Qsemble Capital Management LP purchased a new stake in Motorola Solutions, Inc. (NYSE:MSI - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 1,482 shares of the communications equipment provider's stock, valued at approximately $666,000.

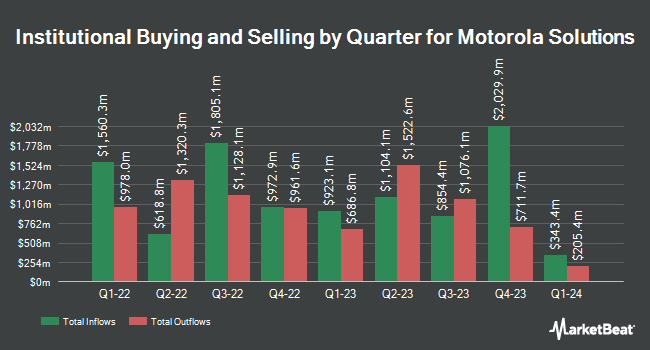

A number of other large investors have also modified their holdings of MSI. Ancora Advisors LLC boosted its position in shares of Motorola Solutions by 0.5% during the 1st quarter. Ancora Advisors LLC now owns 6,771 shares of the communications equipment provider's stock valued at $2,404,000 after acquiring an additional 31 shares in the last quarter. B. Riley Wealth Advisors Inc. grew its stake in shares of Motorola Solutions by 39.9% in the 1st quarter. B. Riley Wealth Advisors Inc. now owns 3,873 shares of the communications equipment provider's stock valued at $1,375,000 after purchasing an additional 1,105 shares during the period. Tidal Investments LLC raised its holdings in shares of Motorola Solutions by 42.2% in the 1st quarter. Tidal Investments LLC now owns 15,764 shares of the communications equipment provider's stock worth $5,595,000 after buying an additional 4,682 shares in the last quarter. iA Global Asset Management Inc. lifted its position in shares of Motorola Solutions by 301.9% during the 1st quarter. iA Global Asset Management Inc. now owns 4,706 shares of the communications equipment provider's stock worth $1,671,000 after buying an additional 3,535 shares during the period. Finally, Citizens Financial Group Inc. RI boosted its stake in Motorola Solutions by 52.2% in the 1st quarter. Citizens Financial Group Inc. RI now owns 1,746 shares of the communications equipment provider's stock valued at $620,000 after buying an additional 599 shares in the last quarter. 84.17% of the stock is currently owned by institutional investors and hedge funds.

Motorola Solutions Stock Up 1.7 %

NYSE:MSI opened at $496.56 on Wednesday. The company has a quick ratio of 1.07, a current ratio of 1.25 and a debt-to-equity ratio of 4.23. The firm has a market capitalization of $82.99 billion, a P/E ratio of 54.39, a P/E/G ratio of 3.88 and a beta of 0.97. The stock's fifty day simple moving average is $467.86 and its 200-day simple moving average is $422.13. Motorola Solutions, Inc. has a 12-month low of $307.09 and a 12-month high of $507.82.

Motorola Solutions (NYSE:MSI - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The communications equipment provider reported $3.46 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.10 by $0.36. The company had revenue of $2.79 billion during the quarter, compared to analyst estimates of $2.76 billion. Motorola Solutions had a net margin of 14.65% and a return on equity of 251.96%. Equities research analysts expect that Motorola Solutions, Inc. will post 12.48 earnings per share for the current year.

Motorola Solutions Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Friday, December 13th will be issued a dividend of $1.09 per share. This represents a $4.36 annualized dividend and a dividend yield of 0.88%. The ex-dividend date of this dividend is Friday, December 13th. This is a boost from Motorola Solutions's previous quarterly dividend of $0.98. Motorola Solutions's payout ratio is 42.94%.

Wall Street Analyst Weigh In

A number of equities analysts have commented on the stock. Jefferies Financial Group boosted their price target on shares of Motorola Solutions from $460.00 to $510.00 and gave the company a "buy" rating in a research report on Tuesday, September 3rd. Deutsche Bank Aktiengesellschaft boosted their target price on Motorola Solutions from $440.00 to $530.00 and gave the stock a "buy" rating in a report on Tuesday. JPMorgan Chase & Co. lifted their price objective on Motorola Solutions from $436.00 to $440.00 and gave the company an "overweight" rating in a research report on Friday, August 2nd. Evercore ISI increased their target price on Motorola Solutions from $450.00 to $500.00 and gave the stock an "outperform" rating in a report on Friday, August 30th. Finally, Barclays raised their target price on Motorola Solutions from $467.00 to $529.00 and gave the company an "overweight" rating in a research note on Friday, November 8th. Nine equities research analysts have rated the stock with a buy rating, According to MarketBeat.com, Motorola Solutions currently has a consensus rating of "Buy" and a consensus target price of $506.29.

Get Our Latest Research Report on MSI

Motorola Solutions Profile

(

Free Report)

Motorola Solutions, Inc provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally. The company operates in two segments, Products and Systems Integration, and Software and Services. The Products and Systems Integration segment offers a portfolio of infrastructure, devices, accessories, and video security devices and infrastructure, as well as the implementation and integration of systems, devices, software, and applications for government, public safety, and commercial customers who operate private communications networks and video security solutions, as well as manage a mobile workforce.

Featured Articles

Want to see what other hedge funds are holding MSI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Motorola Solutions, Inc. (NYSE:MSI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Motorola Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Motorola Solutions wasn't on the list.

While Motorola Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.