Quadrature Capital Ltd acquired a new stake in The Bancorp, Inc. (NASDAQ:TBBK - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 18,974 shares of the bank's stock, valued at approximately $1,014,000.

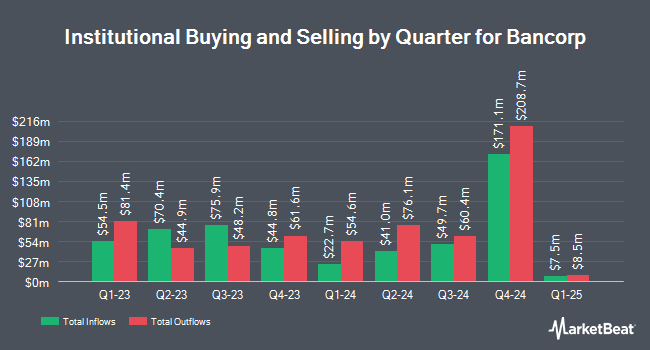

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Point72 DIFC Ltd purchased a new stake in shares of Bancorp in the third quarter valued at approximately $54,000. Paloma Partners Management Co bought a new stake in shares of Bancorp in the third quarter valued at about $487,000. Point72 Asia Singapore Pte. Ltd. purchased a new stake in Bancorp in the third quarter worth about $508,000. Verition Fund Management LLC bought a new position in Bancorp during the 3rd quarter worth about $1,024,000. Finally, Cynosure Group LLC purchased a new position in Bancorp during the 3rd quarter valued at about $367,000. Hedge funds and other institutional investors own 96.22% of the company's stock.

Bancorp Stock Up 1.2 %

Bancorp stock traded up $0.68 during trading hours on Friday, reaching $57.56. The stock had a trading volume of 264,775 shares, compared to its average volume of 514,129. The company has a market cap of $2.76 billion, a price-to-earnings ratio of 14.54 and a beta of 1.48. The business's 50 day moving average price is $54.86 and its 200-day moving average price is $47.63. The Bancorp, Inc. has a 52 week low of $29.92 and a 52 week high of $61.17. The company has a debt-to-equity ratio of 0.18, a current ratio of 0.88 and a quick ratio of 0.85.

Bancorp (NASDAQ:TBBK - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The bank reported $1.04 EPS for the quarter, missing the consensus estimate of $1.12 by ($0.08). Bancorp had a return on equity of 26.63% and a net margin of 30.97%. The firm had revenue of $125.84 million for the quarter, compared to the consensus estimate of $131.34 million. During the same quarter last year, the firm earned $0.92 EPS. Sell-side analysts anticipate that The Bancorp, Inc. will post 4.3 EPS for the current year.

Insider Transactions at Bancorp

In related news, EVP Matthew J. Wallace sold 10,160 shares of the company's stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of $50.06, for a total value of $508,609.60. Following the transaction, the executive vice president now directly owns 74,798 shares of the company's stock, valued at $3,744,387.88. This represents a 11.96 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CMO Maria Wainwright sold 11,357 shares of Bancorp stock in a transaction dated Tuesday, October 29th. The stock was sold at an average price of $50.08, for a total value of $568,758.56. Following the sale, the chief marketing officer now directly owns 23,291 shares of the company's stock, valued at approximately $1,166,413.28. This represents a 32.78 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 26,983 shares of company stock valued at $1,345,366 in the last quarter. 5.20% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Separately, StockNews.com downgraded shares of Bancorp from a "hold" rating to a "sell" rating in a research note on Tuesday, December 3rd.

Check Out Our Latest Analysis on Bancorp

Bancorp Profile

(

Free Report)

The Bancorp, Inc operates as the bank holding company for The Bancorp Bank, National Association that provides banking products and services in the United States. It offers a range of deposit products and services, including checking, savings, time, money market, and commercial accounts; overdrafts; and certificates of deposit.

Featured Stories

Before you consider Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bancorp wasn't on the list.

While Bancorp currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.