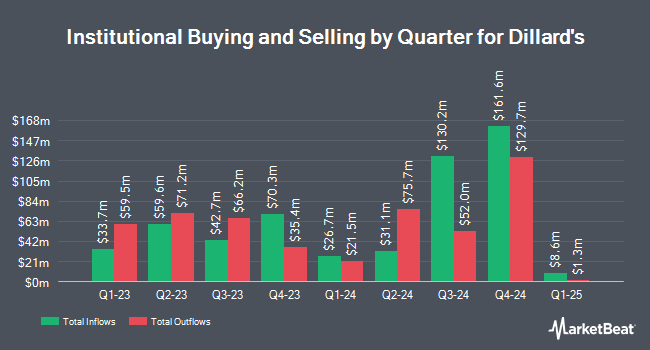

Quantbot Technologies LP lifted its stake in Dillard's, Inc. (NYSE:DDS - Free Report) by 49.3% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 5,659 shares of the company's stock after acquiring an additional 1,868 shares during the quarter. Quantbot Technologies LP's holdings in Dillard's were worth $2,171,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other large investors have also made changes to their positions in DDS. Pacer Advisors Inc. bought a new stake in shares of Dillard's during the 3rd quarter valued at $125,388,000. Knuff & Co LLC bought a new position in shares of Dillard's in the third quarter worth about $384,000. LMR Partners LLP bought a new position in shares of Dillard's in the third quarter worth about $4,796,000. Empowered Funds LLC lifted its position in shares of Dillard's by 23.2% during the 3rd quarter. Empowered Funds LLC now owns 8,067 shares of the company's stock valued at $3,095,000 after buying an additional 1,521 shares in the last quarter. Finally, Victory Capital Management Inc. grew its stake in shares of Dillard's by 229.1% during the 3rd quarter. Victory Capital Management Inc. now owns 18,249 shares of the company's stock valued at $7,002,000 after acquiring an additional 12,704 shares during the period. 67.15% of the stock is currently owned by institutional investors.

Dillard's Price Performance

NYSE DDS traded down $4.22 during trading hours on Friday, reaching $443.19. The company's stock had a trading volume of 70,486 shares, compared to its average volume of 118,596. The company has a quick ratio of 1.02, a current ratio of 2.38 and a debt-to-equity ratio of 0.27. Dillard's, Inc. has a 1 year low of $328.00 and a 1 year high of $476.48. The firm's 50-day moving average price is $392.55 and its 200-day moving average price is $398.53. The company has a market capitalization of $7.17 billion, a price-to-earnings ratio of 11.41 and a beta of 0.86.

Dillard's Dividend Announcement

The business also recently announced a dividend, which will be paid on Monday, January 6th. Investors of record on Friday, December 13th will be paid a dividend of $25.00 per share. The ex-dividend date is Friday, December 13th. Dillard's's payout ratio is 2.57%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on the stock. StockNews.com upgraded shares of Dillard's from a "hold" rating to a "buy" rating in a research note on Friday, November 15th. UBS Group raised their price objective on shares of Dillard's from $194.00 to $198.00 and gave the company a "sell" rating in a research report on Friday, November 15th. Finally, Telsey Advisory Group upped their target price on shares of Dillard's from $380.00 to $450.00 and gave the stock a "market perform" rating in a report on Friday, November 15th.

Get Our Latest Analysis on Dillard's

About Dillard's

(

Free Report)

Dillard's, Inc operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States. The company's stores offer merchandise, including fashion apparel for women, men, and children; and accessories, cosmetics, home furnishings, and other consumer goods.

Featured Stories

Before you consider Dillard's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dillard's wasn't on the list.

While Dillard's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.