QRG Capital Management Inc. decreased its position in STMicroelectronics (NYSE:STM - Free Report) by 23.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 83,754 shares of the semiconductor producer's stock after selling 25,207 shares during the quarter. QRG Capital Management Inc.'s holdings in STMicroelectronics were worth $2,490,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

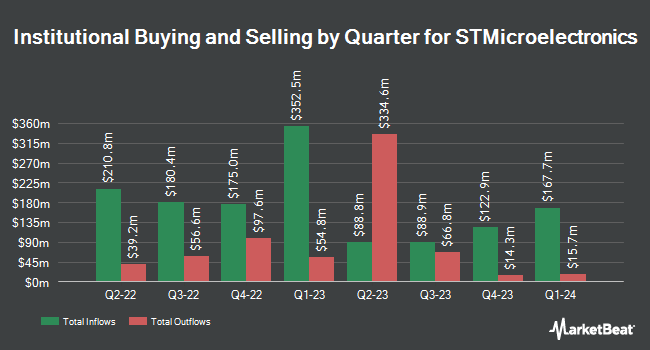

Other hedge funds also recently bought and sold shares of the company. Orion Portfolio Solutions LLC lifted its position in STMicroelectronics by 374.5% in the first quarter. Orion Portfolio Solutions LLC now owns 38,010 shares of the semiconductor producer's stock valued at $1,644,000 after purchasing an additional 29,999 shares during the last quarter. Washington Capital Management Inc. bought a new stake in STMicroelectronics in the third quarter valued at approximately $1,112,000. Jane Street Group LLC lifted its position in STMicroelectronics by 153.8% in the first quarter. Jane Street Group LLC now owns 178,483 shares of the semiconductor producer's stock valued at $7,718,000 after purchasing an additional 108,152 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. bought a new stake in STMicroelectronics in the first quarter valued at approximately $554,000. Finally, Lazard Asset Management LLC lifted its position in STMicroelectronics by 1,564,831.9% in the first quarter. Lazard Asset Management LLC now owns 1,079,803 shares of the semiconductor producer's stock valued at $46,690,000 after purchasing an additional 1,079,734 shares during the last quarter. Institutional investors own 5.05% of the company's stock.

STMicroelectronics Stock Up 2.4 %

STM stock traded up $0.64 during midday trading on Thursday, hitting $27.14. The stock had a trading volume of 4,133,214 shares, compared to its average volume of 3,982,520. STMicroelectronics has a 52-week low of $25.95 and a 52-week high of $51.27. The firm has a market cap of $24.52 billion, a price-to-earnings ratio of 10.90, a price-to-earnings-growth ratio of 3.16 and a beta of 1.57. The business has a 50-day moving average of $28.38 and a two-hundred day moving average of $35.08. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.84 and a quick ratio of 2.16.

STMicroelectronics (NYSE:STM - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The semiconductor producer reported $0.37 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.33 by $0.04. STMicroelectronics had a net margin of 16.11% and a return on equity of 13.29%. The company had revenue of $3.25 billion for the quarter, compared to analysts' expectations of $3.27 billion. During the same quarter in the previous year, the business posted $1.16 EPS. STMicroelectronics's revenue was down 26.6% compared to the same quarter last year. As a group, equities research analysts forecast that STMicroelectronics will post 1.64 earnings per share for the current fiscal year.

STMicroelectronics Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Tuesday, December 17th will be given a dividend of $0.09 per share. This represents a $0.36 annualized dividend and a dividend yield of 1.33%. The ex-dividend date of this dividend is Tuesday, December 17th. STMicroelectronics's dividend payout ratio (DPR) is currently 12.35%.

Wall Street Analyst Weigh In

Several brokerages have weighed in on STM. Citigroup upgraded STMicroelectronics to a "strong-buy" rating in a research report on Thursday, October 10th. Morgan Stanley downgraded STMicroelectronics from an "equal weight" rating to an "underweight" rating in a report on Monday. Susquehanna decreased their target price on STMicroelectronics from $35.00 to $33.00 and set a "positive" rating for the company in a report on Friday, November 1st. StockNews.com downgraded STMicroelectronics from a "buy" rating to a "hold" rating in a report on Thursday, September 19th. Finally, TD Cowen decreased their target price on STMicroelectronics from $50.00 to $40.00 and set a "buy" rating for the company in a report on Friday, July 26th. One investment analyst has rated the stock with a sell rating, four have given a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $37.63.

View Our Latest Research Report on STMicroelectronics

About STMicroelectronics

(

Free Report)

STMicroelectronics N.V., together with its subsidiaries, designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates through Automotive and Discrete Group; Analog, MEMS and Sensors Group; and Microcontrollers and Digital ICs Group segments.

Recommended Stories

Before you consider STMicroelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STMicroelectronics wasn't on the list.

While STMicroelectronics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.