Quadrature Capital Ltd boosted its position in shares of Bilibili Inc. (NASDAQ:BILI - Free Report) by 67.8% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 207,657 shares of the company's stock after purchasing an additional 83,941 shares during the quarter. Quadrature Capital Ltd owned about 0.05% of Bilibili worth $4,855,000 as of its most recent filing with the Securities & Exchange Commission.

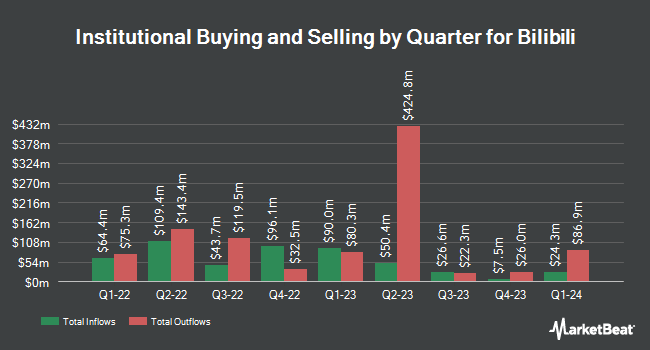

Other institutional investors also recently bought and sold shares of the company. Signaturefd LLC increased its holdings in shares of Bilibili by 6.5% in the 3rd quarter. Signaturefd LLC now owns 9,731 shares of the company's stock valued at $228,000 after acquiring an additional 598 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its holdings in shares of Bilibili by 26.3% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,528 shares of the company's stock valued at $82,000 after acquiring an additional 735 shares during the period. CWM LLC increased its holdings in shares of Bilibili by 61.9% in the 2nd quarter. CWM LLC now owns 2,232 shares of the company's stock valued at $34,000 after acquiring an additional 853 shares during the period. Blue Trust Inc. increased its holdings in shares of Bilibili by 227.3% in the 3rd quarter. Blue Trust Inc. now owns 1,283 shares of the company's stock valued at $30,000 after acquiring an additional 891 shares during the period. Finally, SG Americas Securities LLC increased its holdings in shares of Bilibili by 4.9% in the 2nd quarter. SG Americas Securities LLC now owns 33,711 shares of the company's stock valued at $520,000 after acquiring an additional 1,569 shares during the period. 16.08% of the stock is currently owned by hedge funds and other institutional investors.

Bilibili Price Performance

BILI traded down $0.18 on Friday, reaching $19.08. 4,370,980 shares of the stock were exchanged, compared to its average volume of 7,066,593. The company's 50-day moving average price is $21.33 and its 200 day moving average price is $17.42. Bilibili Inc. has a fifty-two week low of $8.80 and a fifty-two week high of $31.77. The firm has a market capitalization of $7.91 billion, a PE ratio of -20.74 and a beta of 0.80.

Bilibili (NASDAQ:BILI - Get Free Report) last issued its quarterly earnings results on Thursday, November 14th. The company reported $0.57 EPS for the quarter, topping analysts' consensus estimates of $0.10 by $0.47. Bilibili had a negative return on equity of 15.17% and a negative net margin of 10.73%. The company had revenue of $7.31 billion during the quarter, compared to analysts' expectations of $7.14 billion. During the same quarter in the previous year, the firm posted ($0.39) EPS. The firm's revenue was up 25.8% compared to the same quarter last year. As a group, equities analysts forecast that Bilibili Inc. will post -0.34 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts have recently issued reports on the company. Nomura upgraded Bilibili from a "neutral" rating to a "buy" rating and set a $18.00 price target on the stock in a report on Thursday, August 22nd. Barclays lifted their price target on Bilibili from $19.00 to $24.00 and gave the company an "overweight" rating in a report on Monday, November 18th. Sanford C. Bernstein boosted their target price on Bilibili from $12.00 to $13.00 and gave the stock a "market perform" rating in a research note on Friday, August 23rd. Nomura Securities upgraded Bilibili from a "hold" rating to a "strong-buy" rating in a research note on Thursday, August 22nd. Finally, Daiwa America upgraded Bilibili from a "hold" rating to a "strong-buy" rating in a research note on Friday, November 8th. Three investment analysts have rated the stock with a hold rating, nine have issued a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat, Bilibili has a consensus rating of "Moderate Buy" and a consensus price target of $19.69.

Read Our Latest Report on Bilibili

Bilibili Company Profile

(

Free Report)

Bilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

Further Reading

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.