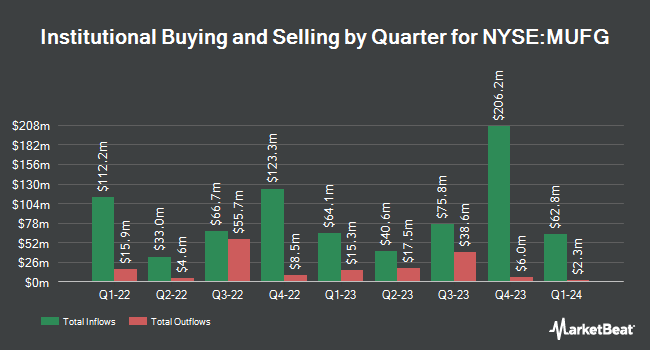

Quantbot Technologies LP grew its stake in Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG - Free Report) by 87.6% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 91,973 shares of the company's stock after acquiring an additional 42,958 shares during the quarter. Quantbot Technologies LP's holdings in Mitsubishi UFJ Financial Group were worth $936,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in MUFG. Blue Trust Inc. raised its holdings in shares of Mitsubishi UFJ Financial Group by 98.7% during the 3rd quarter. Blue Trust Inc. now owns 125,734 shares of the company's stock valued at $1,358,000 after buying an additional 62,449 shares during the period. Federated Hermes Inc. boosted its position in Mitsubishi UFJ Financial Group by 17.7% in the 2nd quarter. Federated Hermes Inc. now owns 975,661 shares of the company's stock valued at $10,537,000 after buying an additional 146,904 shares during the last quarter. Fisher Asset Management LLC increased its position in shares of Mitsubishi UFJ Financial Group by 15.7% during the third quarter. Fisher Asset Management LLC now owns 7,853,310 shares of the company's stock worth $79,947,000 after acquiring an additional 1,067,409 shares during the last quarter. Bleakley Financial Group LLC lifted its stake in shares of Mitsubishi UFJ Financial Group by 11.8% in the third quarter. Bleakley Financial Group LLC now owns 25,613 shares of the company's stock worth $261,000 after acquiring an additional 2,701 shares in the last quarter. Finally, Crossmark Global Holdings Inc. boosted its holdings in Mitsubishi UFJ Financial Group by 23.4% in the third quarter. Crossmark Global Holdings Inc. now owns 866,032 shares of the company's stock valued at $8,816,000 after purchasing an additional 164,206 shares during the last quarter. Hedge funds and other institutional investors own 13.59% of the company's stock.

Mitsubishi UFJ Financial Group Stock Up 2.2 %

NYSE:MUFG traded up $0.26 during trading hours on Monday, hitting $12.17. 1,654,211 shares of the company's stock traded hands, compared to its average volume of 2,425,197. Mitsubishi UFJ Financial Group, Inc. has a twelve month low of $8.19 and a twelve month high of $12.20. The firm has a market cap of $141.87 billion, a P/E ratio of 11.68, a P/E/G ratio of 1.10 and a beta of 0.59. The company has a debt-to-equity ratio of 2.04, a quick ratio of 0.92 and a current ratio of 0.91. The stock's fifty day moving average price is $10.88 and its two-hundred day moving average price is $10.61.

Analysts Set New Price Targets

Separately, StockNews.com upgraded shares of Mitsubishi UFJ Financial Group from a "sell" rating to a "hold" rating in a research report on Saturday, November 23rd.

Get Our Latest Analysis on Mitsubishi UFJ Financial Group

Mitsubishi UFJ Financial Group Profile

(

Free Report)

Mitsubishi UFJ Financial Group, Inc operates as the bank holding company, that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally. It operates through seven segments: Digital Service, Retail & Commercial Banking, Japanese Corporate & Investment Banking, Global Commercial Banking, Asset Management & Investor Services, Global Corporate & Investment Banking, and Global Markets.

Read More

Before you consider Mitsubishi UFJ Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mitsubishi UFJ Financial Group wasn't on the list.

While Mitsubishi UFJ Financial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.