QSV Equity Investors LLC decreased its position in Hawkins, Inc. (NASDAQ:HWKN - Free Report) by 25.6% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 17,407 shares of the specialty chemicals company's stock after selling 5,991 shares during the period. Hawkins comprises 2.1% of QSV Equity Investors LLC's portfolio, making the stock its 9th biggest position. QSV Equity Investors LLC owned about 0.08% of Hawkins worth $2,219,000 at the end of the most recent reporting period.

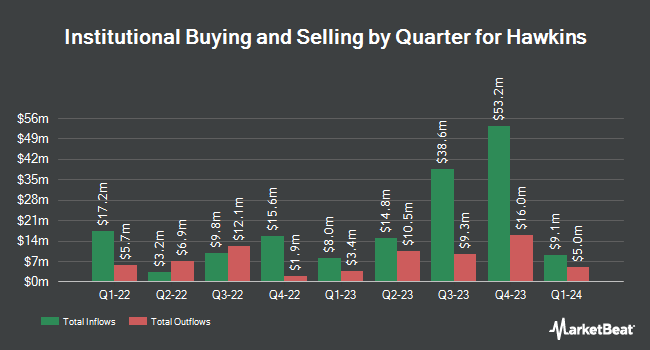

Several other institutional investors also recently modified their holdings of the company. Westwood Holdings Group Inc. grew its stake in shares of Hawkins by 11.5% in the second quarter. Westwood Holdings Group Inc. now owns 457,342 shares of the specialty chemicals company's stock worth $41,618,000 after purchasing an additional 47,129 shares during the last quarter. American Century Companies Inc. raised its stake in Hawkins by 22.4% in the 2nd quarter. American Century Companies Inc. now owns 360,714 shares of the specialty chemicals company's stock valued at $32,825,000 after acquiring an additional 66,109 shares during the period. FMR LLC lifted its holdings in Hawkins by 20.9% during the 3rd quarter. FMR LLC now owns 256,245 shares of the specialty chemicals company's stock worth $32,663,000 after purchasing an additional 44,351 shares in the last quarter. Bank of New York Mellon Corp increased its stake in Hawkins by 2.4% in the 2nd quarter. Bank of New York Mellon Corp now owns 191,433 shares of the specialty chemicals company's stock worth $17,420,000 after acquiring an additional 4,398 shares during the last quarter. Finally, Renaissance Technologies LLC increased its position in shares of Hawkins by 8.8% during the 2nd quarter. Renaissance Technologies LLC now owns 121,198 shares of the specialty chemicals company's stock valued at $11,029,000 after purchasing an additional 9,800 shares during the last quarter. 69.71% of the stock is currently owned by institutional investors and hedge funds.

Hawkins Stock Performance

HWKN traded down $3.12 during midday trading on Thursday, hitting $134.49. 37,824 shares of the company traded hands, compared to its average volume of 126,913. The firm has a market capitalization of $2.81 billion, a PE ratio of 35.19, a price-to-earnings-growth ratio of 4.77 and a beta of 0.83. The company has a quick ratio of 1.39, a current ratio of 2.27 and a debt-to-equity ratio of 0.21. The company's 50-day moving average is $125.66 and its 200 day moving average is $111.96. Hawkins, Inc. has a 52 week low of $54.44 and a 52 week high of $138.86.

Hawkins (NASDAQ:HWKN - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The specialty chemicals company reported $1.16 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.18 by ($0.02). The business had revenue of $247.03 million during the quarter, compared to analysts' expectations of $259.59 million. Hawkins had a return on equity of 19.64% and a net margin of 8.74%. On average, research analysts expect that Hawkins, Inc. will post 4.12 EPS for the current year.

Hawkins Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, November 29th. Shareholders of record on Friday, November 15th were given a dividend of $0.18 per share. This represents a $0.72 dividend on an annualized basis and a yield of 0.54%. The ex-dividend date of this dividend was Friday, November 15th. Hawkins's dividend payout ratio (DPR) is 18.41%.

Wall Street Analysts Forecast Growth

Separately, BWS Financial reissued a "neutral" rating and set a $122.00 price objective on shares of Hawkins in a research report on Thursday, October 31st.

Check Out Our Latest Research Report on Hawkins

About Hawkins

(

Free Report)

Hawkins, Inc operates as a specialty chemical and ingredients company in the United States. It operates through three segments: Industrial, Water Treatment, and Health and Nutrition. The Industrial segment offers industrial chemicals, products, and services to agriculture, chemical processing, electronics, energy, food, pharmaceutical, and plating industries.

Read More

Before you consider Hawkins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hawkins wasn't on the list.

While Hawkins currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.