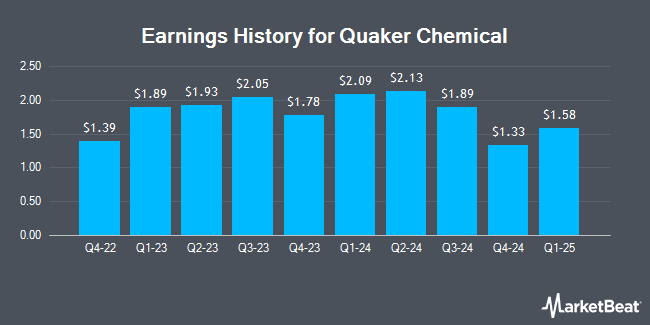

Quaker Chemical (NYSE:KWR - Get Free Report) released its earnings results on Monday. The specialty chemicals company reported $1.33 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.62 by ($0.29), Zacks reports. The firm had revenue of $444.09 million during the quarter, compared to analysts' expectations of $430.47 million. Quaker Chemical had a return on equity of 10.10% and a net margin of 6.58%. During the same period in the prior year, the business earned $1.78 earnings per share.

Quaker Chemical Stock Performance

Shares of NYSE:KWR traded up $2.72 on Thursday, reaching $140.80. 37,484 shares of the company's stock were exchanged, compared to its average volume of 149,063. The firm has a market capitalization of $2.50 billion, a price-to-earnings ratio of 20.65, a PEG ratio of 1.62 and a beta of 1.39. Quaker Chemical has a fifty-two week low of $124.66 and a fifty-two week high of $207.83. The business's 50-day moving average is $138.22 and its two-hundred day moving average is $153.74. The company has a quick ratio of 1.88, a current ratio of 2.54 and a debt-to-equity ratio of 0.48.

Quaker Chemical Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Wednesday, April 16th will be paid a $0.485 dividend. The ex-dividend date is Wednesday, April 16th. This represents a $1.94 annualized dividend and a dividend yield of 1.38%. Quaker Chemical's dividend payout ratio (DPR) is presently 28.45%.

Analysts Set New Price Targets

Several analysts have weighed in on KWR shares. Piper Sandler reaffirmed a "neutral" rating and set a $170.00 price objective (down from $200.00) on shares of Quaker Chemical in a research report on Tuesday, January 7th. StockNews.com lowered shares of Quaker Chemical from a "buy" rating to a "hold" rating in a research report on Wednesday. Deutsche Bank Aktiengesellschaft cut their price objective on shares of Quaker Chemical from $190.00 to $182.00 and set a "buy" rating on the stock in a report on Monday, November 4th. Finally, Royal Bank of Canada cut their price objective on shares of Quaker Chemical from $172.00 to $169.00 and set an "outperform" rating for the company in a report on Wednesday.

View Our Latest Stock Report on Quaker Chemical

Quaker Chemical Company Profile

(

Get Free Report)

Quaker Chemical Corporation, together with its subsidiaries, develops, produces, and markets various formulated specialty chemical products for a range of heavy industrial and manufacturing applications in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers metal removal fluids, cleaning fluids, corrosion inhibitors, metal drawing and forming fluids, die-cast mold releases, heat treatment and quenchants, metal forging fluids, hydraulic fluids, specialty greases, offshore sub-sea energy control fluids, rolling lubricants, rod and wire drawing fluids, and surface treatment chemicals.

Recommended Stories

Before you consider Quaker Chemical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quaker Chemical wasn't on the list.

While Quaker Chemical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.