Quantbot Technologies LP purchased a new stake in shares of Telephone and Data Systems, Inc. (NYSE:TDS - Free Report) in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 9,518 shares of the Wireless communications provider's stock, valued at approximately $325,000.

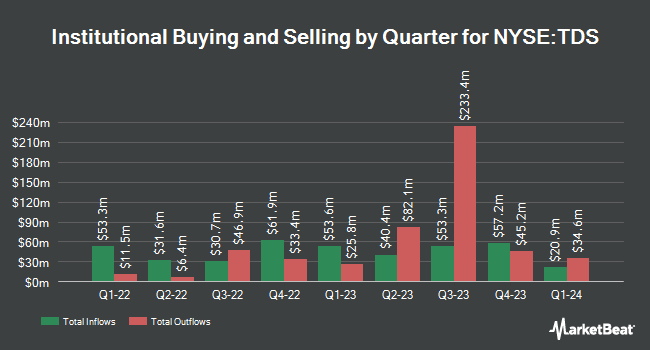

Several other hedge funds have also bought and sold shares of TDS. Charles Schwab Investment Management Inc. boosted its holdings in Telephone and Data Systems by 7.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,463,863 shares of the Wireless communications provider's stock worth $34,035,000 after buying an additional 103,114 shares in the last quarter. Cerity Partners LLC boosted its stake in shares of Telephone and Data Systems by 19.3% during the 3rd quarter. Cerity Partners LLC now owns 20,078 shares of the Wireless communications provider's stock worth $467,000 after acquiring an additional 3,255 shares in the last quarter. The Manufacturers Life Insurance Company boosted its stake in shares of Telephone and Data Systems by 7.5% during the 3rd quarter. The Manufacturers Life Insurance Company now owns 54,845 shares of the Wireless communications provider's stock worth $1,275,000 after acquiring an additional 3,824 shares in the last quarter. FMR LLC grew its position in shares of Telephone and Data Systems by 0.3% during the 3rd quarter. FMR LLC now owns 1,152,579 shares of the Wireless communications provider's stock valued at $26,797,000 after acquiring an additional 3,002 shares during the period. Finally, Healthcare of Ontario Pension Plan Trust Fund purchased a new position in shares of Telephone and Data Systems in the 3rd quarter valued at about $1,574,000. Hedge funds and other institutional investors own 80.00% of the company's stock.

Analyst Ratings Changes

Separately, JPMorgan Chase & Co. boosted their price objective on Telephone and Data Systems from $53.00 to $56.00 and gave the company an "overweight" rating in a research report on Monday, February 24th.

Read Our Latest Stock Report on TDS

Telephone and Data Systems Price Performance

Shares of NYSE:TDS traded up $0.13 during trading on Tuesday, reaching $38.87. The stock had a trading volume of 346,117 shares, compared to its average volume of 1,069,014. The business has a fifty day moving average price of $36.54 and a 200-day moving average price of $32.41. Telephone and Data Systems, Inc. has a 1-year low of $14.04 and a 1-year high of $41.21. The company has a debt-to-equity ratio of 0.85, a quick ratio of 1.44 and a current ratio of 1.59. The stock has a market cap of $4.43 billion, a PE ratio of -7.20 and a beta of 0.75.

Telephone and Data Systems (NYSE:TDS - Get Free Report) last released its earnings results on Friday, February 21st. The Wireless communications provider reported ($0.09) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.32) by $0.23. Telephone and Data Systems had a negative net margin of 10.72% and a positive return on equity of 1.12%. The business had revenue of $1.24 billion during the quarter, compared to analyst estimates of $1.23 billion. On average, equities analysts forecast that Telephone and Data Systems, Inc. will post -0.31 earnings per share for the current fiscal year.

Telephone and Data Systems Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Monday, March 17th were given a dividend of $0.04 per share. The ex-dividend date of this dividend was Monday, March 17th. This represents a $0.16 dividend on an annualized basis and a yield of 0.41%. Telephone and Data Systems's payout ratio is -18.60%.

Telephone and Data Systems Profile

(

Free Report)

Telephone and Data Systems, Inc, a telecommunications company, provides communications services in the United States. It operates through two segments: UScellular and TDS Telecom. The company offers wireless solutions to consumers, and business and government customers, including a suite of connected Internet of things (IoT) solutions, and software applications for monitor and control, business automation/operations, communication, fleet and asset management, smart water solutions, private cellular networks and custom, and end-to-end IoT solutions; wireless priority services and quality priority and preemption options; smartphones and other handsets, tablets, wearables, mobile hotspots, fixed wireless home internet, and IoT devices; and accessories, such as cases, screen protectors, chargers, and memory cards, as well as consumer electronics, including audio, home automation and networking products.

Read More

Before you consider Telephone and Data Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Telephone and Data Systems wasn't on the list.

While Telephone and Data Systems currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.