Quantbot Technologies LP increased its holdings in shares of Amphenol Co. (NYSE:APH - Free Report) by 231.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 396,981 shares of the electronics maker's stock after buying an additional 277,245 shares during the quarter. Amphenol comprises approximately 1.0% of Quantbot Technologies LP's portfolio, making the stock its 2nd biggest holding. Quantbot Technologies LP's holdings in Amphenol were worth $25,867,000 as of its most recent SEC filing.

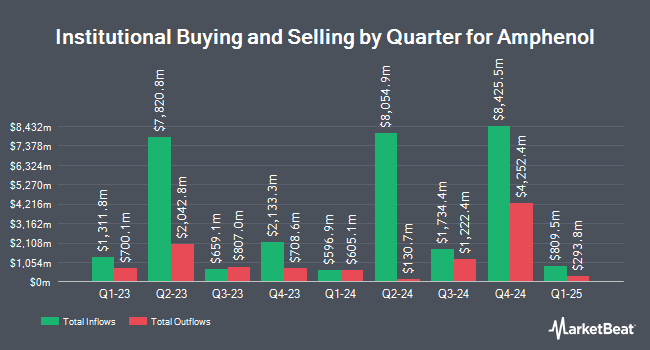

A number of other institutional investors have also recently bought and sold shares of APH. Texas Permanent School Fund Corp raised its position in Amphenol by 61.1% in the second quarter. Texas Permanent School Fund Corp now owns 199,758 shares of the electronics maker's stock valued at $13,458,000 after purchasing an additional 75,753 shares during the period. United Services Automobile Association boosted its stake in shares of Amphenol by 102.0% in the second quarter. United Services Automobile Association now owns 31,980 shares of the electronics maker's stock valued at $2,154,000 after purchasing an additional 16,149 shares during the period. LMR Partners LLP increased its stake in Amphenol by 315.1% during the 3rd quarter. LMR Partners LLP now owns 294,800 shares of the electronics maker's stock worth $19,209,000 after buying an additional 223,784 shares during the period. Advisors Asset Management Inc. lifted its holdings in Amphenol by 22.3% in the 3rd quarter. Advisors Asset Management Inc. now owns 106,899 shares of the electronics maker's stock worth $6,966,000 after buying an additional 19,496 shares in the last quarter. Finally, Daiwa Securities Group Inc. boosted its holdings in Amphenol by 50.9% in the third quarter. Daiwa Securities Group Inc. now owns 268,219 shares of the electronics maker's stock valued at $17,477,000 after purchasing an additional 90,450 shares during the last quarter. 97.01% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Amphenol

In other Amphenol news, CEO Richard Adam Norwitt sold 900,672 shares of the business's stock in a transaction dated Tuesday, October 29th. The stock was sold at an average price of $68.81, for a total value of $61,975,240.32. Following the completion of the sale, the chief executive officer now owns 1,934,848 shares of the company's stock, valued at $133,136,890.88. The trade was a 31.76 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP David M. Silverman sold 180,000 shares of the stock in a transaction dated Tuesday, October 29th. The shares were sold at an average price of $68.84, for a total value of $12,391,200.00. Following the transaction, the vice president now directly owns 14,000 shares in the company, valued at approximately $963,760. This represents a 92.78 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,842,672 shares of company stock valued at $128,858,080 in the last quarter. Company insiders own 1.80% of the company's stock.

Amphenol Trading Down 0.0 %

Shares of Amphenol stock traded down $0.03 during trading on Tuesday, hitting $73.26. The stock had a trading volume of 4,606,175 shares, compared to its average volume of 6,631,690. Amphenol Co. has a 1 year low of $44.81 and a 1 year high of $74.93. The stock has a 50 day simple moving average of $67.85 and a 200 day simple moving average of $66.47. The company has a quick ratio of 1.33, a current ratio of 1.99 and a debt-to-equity ratio of 0.53. The company has a market capitalization of $88.32 billion, a PE ratio of 42.14, a P/E/G ratio of 2.47 and a beta of 1.23.

Amphenol (NYSE:APH - Get Free Report) last released its earnings results on Wednesday, October 23rd. The electronics maker reported $0.50 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.45 by $0.05. Amphenol had a return on equity of 24.68% and a net margin of 15.40%. The company had revenue of $4.04 billion during the quarter, compared to analyst estimates of $3.81 billion. The company's revenue for the quarter was up 26.3% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.39 earnings per share. On average, research analysts expect that Amphenol Co. will post 1.84 EPS for the current fiscal year.

Amphenol Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 8th. Shareholders of record on Tuesday, December 17th will be given a $0.165 dividend. The ex-dividend date of this dividend is Tuesday, December 17th. This represents a $0.66 dividend on an annualized basis and a yield of 0.90%. Amphenol's payout ratio is 37.93%.

Wall Street Analysts Forecast Growth

APH has been the topic of several recent analyst reports. Robert W. Baird upped their price target on shares of Amphenol from $71.00 to $77.00 and gave the company an "outperform" rating in a report on Thursday, October 24th. Evercore ISI boosted their price objective on Amphenol from $75.00 to $80.00 and gave the company an "outperform" rating in a report on Thursday, October 24th. TD Cowen increased their target price on Amphenol from $60.00 to $63.00 and gave the stock a "hold" rating in a report on Friday, October 25th. Truist Financial boosted their price target on Amphenol from $76.00 to $82.00 and gave the company a "buy" rating in a report on Thursday, October 24th. Finally, Bank of America lifted their price target on shares of Amphenol from $70.00 to $74.00 and gave the company a "neutral" rating in a report on Thursday, October 24th. Five investment analysts have rated the stock with a hold rating, seven have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Amphenol currently has an average rating of "Moderate Buy" and an average price target of $69.63.

Get Our Latest Stock Report on APH

Amphenol Profile

(

Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Featured Articles

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.