Quantbot Technologies LP increased its position in International Seaways, Inc. (NYSE:INSW - Free Report) by 225.8% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 32,645 shares of the transportation company's stock after buying an additional 22,624 shares during the quarter. Quantbot Technologies LP owned 0.07% of International Seaways worth $1,173,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

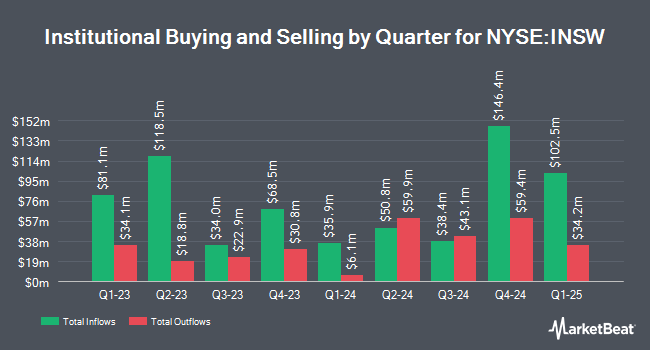

Other hedge funds and other institutional investors have also bought and sold shares of the company. Intech Investment Management LLC bought a new position in shares of International Seaways during the third quarter valued at about $620,000. Charles Schwab Investment Management Inc. boosted its holdings in International Seaways by 8.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 430,658 shares of the transportation company's stock valued at $22,205,000 after acquiring an additional 32,825 shares during the period. Kingsview Wealth Management LLC bought a new position in International Seaways during the 3rd quarter worth approximately $2,161,000. FMR LLC increased its stake in International Seaways by 221.0% in the 3rd quarter. FMR LLC now owns 602,213 shares of the transportation company's stock worth $31,050,000 after purchasing an additional 414,610 shares during the period. Finally, Cynosure Group LLC lifted its position in International Seaways by 6.6% in the third quarter. Cynosure Group LLC now owns 7,171 shares of the transportation company's stock valued at $370,000 after purchasing an additional 447 shares during the last quarter. Hedge funds and other institutional investors own 67.29% of the company's stock.

Insider Buying and Selling

In other International Seaways news, CEO Lois K. Zabrocky sold 2,000 shares of the stock in a transaction on Monday, March 17th. The stock was sold at an average price of $34.66, for a total value of $69,320.00. Following the completion of the transaction, the chief executive officer now owns 179,557 shares in the company, valued at approximately $6,223,445.62. This represents a 1.10 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, SVP Derek G. Solon sold 4,400 shares of the business's stock in a transaction on Thursday, March 13th. The shares were sold at an average price of $33.39, for a total transaction of $146,916.00. Following the sale, the senior vice president now owns 50,453 shares in the company, valued at approximately $1,684,625.67. This trade represents a 8.02 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 9,400 shares of company stock valued at $324,296 over the last three months. Corporate insiders own 1.90% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently issued reports on INSW shares. Jefferies Financial Group restated a "buy" rating and issued a $58.00 target price on shares of International Seaways in a report on Thursday, February 27th. SEB Equity Research set a $50.00 price objective on shares of International Seaways in a research report on Friday, January 24th. Two analysts have rated the stock with a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $57.50.

Read Our Latest Report on International Seaways

International Seaways Trading Up 0.9 %

INSW stock traded up $0.29 on Friday, reaching $33.16. The company's stock had a trading volume of 491,479 shares, compared to its average volume of 713,316. The firm has a market cap of $1.63 billion, a PE ratio of 3.20 and a beta of -0.17. The business has a fifty day simple moving average of $36.28 and a two-hundred day simple moving average of $40.72. International Seaways, Inc. has a 12-month low of $31.70 and a 12-month high of $65.94. The company has a debt-to-equity ratio of 0.32, a quick ratio of 3.60 and a current ratio of 3.60.

International Seaways Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, March 28th. Investors of record on Friday, March 14th were given a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 1.45%. The ex-dividend date of this dividend was Friday, March 14th. International Seaways's dividend payout ratio is currently 5.72%.

About International Seaways

(

Free Report)

International Seaways, Inc owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade. It operates in two segments: Crude Tankers and Product Carriers. As of December 31, 2023, the company owned a fleet of 73 vessels. It serves independent and state-owned oil companies, oil traders, refinery operators, and international government entities.

See Also

Before you consider International Seaways, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Seaways wasn't on the list.

While International Seaways currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.