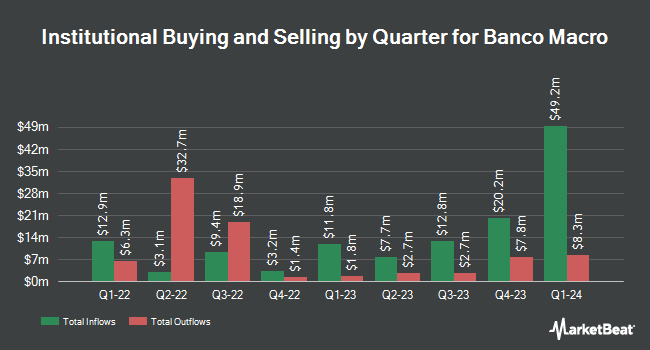

Quantbot Technologies LP lifted its stake in shares of Banco Macro S.A. (NYSE:BMA - Free Report) by 2,299.2% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 5,878 shares of the bank's stock after buying an additional 5,633 shares during the quarter. Quantbot Technologies LP's holdings in Banco Macro were worth $569,000 as of its most recent filing with the SEC.

Several other hedge funds and other institutional investors have also recently bought and sold shares of BMA. HUB Investment Partners LLC acquired a new stake in Banco Macro in the fourth quarter valued at approximately $326,000. William Blair Investment Management LLC grew its holdings in Banco Macro by 136.1% during the 4th quarter. William Blair Investment Management LLC now owns 570,374 shares of the bank's stock valued at $55,188,000 after purchasing an additional 328,800 shares in the last quarter. Erste Asset Management GmbH purchased a new stake in Banco Macro during the 4th quarter worth $1,002,000. EverSource Wealth Advisors LLC acquired a new position in Banco Macro in the 4th quarter worth $416,000. Finally, Cape Ann Asset Management Ltd purchased a new position in Banco Macro in the 4th quarter valued at about $20,203,000.

Banco Macro Stock Up 1.4 %

BMA stock traded up $1.09 during mid-day trading on Tuesday, hitting $76.60. 245,879 shares of the company were exchanged, compared to its average volume of 333,596. The company has a market capitalization of $4.89 billion, a PE ratio of 6.71 and a beta of 1.73. Banco Macro S.A. has a twelve month low of $42.23 and a twelve month high of $118.42. The firm has a fifty day simple moving average of $88.72 and a 200 day simple moving average of $86.44. The company has a current ratio of 1.02, a quick ratio of 0.79 and a debt-to-equity ratio of 0.13.

Analyst Ratings Changes

Separately, Morgan Stanley raised Banco Macro from an "underweight" rating to an "overweight" rating and set a $12.50 target price on the stock in a research report on Monday, December 16th.

Get Our Latest Stock Analysis on Banco Macro

Banco Macro Profile

(

Free Report)

Banco Macro SA provides various banking products and services to retail and corporate customers in Argentina. It offers various retail banking products and services, such as savings and checking accounts, time deposits, credit and debit cards, consumer finance loans, mortgage loans, automobile loans, overdrafts, credit-related services, home and car insurance coverage, tax collection, utility payments, automated teller machines, and money transfers.

Recommended Stories

Before you consider Banco Macro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Macro wasn't on the list.

While Banco Macro currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.