Quantbot Technologies LP purchased a new position in shares of Associated Banc-Corp (NYSE:ASB - Free Report) during the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 44,327 shares of the bank's stock, valued at approximately $955,000.

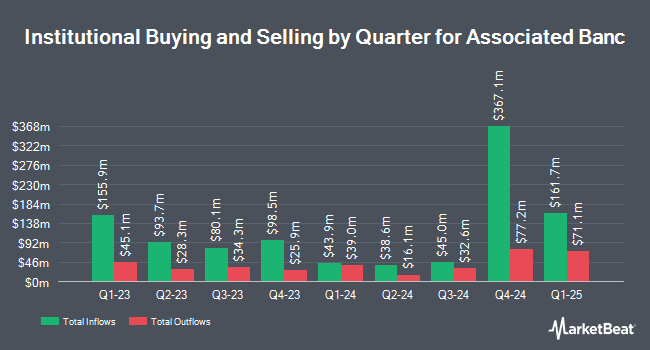

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Vanguard Personalized Indexing Management LLC raised its stake in Associated Banc by 4.9% in the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 11,312 shares of the bank's stock valued at $234,000 after acquiring an additional 525 shares during the period. Wealth Enhancement Advisory Services LLC grew its stake in shares of Associated Banc by 2.8% in the third quarter. Wealth Enhancement Advisory Services LLC now owns 19,461 shares of the bank's stock worth $419,000 after purchasing an additional 525 shares during the last quarter. Arizona State Retirement System increased its position in Associated Banc by 1.4% during the 2nd quarter. Arizona State Retirement System now owns 42,068 shares of the bank's stock valued at $890,000 after purchasing an additional 586 shares during the period. Truist Financial Corp boosted its position in shares of Associated Banc by 2.4% during the 2nd quarter. Truist Financial Corp now owns 27,082 shares of the bank's stock valued at $573,000 after purchasing an additional 636 shares in the last quarter. Finally, Thrivent Financial for Lutherans grew its holdings in Associated Banc by 1.3% in the second quarter. Thrivent Financial for Lutherans now owns 50,680 shares of the bank's stock worth $1,072,000 after purchasing an additional 656 shares during the period. 82.98% of the stock is currently owned by institutional investors and hedge funds.

Associated Banc Stock Performance

Associated Banc stock traded up $0.05 during midday trading on Monday, hitting $26.51. 747,601 shares of the company's stock were exchanged, compared to its average volume of 1,433,269. The stock has a market cap of $4.01 billion, a price-to-earnings ratio of 22.24, a price-to-earnings-growth ratio of 1.93 and a beta of 0.91. The company has a debt-to-equity ratio of 0.65, a quick ratio of 0.88 and a current ratio of 0.88. Associated Banc-Corp has a 12-month low of $18.56 and a 12-month high of $28.18. The firm's 50 day simple moving average is $23.91 and its 200 day simple moving average is $22.29.

Associated Banc (NYSE:ASB - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The bank reported $0.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.50 by $0.06. The business had revenue of $607.54 million for the quarter, compared to the consensus estimate of $336.52 million. Associated Banc had a net margin of 8.15% and a return on equity of 8.18%. During the same quarter in the prior year, the firm posted $0.53 earnings per share. Equities research analysts predict that Associated Banc-Corp will post 2.13 EPS for the current year.

Associated Banc Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be given a $0.23 dividend. This is a positive change from Associated Banc's previous quarterly dividend of $0.22. The ex-dividend date is Monday, December 2nd. This represents a $0.92 annualized dividend and a dividend yield of 3.47%. Associated Banc's dividend payout ratio (DPR) is presently 73.33%.

Insider Buying and Selling at Associated Banc

In related news, EVP David L. Stein sold 29,536 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $27.43, for a total transaction of $810,172.48. Following the completion of the transaction, the executive vice president now directly owns 81,021 shares in the company, valued at $2,222,406.03. This represents a 26.72 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Lith Karen Van sold 8,061 shares of the firm's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $20.48, for a total transaction of $165,089.28. Following the transaction, the director now directly owns 54,114 shares of the company's stock, valued at $1,108,254.72. The trade was a 12.97 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 56,641 shares of company stock worth $1,435,936 over the last ninety days. Company insiders own 1.45% of the company's stock.

Analysts Set New Price Targets

Several research firms have commented on ASB. Barclays lifted their target price on Associated Banc from $23.00 to $24.00 and gave the stock an "equal weight" rating in a research note on Friday, October 25th. StockNews.com raised shares of Associated Banc from a "sell" rating to a "hold" rating in a research note on Thursday, October 31st. Finally, Royal Bank of Canada upped their price target on Associated Banc from $24.00 to $25.00 and gave the company a "sector perform" rating in a research report on Friday, October 25th. Ten research analysts have rated the stock with a hold rating and one has issued a buy rating to the stock. According to MarketBeat.com, Associated Banc has a consensus rating of "Hold" and an average target price of $23.89.

Read Our Latest Research Report on ASB

Associated Banc Profile

(

Free Report)

Associated Banc-Corp, a bank holding company, provides various banking and nonbanking products to individuals and businesses in Wisconsin, Illinois, and Minnesota. The company offers lending solutions, including commercial loans and lines of credit, commercial real estate financing, construction loans, letters of credit, leasing, asset based lending and equipment finance, loan syndications products, residential mortgages, home equity loans and lines of credit, personal and installment loans, auto finance and business loans, and business lines of credit.

See Also

Before you consider Associated Banc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Associated Banc wasn't on the list.

While Associated Banc currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.