Treasurer of the State of North Carolina boosted its holdings in shares of QUALCOMM Incorporated (NASDAQ:QCOM - Free Report) by 0.9% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 587,206 shares of the wireless technology company's stock after acquiring an additional 5,288 shares during the quarter. Treasurer of the State of North Carolina owned 0.05% of QUALCOMM worth $90,207,000 as of its most recent SEC filing.

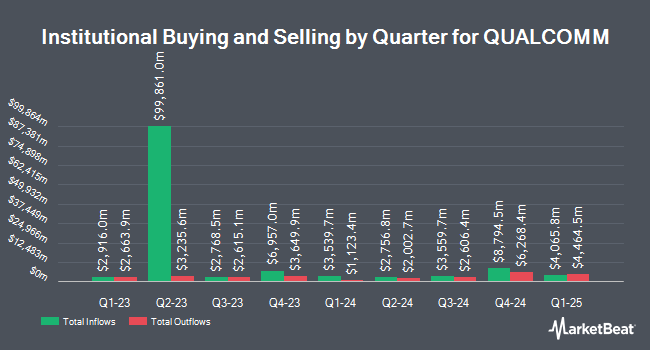

A number of other large investors also recently bought and sold shares of the business. Kohmann Bosshard Financial Services LLC purchased a new stake in shares of QUALCOMM during the fourth quarter valued at $26,000. CKW Financial Group purchased a new stake in QUALCOMM in the 4th quarter valued at about $27,000. Centricity Wealth Management LLC bought a new position in QUALCOMM in the 4th quarter worth about $29,000. CoreFirst Bank & Trust bought a new position in QUALCOMM in the 4th quarter worth about $33,000. Finally, Synergy Asset Management LLC purchased a new position in shares of QUALCOMM during the fourth quarter worth approximately $38,000. Hedge funds and other institutional investors own 74.35% of the company's stock.

Insider Activity

In other news, CFO Akash J. Palkhiwala sold 3,000 shares of QUALCOMM stock in a transaction that occurred on Wednesday, February 12th. The shares were sold at an average price of $169.80, for a total transaction of $509,400.00. Following the completion of the transaction, the chief financial officer now directly owns 63,115 shares of the company's stock, valued at $10,716,927. The trade was a 4.54 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CAO Neil Martin sold 744 shares of the firm's stock in a transaction dated Friday, February 21st. The shares were sold at an average price of $174.83, for a total value of $130,073.52. Following the sale, the chief accounting officer now owns 461 shares in the company, valued at $80,596.63. This trade represents a 61.74 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 30,666 shares of company stock valued at $5,047,052 in the last quarter. 0.08% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

QCOM has been the subject of a number of research reports. Benchmark reiterated a "buy" rating and issued a $240.00 price target on shares of QUALCOMM in a report on Friday, February 7th. Cantor Fitzgerald reissued a "neutral" rating and set a $160.00 price target on shares of QUALCOMM in a research report on Thursday, February 6th. Mizuho cut their price target on QUALCOMM from $245.00 to $215.00 and set an "outperform" rating on the stock in a research note on Tuesday, January 7th. Barclays lowered their price objective on shares of QUALCOMM from $200.00 to $185.00 and set an "overweight" rating for the company in a research note on Friday, January 17th. Finally, TD Cowen cut their target price on shares of QUALCOMM from $195.00 to $160.00 and set a "buy" rating on the stock in a research report on Wednesday, April 9th. One investment analyst has rated the stock with a sell rating, fourteen have issued a hold rating and sixteen have issued a buy rating to the company's stock. Based on data from MarketBeat, QUALCOMM presently has a consensus rating of "Hold" and a consensus price target of $201.21.

View Our Latest Analysis on QUALCOMM

QUALCOMM Stock Performance

NASDAQ QCOM traded down $1.13 during trading hours on Monday, reaching $138.12. The stock had a trading volume of 3,072,803 shares, compared to its average volume of 8,858,575. QUALCOMM Incorporated has a 52-week low of $120.80 and a 52-week high of $230.63. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.99 and a current ratio of 2.62. The stock has a market cap of $152.76 billion, a P/E ratio of 14.76, a price-to-earnings-growth ratio of 2.01 and a beta of 1.28. The stock has a fifty day moving average of $156.49 and a 200 day moving average of $161.38.

QUALCOMM (NASDAQ:QCOM - Get Free Report) last issued its earnings results on Wednesday, February 5th. The wireless technology company reported $2.86 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.93 by ($0.07). QUALCOMM had a return on equity of 39.51% and a net margin of 25.94%. Sell-side analysts predict that QUALCOMM Incorporated will post 9.39 earnings per share for the current year.

QUALCOMM Company Profile

(

Free Report)

QUALCOMM Incorporated engages in the development and commercialization of foundational technologies for the wireless industry worldwide. It operates through three segments: Qualcomm CDMA Technologies (QCT); Qualcomm Technology Licensing (QTL); and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on 3G/4G/5G and other technologies for use in wireless voice and data communications, networking, computing, multimedia, and position location products.

Read More

Before you consider QUALCOMM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QUALCOMM wasn't on the list.

While QUALCOMM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.