Quantbot Technologies LP acquired a new position in shares of Bank of Hawaii Co. (NYSE:BOH - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 20,133 shares of the bank's stock, valued at approximately $1,264,000. Quantbot Technologies LP owned 0.05% of Bank of Hawaii at the end of the most recent reporting period.

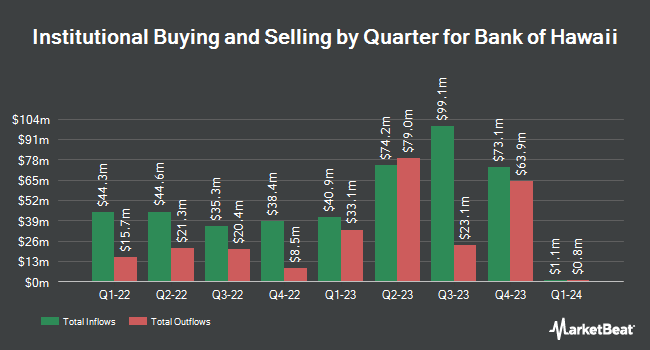

Other large investors have also recently bought and sold shares of the company. Point72 Asia Singapore Pte. Ltd. acquired a new position in shares of Bank of Hawaii during the 2nd quarter worth $106,000. Point72 DIFC Ltd purchased a new stake in Bank of Hawaii during the second quarter worth about $119,000. UMB Bank n.a. grew its position in Bank of Hawaii by 5,508.3% during the third quarter. UMB Bank n.a. now owns 2,692 shares of the bank's stock worth $169,000 after buying an additional 2,644 shares during the period. Rothschild Investment LLC purchased a new position in Bank of Hawaii in the second quarter valued at about $172,000. Finally, Crestwood Advisors Group LLC acquired a new stake in shares of Bank of Hawaii during the 3rd quarter valued at approximately $207,000. Hedge funds and other institutional investors own 82.18% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on BOH. Barclays raised their price objective on Bank of Hawaii from $50.00 to $56.00 and gave the company an "underweight" rating in a research note on Tuesday, October 29th. Keefe, Bruyette & Woods lifted their price target on Bank of Hawaii from $67.00 to $74.00 and gave the stock a "market perform" rating in a research note on Tuesday, October 29th. DA Davidson boosted their price objective on shares of Bank of Hawaii from $65.00 to $74.00 and gave the stock a "neutral" rating in a research report on Tuesday, October 29th. Piper Sandler raised their target price on shares of Bank of Hawaii from $61.00 to $66.00 and gave the company an "underweight" rating in a report on Tuesday, October 29th. Finally, Stephens initiated coverage on shares of Bank of Hawaii in a report on Wednesday. They issued an "overweight" rating and a $90.00 price target on the stock. Three investment analysts have rated the stock with a sell rating, three have given a hold rating and one has issued a buy rating to the company's stock. According to data from MarketBeat.com, Bank of Hawaii has a consensus rating of "Hold" and a consensus target price of $69.00.

View Our Latest Research Report on BOH

Insider Buying and Selling at Bank of Hawaii

In related news, insider Matthew Emerson sold 1,355 shares of the firm's stock in a transaction that occurred on Wednesday, October 30th. The shares were sold at an average price of $72.27, for a total value of $97,925.85. Following the sale, the insider now directly owns 13,717 shares of the company's stock, valued at approximately $991,327.59. This trade represents a 8.99 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 2.11% of the stock is owned by company insiders.

Bank of Hawaii Trading Down 0.8 %

Shares of NYSE BOH traded down $0.66 during midday trading on Friday, reaching $78.98. 120,907 shares of the stock were exchanged, compared to its average volume of 340,967. The stock has a 50 day moving average price of $70.69 and a 200-day moving average price of $64.93. The company has a current ratio of 0.71, a quick ratio of 0.71 and a debt-to-equity ratio of 0.42. The company has a market capitalization of $3.14 billion, a P/E ratio of 23.72, a P/E/G ratio of 5.19 and a beta of 1.03. Bank of Hawaii Co. has a 52-week low of $54.50 and a 52-week high of $82.70.

Bank of Hawaii (NYSE:BOH - Get Free Report) last released its earnings results on Monday, October 28th. The bank reported $0.93 EPS for the quarter, topping the consensus estimate of $0.82 by $0.11. Bank of Hawaii had a net margin of 13.76% and a return on equity of 11.33%. The firm had revenue of $265.76 million during the quarter, compared to analysts' expectations of $160.29 million. During the same period in the previous year, the company earned $1.17 EPS. Equities research analysts expect that Bank of Hawaii Co. will post 3.52 earnings per share for the current fiscal year.

Bank of Hawaii Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Friday, November 29th will be paid a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 3.55%. The ex-dividend date is Friday, November 29th. Bank of Hawaii's payout ratio is 84.08%.

Bank of Hawaii Profile

(

Free Report)

Bank of Hawaii Corporation operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands. It operates in three segments: Consumer Banking, Commercial Banking, and Treasury and Other. The Consumer Banking segment offers checking, savings, and time deposit accounts; residential mortgage loans, home equity lines of credit, automobile loans and leases, overdraft lines of credit, installment loans, small business loans and leases, and credit cards; private and international client banking, investment, credit, and trust services to individuals and families, as well as high-net-worth individuals; investment management; institutional investment advisory services to corporations, government entities, and foundations; and brokerage offerings, including equities, mutual funds, life insurance, and annuity products.

Featured Articles

Before you consider Bank of Hawaii, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Hawaii wasn't on the list.

While Bank of Hawaii currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.