Quantbot Technologies LP acquired a new stake in shares of Equinox Gold Corp. (NYSEAMERICAN:EQX - Free Report) during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund acquired 112,248 shares of the company's stock, valued at approximately $684,000.

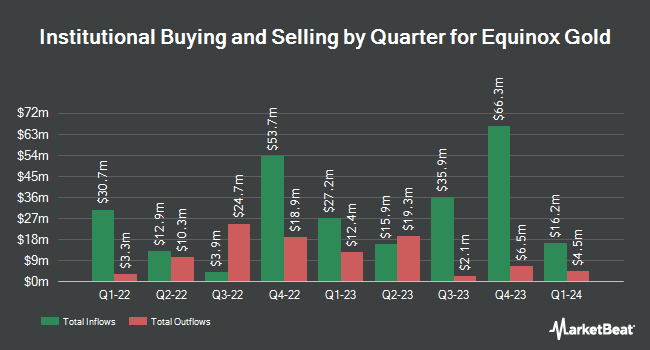

Several other institutional investors have also recently added to or reduced their stakes in EQX. The Manufacturers Life Insurance Company increased its stake in shares of Equinox Gold by 212.9% during the 3rd quarter. The Manufacturers Life Insurance Company now owns 932,050 shares of the company's stock worth $5,681,000 after purchasing an additional 634,210 shares during the last quarter. CIBC Asset Management Inc raised its holdings in shares of Equinox Gold by 3.5% during the third quarter. CIBC Asset Management Inc now owns 520,879 shares of the company's stock valued at $3,179,000 after purchasing an additional 17,732 shares during the period. Hollencrest Capital Management boosted its stake in Equinox Gold by 12.4% during the 3rd quarter. Hollencrest Capital Management now owns 140,398 shares of the company's stock valued at $855,000 after purchasing an additional 15,436 shares during the last quarter. Harvest Portfolios Group Inc. boosted its holdings in Equinox Gold by 5.2% during the 3rd quarter. Harvest Portfolios Group Inc. now owns 108,963 shares of the company's stock worth $665,000 after acquiring an additional 5,418 shares during the last quarter. Finally, Intact Investment Management Inc. grew its holdings in shares of Equinox Gold by 70.3% in the third quarter. Intact Investment Management Inc. now owns 188,000 shares of the company's stock valued at $1,147,000 after acquiring an additional 77,600 shares in the last quarter. 38.85% of the stock is owned by institutional investors.

Equinox Gold Price Performance

NYSEAMERICAN EQX traded up $0.28 during trading on Tuesday, reaching $5.80. The company's stock had a trading volume of 2,990,437 shares, compared to its average volume of 3,139,908. Equinox Gold Corp. has a one year low of $3.95 and a one year high of $6.50. The company has a quick ratio of 0.33, a current ratio of 0.85 and a debt-to-equity ratio of 0.37. The firm has a market capitalization of $2.64 billion, a P/E ratio of 113.00 and a beta of 1.32.

Equinox Gold (NYSEAMERICAN:EQX - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.09 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.10 by ($0.01). The company had revenue of $428.40 million for the quarter, compared to analysts' expectations of $437.84 million. Equinox Gold had a net margin of 19.83% and a return on equity of 0.69%. The company's quarterly revenue was up 50.5% compared to the same quarter last year. As a group, equities analysts anticipate that Equinox Gold Corp. will post 0.38 EPS for the current fiscal year.

Equinox Gold Profile

(

Free Report)

Equinox Gold Corp. engages in the exploration, acquisition, development, and operation of mineral properties in the Americas. It explores gold and silver deposits. It holds interest in properties in California located in the United States; Guerrero State located in Mexico; Maranhão, Bahia, and Mina Gerais state located in Brazil; and Ontario, Canada.

See Also

Before you consider Equinox Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equinox Gold wasn't on the list.

While Equinox Gold currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.