Quantbot Technologies LP increased its holdings in shares of Hamilton Insurance Group, Ltd. (NYSE:HG - Free Report) by 154.5% in the third quarter, according to its most recent disclosure with the SEC. The firm owned 101,901 shares of the company's stock after purchasing an additional 61,859 shares during the period. Quantbot Technologies LP owned 0.10% of Hamilton Insurance Group worth $1,971,000 as of its most recent filing with the SEC.

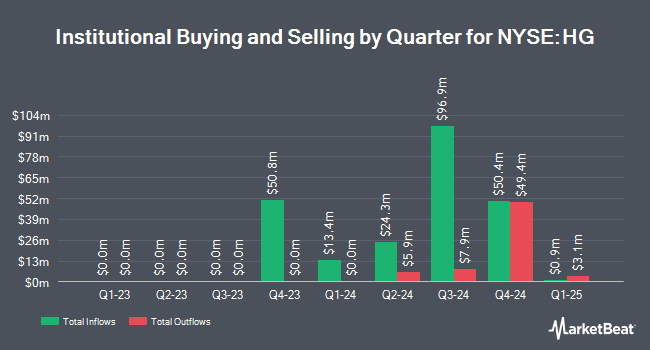

A number of other institutional investors have also recently bought and sold shares of HG. Thurston Springer Miller Herd & Titak Inc. bought a new stake in Hamilton Insurance Group in the 2nd quarter valued at about $34,000. Financial Management Professionals Inc. acquired a new position in Hamilton Insurance Group during the third quarter worth about $34,000. US Bancorp DE bought a new position in Hamilton Insurance Group in the 3rd quarter valued at approximately $107,000. American International Group Inc. acquired a new stake in shares of Hamilton Insurance Group during the 1st quarter valued at $115,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank acquired a new stake in shares of Hamilton Insurance Group during the second quarter valued at about $156,000. Institutional investors and hedge funds own 29.17% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have commented on the company. Wells Fargo & Company upped their price target on Hamilton Insurance Group from $20.00 to $21.00 and gave the company an "overweight" rating in a research report on Thursday, October 10th. Barclays assumed coverage on shares of Hamilton Insurance Group in a research report on Wednesday, September 4th. They issued an "overweight" rating and a $26.00 price target for the company. Morgan Stanley downgraded shares of Hamilton Insurance Group from an "overweight" rating to an "equal weight" rating and set a $19.00 price objective on the stock. in a report on Monday, August 19th. Keefe, Bruyette & Woods lifted their price objective on shares of Hamilton Insurance Group from $21.00 to $22.00 and gave the company an "outperform" rating in a report on Wednesday, August 14th. Finally, JMP Securities upped their target price on shares of Hamilton Insurance Group from $23.00 to $25.00 and gave the stock a "market outperform" rating in a report on Thursday, August 8th. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat, Hamilton Insurance Group presently has an average rating of "Moderate Buy" and a consensus target price of $21.43.

Get Our Latest Stock Report on HG

Insider Buying and Selling at Hamilton Insurance Group

In other news, CAO Brian John Deegan sold 17,500 shares of the stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $19.18, for a total value of $335,650.00. Following the completion of the transaction, the chief accounting officer now owns 20,824 shares of the company's stock, valued at approximately $399,404.32. This represents a 45.66 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 2.70% of the stock is currently owned by corporate insiders.

Hamilton Insurance Group Stock Performance

Shares of NYSE HG traded up $0.12 during trading on Friday, reaching $19.14. 195,315 shares of the stock traded hands, compared to its average volume of 429,717. Hamilton Insurance Group, Ltd. has a 52-week low of $12.44 and a 52-week high of $20.71. The company has a 50-day moving average of $18.41 and a 200-day moving average of $17.67. The stock has a market capitalization of $1.94 billion and a P/E ratio of 4.25. The company has a debt-to-equity ratio of 0.06, a current ratio of 0.77 and a quick ratio of 0.77.

Hamilton Insurance Group (NYSE:HG - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The company reported $0.74 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.69 by $0.05. The business had revenue of $512.84 million for the quarter, compared to analysts' expectations of $515.96 million. Hamilton Insurance Group had a return on equity of 21.92% and a net margin of 21.88%. During the same quarter in the prior year, the firm posted $0.41 EPS. Analysts forecast that Hamilton Insurance Group, Ltd. will post 4.03 EPS for the current fiscal year.

About Hamilton Insurance Group

(

Free Report)

Hamilton Insurance Group, Ltd., through its subsidiaries, provides underwriting specialty insurance and reinsurance risks in Bermuda and internationally. The company operates Hamilton Global Specialty, Hamilton Select, and Hamilton Re underwriting platforms. The company offers casualty reinsurance products, such as commercial motor, general liability, healthcare, multiline, personal motor, professional liability, umbrella and excess casualty, and worker's compensation and employer's liability reinsurance; property reinsurance and insurance; and specialty reinsurance solutions, including accident and health, aviation and space, crisis management, mortgage, financial lines, marine and energy, and multiline specialty.

Read More

Before you consider Hamilton Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hamilton Insurance Group wasn't on the list.

While Hamilton Insurance Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.