QUALCOMM (NASDAQ:QCOM - Get Free Report)'s stock had its "neutral" rating restated by equities research analysts at Cantor Fitzgerald in a note issued to investors on Wednesday,Benzinga reports. They presently have a $160.00 price objective on the wireless technology company's stock. Cantor Fitzgerald's price objective points to a potential upside of 3.71% from the company's current price.

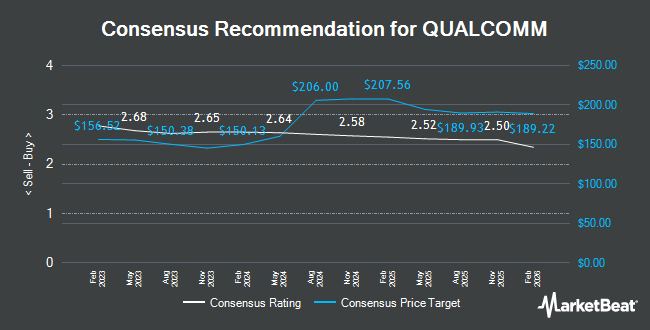

A number of other brokerages have also recently commented on QCOM. Wells Fargo & Company increased their price target on shares of QUALCOMM from $170.00 to $175.00 and gave the company an "underweight" rating in a research note on Thursday, November 7th. StockNews.com cut QUALCOMM from a "strong-buy" rating to a "buy" rating in a report on Wednesday, October 2nd. JPMorgan Chase & Co. dropped their price objective on QUALCOMM from $210.00 to $195.00 and set an "overweight" rating on the stock in a research note on Tuesday, November 5th. Morgan Stanley decreased their target price on QUALCOMM from $207.00 to $204.00 and set an "equal weight" rating on the stock in a report on Thursday, November 7th. Finally, DZ Bank raised QUALCOMM from a "hold" rating to a "buy" rating and set a $210.00 price target for the company in a report on Friday, August 2nd. One research analyst has rated the stock with a sell rating, twelve have given a hold rating, fifteen have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $210.15.

Check Out Our Latest Analysis on QUALCOMM

QUALCOMM Stock Down 6.3 %

Shares of QCOM stock traded down $10.44 during trading on Wednesday, reaching $154.27. The company's stock had a trading volume of 14,454,817 shares, compared to its average volume of 9,027,241. The company has a quick ratio of 1.79, a current ratio of 2.40 and a debt-to-equity ratio of 0.51. QUALCOMM has a one year low of $125.67 and a one year high of $230.63. The business has a fifty day moving average price of $168.48 and a 200-day moving average price of $182.13. The company has a market cap of $171.39 billion, a price-to-earnings ratio of 17.25, a price-to-earnings-growth ratio of 2.70 and a beta of 1.28.

Insiders Place Their Bets

In related news, General Counsel Ann C. Chaplin sold 1,901 shares of the firm's stock in a transaction that occurred on Monday, November 4th. The shares were sold at an average price of $165.06, for a total value of $313,779.06. Following the completion of the transaction, the general counsel now directly owns 12,007 shares of the company's stock, valued at approximately $1,981,875.42. This trade represents a 13.67 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Alexander H. Rogers sold 3,245 shares of QUALCOMM stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $166.15, for a total value of $539,156.75. Following the completion of the transaction, the insider now owns 32,231 shares of the company's stock, valued at approximately $5,355,180.65. This trade represents a 9.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 16,146 shares of company stock valued at $2,709,186 in the last three months. 0.08% of the stock is currently owned by insiders.

Institutional Investors Weigh In On QUALCOMM

Several hedge funds and other institutional investors have recently modified their holdings of QCOM. HWG Holdings LP bought a new position in shares of QUALCOMM in the second quarter worth $30,000. Reston Wealth Management LLC purchased a new stake in QUALCOMM in the third quarter worth approximately $26,000. Financial Connections Group Inc. purchased a new position in QUALCOMM in the 2nd quarter worth $32,000. Aspect Partners LLC boosted its position in QUALCOMM by 71.8% during the second quarter. Aspect Partners LLC now owns 177 shares of the wireless technology company's stock valued at $35,000 after buying an additional 74 shares during the period. Finally, Planning Capital Management Corp grew its position in QUALCOMM by 137.3% during the 3rd quarter. Planning Capital Management Corp now owns 197 shares of the wireless technology company's stock worth $34,000 after acquiring an additional 114 shares during the last quarter. 74.35% of the stock is currently owned by institutional investors.

About QUALCOMM

(

Get Free Report)

QUALCOMM Incorporated engages in the development and commercialization of foundational technologies for the wireless industry worldwide. It operates through three segments: Qualcomm CDMA Technologies (QCT); Qualcomm Technology Licensing (QTL); and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on 3G/4G/5G and other technologies for use in wireless voice and data communications, networking, computing, multimedia, and position location products.

Featured Stories

Before you consider QUALCOMM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QUALCOMM wasn't on the list.

While QUALCOMM currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.