified their holdings of CALM. Axiom Advisory LLC lifted its stake in Cal-Maine Foods by 3.3% in the 3rd quarter. Axiom Advisory LLC now owns 4,061 shares of the basic materials company's stock worth $280,000 after acquiring an additional 128 shares in the last quarter. Hexagon Capital Partners LLC boosted its holdings in shares of Cal-Maine Foods by 57.0% during the third quarter. Hexagon Capital Partners LLC now owns 427 shares of the basic materials company's stock worth $32,000 after purchasing an additional 155 shares during the period. Garner Asset Management Corp grew its position in Cal-Maine Foods by 0.9% during the second quarter. Garner Asset Management Corp now owns 20,252 shares of the basic materials company's stock valued at $1,238,000 after purchasing an additional 183 shares in the last quarter. Regal Investment Advisors LLC increased its stake in Cal-Maine Foods by 3.9% in the 2nd quarter. Regal Investment Advisors LLC now owns 5,404 shares of the basic materials company's stock valued at $330,000 after buying an additional 203 shares during the period. Finally, Arizona State Retirement System lifted its position in Cal-Maine Foods by 2.0% in the 2nd quarter. Arizona State Retirement System now owns 11,765 shares of the basic materials company's stock worth $719,000 after buying an additional 230 shares in the last quarter. Institutional investors and hedge funds own 84.67% of the company's stock.

Insider Transactions at Cal-Maine Foods

In related news, VP Robert L. Holladay, Jr. sold 1,500 shares of the firm's stock in a transaction on Tuesday, August 20th. The shares were sold at an average price of $70.93, for a total value of $106,395.00. Following the transaction, the vice president now directly owns 16,754 shares in the company, valued at approximately $1,188,361.22. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. 13.45% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several research firms have recently commented on CALM. StockNews.com upgraded shares of Cal-Maine Foods from a "hold" rating to a "buy" rating in a report on Thursday. The Goldman Sachs Group upped their target price on Cal-Maine Foods from $47.00 to $52.00 and gave the stock a "sell" rating in a research report on Wednesday, July 17th. Finally, Stephens initiated coverage on Cal-Maine Foods in a research note on Thursday, October 3rd. They set an "equal weight" rating and a $82.00 price target for the company.

Get Our Latest Research Report on CALM

Cal-Maine Foods Stock Performance

Shares of Cal-Maine Foods stock traded up $1.58 during midday trading on Friday, reaching $90.95. 636,268 shares of the company's stock traded hands, compared to its average volume of 607,087. Cal-Maine Foods, Inc. has a 52 week low of $45.07 and a 52 week high of $95.06. The company's 50 day simple moving average is $80.92 and its 200 day simple moving average is $69.29. The company has a market cap of $4.46 billion, a price-to-earnings ratio of 10.24 and a beta of -0.12.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last issued its quarterly earnings data on Tuesday, October 1st. The basic materials company reported $3.06 earnings per share for the quarter, missing analysts' consensus estimates of $3.36 by ($0.30). The company had revenue of $785.87 million during the quarter, compared to the consensus estimate of $704.65 million. Cal-Maine Foods had a net margin of 16.09% and a return on equity of 24.25%. The firm's revenue was up 71.1% on a year-over-year basis. During the same period in the previous year, the business posted $0.02 earnings per share.

About Cal-Maine Foods

(

Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

Read More

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.