Quantbot Technologies LP lifted its position in Oxford Industries, Inc. (NYSE:OXM - Free Report) by 229.3% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 21,655 shares of the textile maker's stock after purchasing an additional 15,078 shares during the quarter. Quantbot Technologies LP owned about 0.14% of Oxford Industries worth $1,879,000 at the end of the most recent quarter.

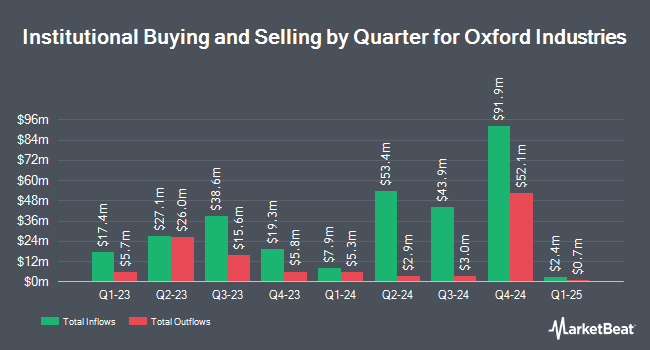

Several other institutional investors have also recently made changes to their positions in OXM. Pacer Advisors Inc. bought a new position in Oxford Industries in the second quarter valued at $54,882,000. FMR LLC increased its stake in Oxford Industries by 36.8% in the third quarter. FMR LLC now owns 906,324 shares of the textile maker's stock valued at $78,633,000 after acquiring an additional 244,022 shares during the last quarter. Millennium Management LLC increased its stake in Oxford Industries by 254.1% in the second quarter. Millennium Management LLC now owns 266,412 shares of the textile maker's stock valued at $26,681,000 after acquiring an additional 191,185 shares during the last quarter. Victory Capital Management Inc. increased its stake in Oxford Industries by 31.6% in the third quarter. Victory Capital Management Inc. now owns 652,726 shares of the textile maker's stock valued at $56,631,000 after acquiring an additional 156,634 shares during the last quarter. Finally, Ceredex Value Advisors LLC bought a new position in Oxford Industries in the second quarter valued at $10,040,000. Institutional investors own 91.16% of the company's stock.

Insider Buying and Selling at Oxford Industries

In other Oxford Industries news, EVP Scott Grassmyer sold 1,495 shares of the firm's stock in a transaction that occurred on Tuesday, September 24th. The shares were sold at an average price of $86.77, for a total transaction of $129,721.15. Following the completion of the transaction, the executive vice president now owns 31,428 shares of the company's stock, valued at approximately $2,727,007.56. This trade represents a 4.54 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders own 5.70% of the company's stock.

Analysts Set New Price Targets

OXM has been the topic of a number of research analyst reports. Telsey Advisory Group reduced their target price on Oxford Industries from $110.00 to $86.00 and set a "market perform" rating on the stock in a research note on Thursday, September 12th. UBS Group cut their price target on shares of Oxford Industries from $101.00 to $91.00 and set a "neutral" rating for the company in a research report on Thursday, September 5th. Finally, Citigroup cut their price target on shares of Oxford Industries from $92.00 to $65.00 and set a "sell" rating for the company in a research report on Friday, September 13th.

Read Our Latest Report on Oxford Industries

Oxford Industries Price Performance

OXM traded up $0.20 on Friday, hitting $83.17. The company had a trading volume of 226,998 shares, compared to its average volume of 274,084. Oxford Industries, Inc. has a 52-week low of $72.24 and a 52-week high of $113.88. The stock has a fifty day simple moving average of $78.38 and a 200-day simple moving average of $90.39. The firm has a market capitalization of $1.31 billion, a P/E ratio of 45.70 and a beta of 1.55.

Oxford Industries (NYSE:OXM - Get Free Report) last issued its quarterly earnings data on Wednesday, September 11th. The textile maker reported $2.77 EPS for the quarter, missing the consensus estimate of $3.00 by ($0.23). Oxford Industries had a return on equity of 21.93% and a net margin of 1.92%. The company had revenue of $419.89 million during the quarter, compared to analysts' expectations of $438.16 million. During the same quarter last year, the business earned $3.45 earnings per share. The business's quarterly revenue was down .1% on a year-over-year basis. Equities research analysts expect that Oxford Industries, Inc. will post 7.16 earnings per share for the current fiscal year.

Oxford Industries Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 1st. Shareholders of record on Friday, October 18th were issued a $0.67 dividend. The ex-dividend date was Friday, October 18th. This represents a $2.68 annualized dividend and a yield of 3.22%. Oxford Industries's dividend payout ratio (DPR) is presently 147.25%.

About Oxford Industries

(

Free Report)

Oxford Industries, Inc, an apparel company, designs, sources, markets, and distributes products of lifestyle and other brands worldwide. The company offers men's and women's sportswear and related products under the Tommy Bahama brand; and women's and girl's dresses and sportswear, scarves, bags, jewelry, and belts, as well as children's apparel, swim, footwear, and licensed products under the Lilly Pulitzer brand.

Further Reading

Before you consider Oxford Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oxford Industries wasn't on the list.

While Oxford Industries currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.