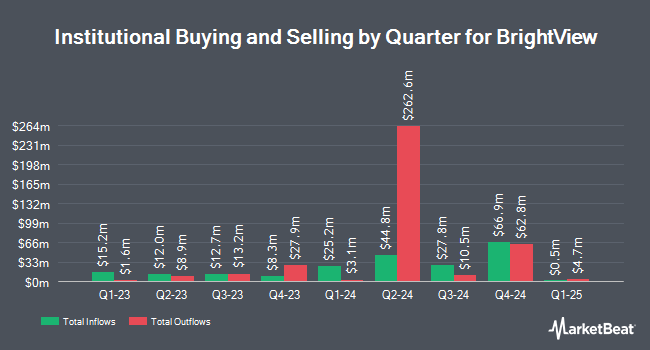

Quantbot Technologies LP acquired a new position in shares of BrightView Holdings, Inc. (NYSE:BV - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 35,246 shares of the company's stock, valued at approximately $555,000.

Other large investors have also recently made changes to their positions in the company. The Manufacturers Life Insurance Company raised its stake in BrightView by 71.2% in the third quarter. The Manufacturers Life Insurance Company now owns 30,641 shares of the company's stock valued at $482,000 after buying an additional 12,745 shares in the last quarter. Telemark Asset Management LLC increased its stake in BrightView by 14.3% in the third quarter. Telemark Asset Management LLC now owns 800,000 shares of the company's stock valued at $12,592,000 after purchasing an additional 100,000 shares during the last quarter. Thompson Siegel & Walmsley LLC raised its holdings in BrightView by 704.9% during the third quarter. Thompson Siegel & Walmsley LLC now owns 339,054 shares of the company's stock worth $5,337,000 after purchasing an additional 296,931 shares in the last quarter. Intech Investment Management LLC purchased a new stake in shares of BrightView during the 3rd quarter worth approximately $251,000. Finally, Quest Partners LLC purchased a new position in shares of BrightView in the 3rd quarter valued at $153,000. 92.41% of the stock is currently owned by hedge funds and other institutional investors.

BrightView Stock Performance

Shares of NYSE:BV traded down $0.26 during midday trading on Tuesday, hitting $17.07. The stock had a trading volume of 257,147 shares, compared to its average volume of 616,607. BrightView Holdings, Inc. has a 1 year low of $7.74 and a 1 year high of $18.89. The company has a current ratio of 1.44, a quick ratio of 1.44 and a debt-to-equity ratio of 0.63. The stock has a 50 day moving average price of $16.55 and a two-hundred day moving average price of $15.03. The company has a market capitalization of $1.62 billion, a PE ratio of 155.83 and a beta of 1.30.

BrightView (NYSE:BV - Get Free Report) last announced its quarterly earnings data on Wednesday, November 13th. The company reported $0.30 earnings per share for the quarter, beating analysts' consensus estimates of $0.28 by $0.02. The company had revenue of $728.70 million for the quarter, compared to analyst estimates of $723.01 million. BrightView had a return on equity of 7.65% and a net margin of 2.40%. The firm's revenue for the quarter was down 2.0% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.14 EPS. As a group, equities analysts predict that BrightView Holdings, Inc. will post 0.75 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on the stock. The Goldman Sachs Group boosted their price target on shares of BrightView from $11.30 to $12.90 and gave the company a "sell" rating in a research report on Friday, November 15th. Morgan Stanley initiated coverage on BrightView in a research report on Thursday, August 22nd. They issued an "equal weight" rating and a $16.00 target price for the company. William Blair raised BrightView from a "market perform" rating to an "outperform" rating in a research report on Friday, November 15th. Robert W. Baird increased their price objective on BrightView from $18.00 to $20.00 and gave the company an "outperform" rating in a report on Thursday, November 14th. Finally, Jefferies Financial Group raised shares of BrightView from a "hold" rating to a "buy" rating and lifted their target price for the company from $13.00 to $17.00 in a report on Wednesday, August 21st. Two investment analysts have rated the stock with a sell rating, one has given a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, BrightView presently has an average rating of "Moderate Buy" and an average price target of $17.11.

Read Our Latest Research Report on BV

Insider Buying and Selling

In other news, EVP Jonathan Mark Gottsegen sold 29,658 shares of BrightView stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $16.06, for a total transaction of $476,307.48. Following the completion of the sale, the executive vice president now directly owns 100,354 shares in the company, valued at approximately $1,611,685.24. This trade represents a 22.81 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 2.40% of the stock is currently owned by corporate insiders.

BrightView Company Profile

(

Free Report)

BrightView Holdings, Inc, through its subsidiaries, provides commercial landscaping services in the United States. It operates through two segments, Maintenance Services and Development Services. The Maintenance Services segment delivers a suite of recurring commercial landscaping services, including mowing, gardening, mulching and snow removal, water management, irrigation maintenance, tree care, golf course maintenance, and specialty turf maintenance.

Featured Articles

Before you consider BrightView, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightView wasn't on the list.

While BrightView currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.