Quantbot Technologies LP raised its holdings in Kennametal Inc. (NYSE:KMT - Free Report) by 93.3% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 36,335 shares of the industrial products company's stock after buying an additional 17,540 shares during the period. Quantbot Technologies LP's holdings in Kennametal were worth $873,000 at the end of the most recent quarter.

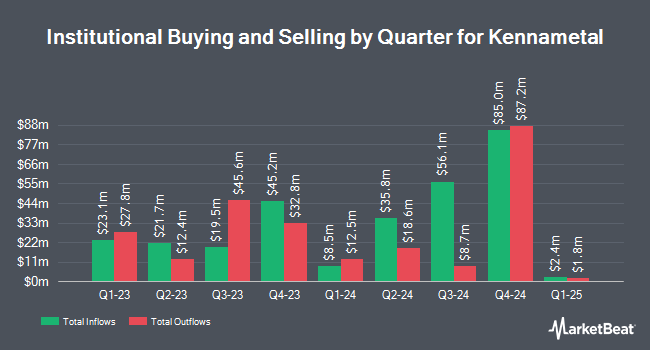

Other hedge funds also recently made changes to their positions in the company. Wellington Management Group LLP raised its stake in Kennametal by 33.5% in the 3rd quarter. Wellington Management Group LLP now owns 6,251,632 shares of the industrial products company's stock valued at $162,105,000 after acquiring an additional 1,567,867 shares during the period. Brandes Investment Partners LP raised its position in shares of Kennametal by 3.1% in the fourth quarter. Brandes Investment Partners LP now owns 2,573,638 shares of the industrial products company's stock valued at $61,819,000 after purchasing an additional 78,149 shares during the period. Pacer Advisors Inc. acquired a new stake in shares of Kennametal during the 4th quarter worth about $59,207,000. Geode Capital Management LLC lifted its stake in shares of Kennametal by 1.0% during the 3rd quarter. Geode Capital Management LLC now owns 1,815,939 shares of the industrial products company's stock worth $47,096,000 after buying an additional 17,265 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its stake in Kennametal by 3.9% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,479,599 shares of the industrial products company's stock valued at $35,540,000 after buying an additional 56,104 shares during the last quarter.

Analyst Ratings Changes

Several brokerages have issued reports on KMT. Morgan Stanley cut their price objective on shares of Kennametal from $28.00 to $24.00 and set an "equal weight" rating for the company in a research report on Wednesday, February 12th. Jefferies Financial Group downgraded Kennametal from a "buy" rating to a "hold" rating and reduced their price target for the company from $40.00 to $32.00 in a research note on Friday, December 6th. Barclays decreased their price objective on Kennametal from $25.00 to $24.00 and set an "equal weight" rating on the stock in a report on Wednesday. Finally, StockNews.com raised Kennametal from a "hold" rating to a "buy" rating in a report on Monday, January 27th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and one has given a buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $26.40.

Check Out Our Latest Research Report on Kennametal

Kennametal Price Performance

NYSE KMT traded down $0.36 during midday trading on Friday, hitting $21.62. The company had a trading volume of 703,920 shares, compared to its average volume of 819,078. The firm has a 50-day moving average price of $22.46 and a 200-day moving average price of $24.85. The company has a market capitalization of $1.67 billion, a PE ratio of 17.72, a P/E/G ratio of 3.69 and a beta of 1.69. The company has a current ratio of 2.53, a quick ratio of 1.13 and a debt-to-equity ratio of 0.47. Kennametal Inc. has a twelve month low of $20.50 and a twelve month high of $32.18.

Kennametal (NYSE:KMT - Get Free Report) last announced its quarterly earnings data on Wednesday, February 5th. The industrial products company reported $0.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.27 by ($0.02). Kennametal had a return on equity of 8.12% and a net margin of 4.76%. As a group, analysts anticipate that Kennametal Inc. will post 1.17 earnings per share for the current fiscal year.

Kennametal Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, February 25th. Shareholders of record on Tuesday, February 11th were issued a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 3.70%. The ex-dividend date was Tuesday, February 11th. Kennametal's dividend payout ratio is presently 65.57%.

Insider Activity

In related news, CEO Sanjay Chowbey purchased 10,000 shares of Kennametal stock in a transaction dated Tuesday, February 11th. The shares were bought at an average cost of $21.75 per share, for a total transaction of $217,500.00. Following the purchase, the chief executive officer now owns 77,595 shares in the company, valued at approximately $1,687,691.25. This trade represents a 14.79 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 1.41% of the company's stock.

Kennametal Profile

(

Free Report)

Kennametal Inc engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide. The company operates through two segments, Metal Cutting and Infrastructure.

Read More

Before you consider Kennametal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kennametal wasn't on the list.

While Kennametal currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.