Quadrature Capital Ltd lifted its position in ATS Co. (NYSE:ATS - Free Report) by 188.8% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 118,400 shares of the company's stock after acquiring an additional 77,400 shares during the period. Quadrature Capital Ltd owned 0.12% of ATS worth $3,442,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

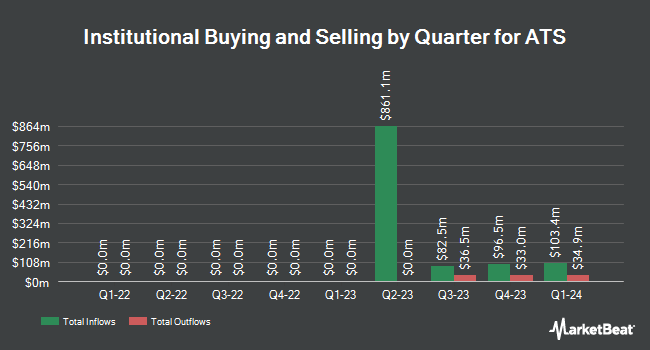

A number of other institutional investors have also recently made changes to their positions in the company. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in shares of ATS by 4.8% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 17,457 shares of the company's stock worth $565,000 after acquiring an additional 804 shares during the last quarter. Van ECK Associates Corp lifted its position in ATS by 28.4% during the third quarter. Van ECK Associates Corp now owns 4,230 shares of the company's stock worth $132,000 after buying an additional 936 shares in the last quarter. CIBC Asset Management Inc lifted its position in ATS by 0.4% during the third quarter. CIBC Asset Management Inc now owns 325,449 shares of the company's stock worth $9,446,000 after buying an additional 1,269 shares in the last quarter. Thornburg Investment Management Inc. lifted its position in ATS by 1.7% during the second quarter. Thornburg Investment Management Inc. now owns 181,408 shares of the company's stock worth $5,861,000 after buying an additional 2,958 shares in the last quarter. Finally, Aigen Investment Management LP lifted its position in ATS by 19.8% during the third quarter. Aigen Investment Management LP now owns 20,493 shares of the company's stock worth $595,000 after buying an additional 3,381 shares in the last quarter. 75.84% of the stock is owned by institutional investors and hedge funds.

ATS Trading Down 3.6 %

NYSE:ATS traded down $1.19 on Friday, reaching $31.57. The company's stock had a trading volume of 81,139 shares, compared to its average volume of 113,304. ATS Co. has a 12-month low of $24.82 and a 12-month high of $44.70. The company has a quick ratio of 1.71, a current ratio of 2.08 and a debt-to-equity ratio of 1.00. The firm has a market cap of $3.09 billion, a price-to-earnings ratio of 32.89 and a beta of 1.15. The stock has a 50 day moving average price of $30.25 and a 200 day moving average price of $29.97.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on ATS. The Goldman Sachs Group reduced their price objective on ATS from $34.00 to $30.00 and set a "sell" rating on the stock in a research report on Tuesday, August 13th. JPMorgan Chase & Co. reduced their price objective on ATS from $36.00 to $31.00 and set a "neutral" rating on the stock in a research report on Tuesday, August 13th.

View Our Latest Report on ATS

ATS Company Profile

(

Free Report)

ATS Corporation, together with its subsidiaries, provides automation solutions worldwide. The company is also involved in planning, designing, building, commissioning, and servicing automated manufacturing and assembly systems, including automation products and test solutions. In addition, it offers pre-automation services comprising discovery and analysis, concept development, simulation, and total cost of ownership modelling; post automation services, including training, process optimization, preventative maintenance, emergency and on-call support, spare parts, retooling, retrofits, and equipment relocation; and contract manufacturing services, as well as after sales and services.

Recommended Stories

Before you consider ATS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ATS wasn't on the list.

While ATS currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.